According to the African Tech Startups Funding Report, 311 companies raised a combined $491 million in funding in 2019. Nigeria co-led with Kenya in terms of total investment. Tom Jackson, co-founder of Disrupt Africa, publishers of the report, attributes the high performance of Nigerian startups, in fundraising, to the maturity of the country’s startup ecosystem.

“These are the most developed markets on the continent, with the biggest addressable markets,” Jackson tells Techpoint.

A comparison of the Nigerian Startup Funding Report 2018 and 2019 published by Intelligence by Techpoint also reveals that startups in Nigeria are attracting more investments.

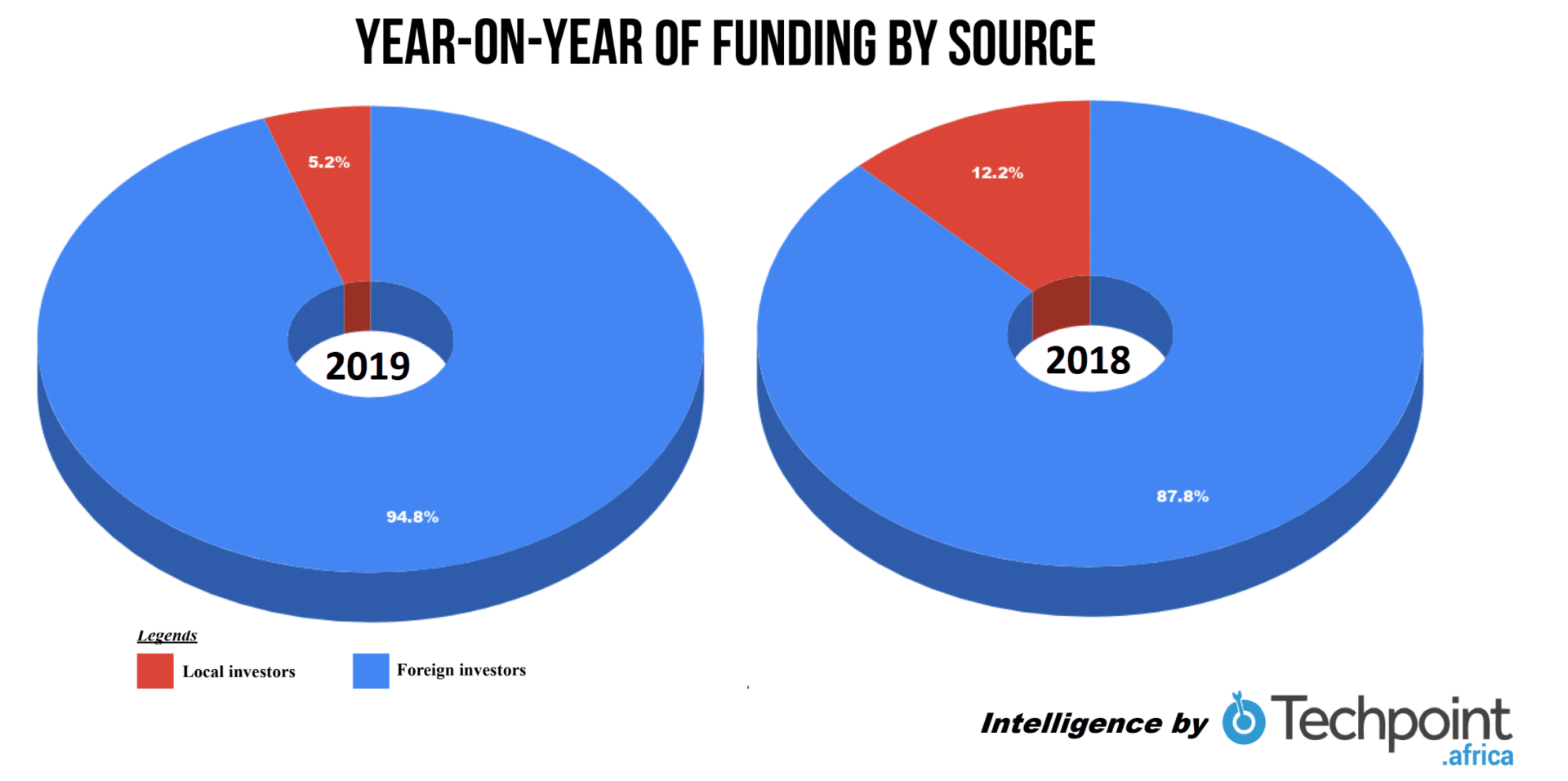

In 2019, over $377 million was raised by Nigerian startups as against $178.3 million raised in 2018. Even though the amount raised from local investors rose from about $2.3 million to nearly $20 million within the same period, the dominance of foreign investors in the ecosystem grew in 2019, with nearly 95% of the total raised being from foreign investors against 87.8% in 2018.

Nigeria is home to some of the wealthiest Africans. Individuals like Aliko Dangote are expanding and solidifying their tight grip on several industries: in tech, Mike Adenuga, reportedly worth over $20 billion, continues to privately own Nigeria’s second largest telecom operator, Globacom Nigeria; Mitchell Elegbe, MD/CEO of Interswitch, an integrated payment and transaction company in Nigeria, is also actively involved in charting the course of tech. Worth mentioning is that Interswitch became Nigeria’s first tech company to be valued at one billion dollars.

It is therefore not wrong to imply that there is a lot of money in Nigeria to drive the growth of the startup ecosystem. While a number of banks and enterprises are setting up hubs and packages for startups, big funds are yet to roll in as investments for startups.

“There seem to be more foreign investors than local investors who actually have money to invest,” Mark Essien, founder of Hotels.ng and seed investor, says.

He also argues that there is an improvement in the performance of local investors within the local ecosystem, in comparison with previous years.

“There are a few active local investors who actually invest a lot in the good startups coming out. They also have relatively large funds and can keep investing. This is different from before when there were just a few of them.”

Jackson and Essien, however, agree that the vast majority of the funding for startups in Nigeria and across Africa comes from international VCs. In quite a number of cases, local and foreign VCs invest in the same venture. For startups that are structured this way, the experiences are different. Provider of online accounting services for SMEs, Accounteer is one of such.

