Despite the global slowdown in venture capital funding, African startups exceeded the $5 billion mark for the second year, even topping the amounts raised in a record-breaking 2021.

While startups in Africa raised more money in 2022, the number of unique deals and investors on the continent also grew. According to Partech Africa, there were 1,234 investors across equity and debt deals in Africa, even as there were 835 unique deals on the continent.

Perhaps driven by stricter equity investment terms, the share of debt deals on the continent grew as Partech reported 71 deals in 2022, a 65% increase year-on-year. On the other hand, the number of equity deals only grew slightly at 2% year-on-year, while mega equity deals fell 50% year-on-year.

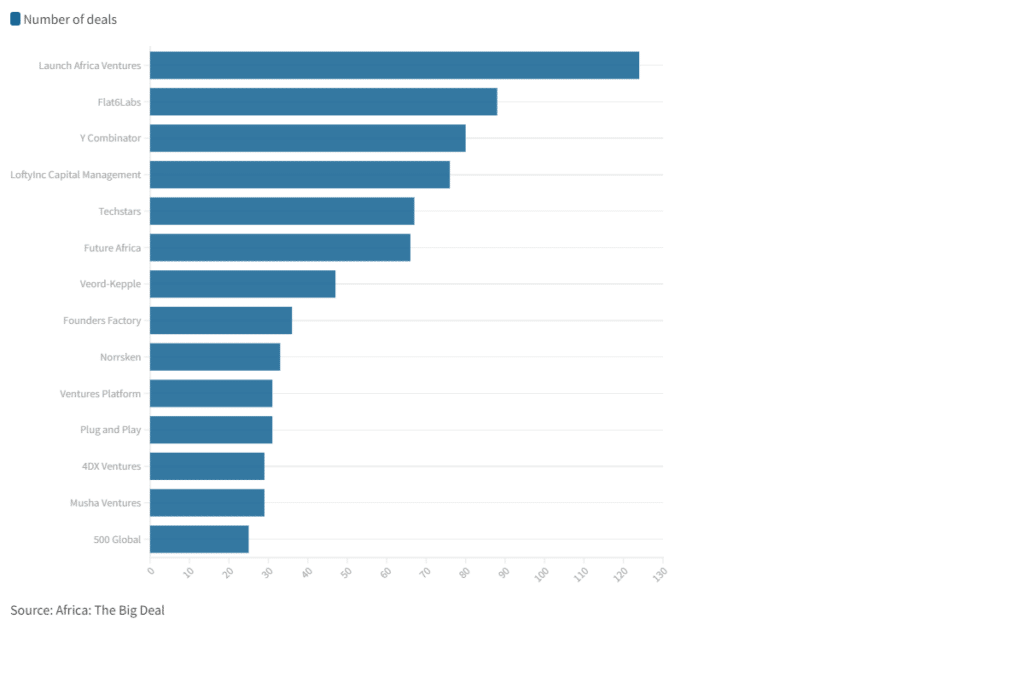

With all this growth, who have been the most active investors in the last two years? Here, we turn to Africa: The Big Deal’s database to ascertain who leads the chart in Africa’s startup investing landscape.

Launch Africa Ventures

The first investor on the list is Launch Africa Ventures. Over the past two years, the firm has invested in 19 countries across Africa and in more than 120 deals. They’ve also been the most active investor on the African continent for two years in a row.

Launch Africa Ventures invests up to $300k in early-stage B2B and B2B2C startups in Africa. In June 2022, it announced the close of its $36.3 million fund. It has invested in startups such as Bitmama, BFree, Chekkit, djamo, Gozem, Julaya, and Kuda.

Flat6Labs

Despite having the second-highest number of deals — at least 88 — in the past two years, Flat6Labs has the least geographical spread of the VCs on this list, having invested in only two countries.

