- Ghana Interbank Payment and Settlement Systems (GhIPSS) has partnered with Visa, a payments giant, to expand its payment services.

- Leveraging the partnership scheduled for May 2024, GhIPSS will begin processing Visa transactions for their services, which include clearing, switching, and settling transactions denominated in domestic currency.

- The partnership also aims to reduce operational and customer transaction costs. Per GhIPSS, it runs one of the lowest costs per transaction and has maintained this low-cost level over the last three years.

Banks pay their service providers in foreign currencies even though they conduct local transactions in Cedi. While increasing transaction volume, the GhIPSS-Visa partnership would reduce fees or requirements associated with foreign currency conversions. Customers will benefit from lower transaction fees.

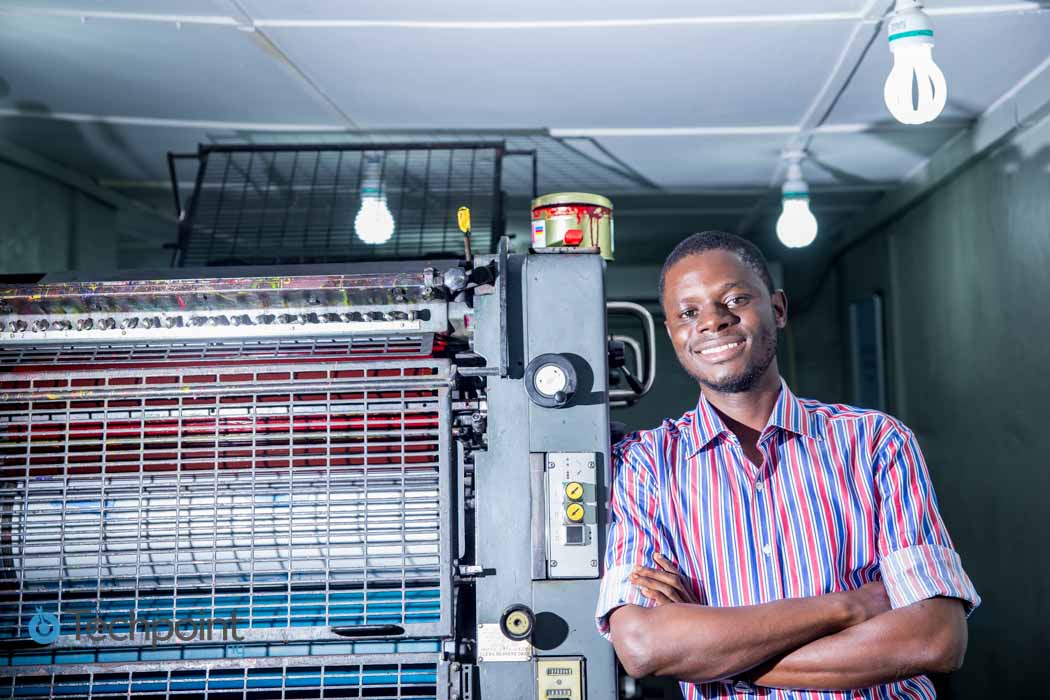

Launched in May 2007, Ghana Interbank Payment and Settlement Systems Limited is a subsidiary of the Bank of Ghana. The institution, led by Archie Hesse, manages payment infrastructure for Ghana's banks and non-bank institutions.

Meanwhile, GhIPSS has introduced an Academy, an educational programme, to sensitise the public about its payment system infrastructure following the partnership.

Additionally, Archie says the initiative will make it easier for the general public to comprehend the role an "effective and efficient national switch" plays in Ghana's development. Besides, GhIPSS intends to strengthen its relationships with banks, fintechs, and mobile money entities through the education initiative.

He added that there is a "possibility of ‘dual cards’ that can connect to local institutions that are not traditionally on Visa’s network as well as those on Visa’s infrastructure."

In 2022, the Bank of Ghana launched GhanaPay — one of GhIPSS' products — a mobile money service provided by savings and loan companies and universal and rural banks to enable digital payments to individuals and businesses.

By 2024 and 2027, the digital payment market in Ghana is expected to reach $7.10 billion and $11.51 billion, respectively. Mobile point-of-sale (PoS) payments are the key driver of digital payments, with a projected $5.30 billion in total transaction value by 2024.