Loans vs Equity

Accounteer’s path to investors is similar to that of other startups. The startup started around 2016 as an in-house tool to provide accounting solutions; it had paying clients even before it approached investors. But as the company began to grow, it needed additional funds to meet the demands of its growing number of paying users and compete with the strong competitors in the market — companies like Wave.

“Initially, the company was self-funded as we were using revenue to run the company. But there was a need for increased capacity. As users kept increasing, support kept increasing. Revenue alone could not run the company and we were struggling to cope,” explains Niyi Adegboye, Accounteer’s Head of Growth Strategy and Partnership.

Before securing some funding, the startup pitched at some of the popular startup pitching competitions organised by Techpoint, Fintech Summit, and MEST. In addition to its foreign investor, presently, Accounteer has a number of local investors, including Ventures Platform, Mictotraction, and Honeywell Group’s Itanna.

Anytime a startup announces a new round of investment, it can be in return for a stake in the company, a loan to be repaid with interest, or a credit facility that can be converted to stakes after reevaluating the company.

In Accounteer’s case, while foreign investors gave the company funds in direct equity only, it wasn’t entirely the same with local investors.

Information made available to Techpoint revealed Microtraction and Itanna provided Accounteer with convertible notes, which are essentially short-term debts that can be converted into equity in a future funding round. Ventures Platform, on the other hand, provided funds for equity and also as convertible notes.

Industry experts told Techpoint that this arrangement is a familiar practice among Nigerian startups raising funds from local investors.

“When a Nigerian startup announces it has raised funding from local sources, most times it is a short-term loan to be paid within a period of two years or thereabout. But they do not mention that in their press statement,” an industry expert told Techpoint.

According to Adegboye, Accounteer was so worried about its rising debt profile that it turned down the $50,000 convertible debt it was meant to receive after winning the 2018 MEST Entrepreneur Challenge.

The Ibeju-Lekki factor

![]()

There are several reasons startups will prefer to seek funding from foreign investors over local VCs and one of such is the currency.

“$50,000 is not the same as ₦50,000,” Adegboye remarks.