While its fund is focused on the Middle East and North Africa region, the firm has only invested in startups operating in Egypt and Tunisia so far. It raised $10 million to invest in North African startups in 2021; some of the startups in its portfolio include Shader, Dajin, Edupay, Bako Motors, and Ijeni.

Y Combinator

The American startup accelerator is one of the most famous investors in the region, with some of Africa’s most notable startups in its portfolio. Per Africa: The Big Deal, it has participated in at least 80 deals across 14 African countries.

Since it began investing in African startups, its startup directory shows it has invested in 86 startups and has Flutterwave, Wave, and Paystack as an alumnus.

Since 2021, it has invested in Topship, Pivo, Moni, Curacel, and Remedial Health. While most of its investments have gone to startups in Nigeria, it began diversifying its portfolio in 2021, investing in Jabu Logistics in Namibia, Union54 in Zambia, and beU delivery, a foodtech startup in Ethiopia.

LoftyInc Capital Management

Next on the list is Nigeria-founded LoftyInc Capital Management. Led by Idris Bello, the firm has participated in at least 76 deals in 11 African countries.

Like many other VC firms operating out of Africa, its sector-agnostic approach means it invests in various industries, including fintech, edtech, eCommerce, and travel. Some startups in its portfolio include Payday, Aku, Akiba, Andela, FlexPay, and Flutterwave.

Techstars

Techstars is the second accelerator on the list, and in 2022, it opened a local office in Lagos, Nigeria, in partnership with ARM Labs. The first cohort of startups was revealed in January 2023 and featured startups from Nigeria and Kenya.

Per Africa: The Big Deal, the accelerator has made more than 67 deals in 11 African countries since 2021. Startups in its portfolio include Klas, Raenest, Fez, and AltSchool Africa.

Future Africa

Future Africa was founded by Iyinoluwa Aboyeji, Olabinjo Adeniran, Adenike Sheriff, and Chuba Ezekwesili in March 2019. The firm’s initial goal was to invest $50,000 in 20 founders annually.

Africa: The Big Deal reports that it has taken part in 66 deals across seven African countries. While Future Africa’s direction seems to have changed in the past year, it has continued investing in startups, with Mecho Autotech, Norebase, Spleet, and Eden Life, a few of its portfolio companies.

Verod Kepple

Verod Kepple has invested in 47 deals since 2021. Some of their portfolio companies include Moove, Ceviant, Lifestores Healthcare, and Koko Networks. Overall, its investments have occurred in nine African countries.

Founders Factory

Founders Factory invests in African startups across fintech, healthtech, and agritech. Since 2021, it has been involved in 36 deals across six African countries. Some of its portfolio companies are bus ticketing platform, BuuPass, which recently closed its pre-seed round; healthtech startups, PneumaCare and Zuri Health; and Nigerian edtech startup, Schoolable.

Norrsken

In January 2022, Norrsken teamed up with 30 founders and a handful of venture capital and private equity investors to launch a fund targeted at African startups.

Easily one of the largest funds focused on Africa, the Norrsken22 African Tech Growth Fund reached the first close of its $200 million fund. With 33 deals across nine African countries, Norrsken is one of the continent’s most active investors.

Shortly after the first close of its fund, Ngetha Waithaka, a General Partner at the firm, revealed that it would invest 40% of its fund in Series A and B companies, with the rest going to follow-on rounds from Series C upwards. Norrsken has backed startups such as Orda, Kapu, and Power.

Plug and Play

Plug and Play rounds up the top ten with 31 deals across seven African countries. Since 2021, it has invested in Bumpa, Pastel, Chari, and Klasha.

Honourable mentions

While these VC firms have been the most active investors in the last two years, Ventures Platform, Musha Ventures, 4DX Ventures, and 500 Global have also been very active. While Ventures Platform has been involved in 31 deals in six African countries, Musha Ventures and 4DX Ventures have done 29 deals in eight and seven countries, respectively. 500 Global, on the other hand, has completed 25 deals in six African countries.