To him, having good numbers seems to be enough to attract funding from a foreign VC. But for local investors, numbers seem to be not enough. He attributes this to local investors’ ‘low appetite for failure’.

“I think the reason for this is that a foreign investor could have successfully exited from 5 out of 10 previous investments, unlike local VCs that may not have recorded any successful exit yet.”

There is also the existence of other investment portfolios such as real estate for local VCs to invest their funds and be sure of great returns, unlike the uncertain and volatile startup landscape.

“They will tell you that they can use their money to buy plots of land at Ibeju-Lekki and resell the property at a much higher profit margin in the next years when its value would have significantly appreciated.”

But Adegboye and Jackson expect this to change as local VCs successfully exit and highly successful startup founders become investors themselves.

“There are positive signs — the number of local angel investor networks is on the rise, and entrepreneurial success stories like Iyinoluwa Aboyeji from Flutterwave and Andela are starting to give back, so there are reasons for optimism,” Jackson tells Techpoint.

Yet in spite of the peculiar challenges of dealing with local investors, Adegboye thinks startups need local VCs not just because of the funds but to access their network of potential clients and to also seal major partnership deals.

“The only thing a foreign VC can give you is money, you are the one that will now figure out how to succeed in your local market and this is where local VCs can help. They can introduce you to their peers who can help your company to accelerate its growth in the market and hasten the journey to profitability.”

Accounteer is a beneficiary of such assistance from its local VCs. It has grown from a product that directly serves about 16,000 SMEs to working with major establishments such as Union Bank and Remita, allowing it to potentially grow its market reach exponentially. This in return will improve the company’s performance and raise its market valuation thus enabling investors, local and foreign, to get more returns on their investments.

Working together

Essien believes that since local investors are around, startup founders get to talk to them more.

“Local investors understand some peculiar challenges without overly quizzing you,” he says.

But a cross-section of Nigerian startups that have local VCs told Techpoint that they often struggle to cope with the numerous demands from their Nigerian investors who often ask for monthly reports and tend to assert domineering control over operations at the company, leaving little or no room for the startup founders to actively pursue their vision.

Adegboye agrees. He thinks local VCs need to “stop choking startup founders” and allow them to run their businesses smoothly with little or no interference from the investors.

“Local VCs need to learn from their foreign counterparts who often put systems in place and everyone knows what is going on without putting so much stress on the company.”

He also advises startup founders to read the fine prints of agreements they are signing with any investor and be aware of the implications of agreement term sheets.

“Some local VCs may put an anti-dilution clause in agreements, which means nothing can happen to their share of the company when new investors come in. But unfortunately, many startup founders do not have legal expertise nor have any lawyer on their team so they will sign such an agreement that can create future problems for them and the company.”

Suggested Read: OyaPay shutdown: A sad case of family investment gone wrong

The line between Nigerian and foreign VCs is getting blurry as several local investors, including Ventures Platform and Microtraction, are also reportedly managing investment portfolios for several foreign VCs.

Industry experts that spoke to Techpoint expressed optimism regarding the future of local funding in the Nigerian startup ecosystem since new startups will require seed funding from local VCs to see them through the early stages of their existence while those with good products will also need paths to the local market which local VCs can also help provide.

Already, Adegboye notes that local VCs are beginning to be more open in their dealings with startups. Going forward, he believes much can be achieved if local investors continue to learn more from their foreign VC counterparts.

Jackson, on the other hand, argues that funding is not, and should by no means be the most important thing for many startups.

“Startups should focus at least as much on obtaining corporate partnerships and other more tangible things that affect the revenues earned by their business,” he concludes.

** UPDATES

- February 27, 2020 at 4:27 p.m. (WAT): Article was reviewed following claims that Microtraction and Ventures Platform actually invested in Accounteer through equity and not convertible loans.

- There was an error in the chart comparing year-on-year activity of local vs foreign investors. The years were switched but this has been corrected.

- February 28, 2020 at 9:53 p.m (WAT): Following further review, relevant sentences referenced in (1) were reverted to original form, but reworded for clarity.

Also Read: A growing infatuation with VC funding is driving Nigerian startups towards one foreign accelerator.