Fintech

Top stories

After raising $5.5 million to help people swap crypto between blockchains, Polytope Labs is building an on-chain stablecoin infrastructure.

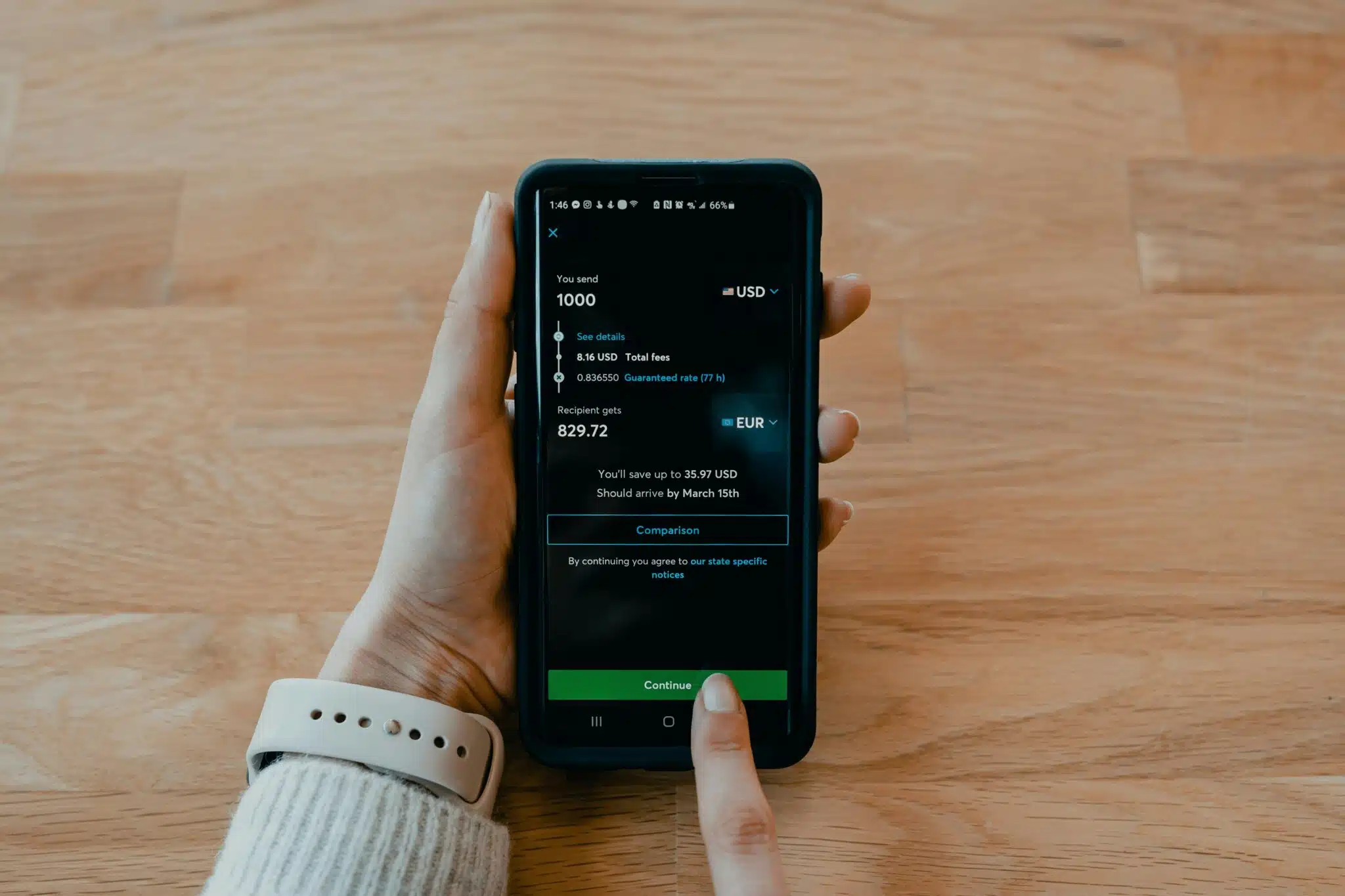

Account-based payments are Nigeria’s new normal, as real-time, reliable rails are now powering business, wallets, and cross-border commerce alike.

Strict data laws can give fintechs powerful moats—boosting trust, raising entry barriers, and creating durable competitive advantage.

Confused about payment gateways vs aggregators? Compare fees, setup, compliance, payouts, and control to choose the right solution.

Redtech, backed by Heirs Holdings, is expanding into 29 African countries and scaling RedPay after processing ₦30 trillion in 2025, with acquisitions also on the table for growth.

This product‑strategy teardown asks the real question beneath the noise: in this deal, who actually stands to benefit more? PayPal or Paga?

MTN is exploring acquisitions in payments, lending, and remittances as it deepens its fintech ambitions, with CEO Ralph Mupita stressing platform growth over dealmaking for its own sake.

Nigerian fintech Nomba has acquired a licensed Canadian payments firm to build B2B trade rails linking Africa and Canada.

Nigerian fintechs are using AI mainly for fraud detection, customer service automation, and credit scoring, according to the CBN. It also identified some key constraints to scaling AI systems.

A new CBN report shows Nigerian fintechs split on regulation, viewing it as neither overly supportive nor restrictive, while highlighting approval delays, compliance costs, and calls for deeper regulator-industry engagement.

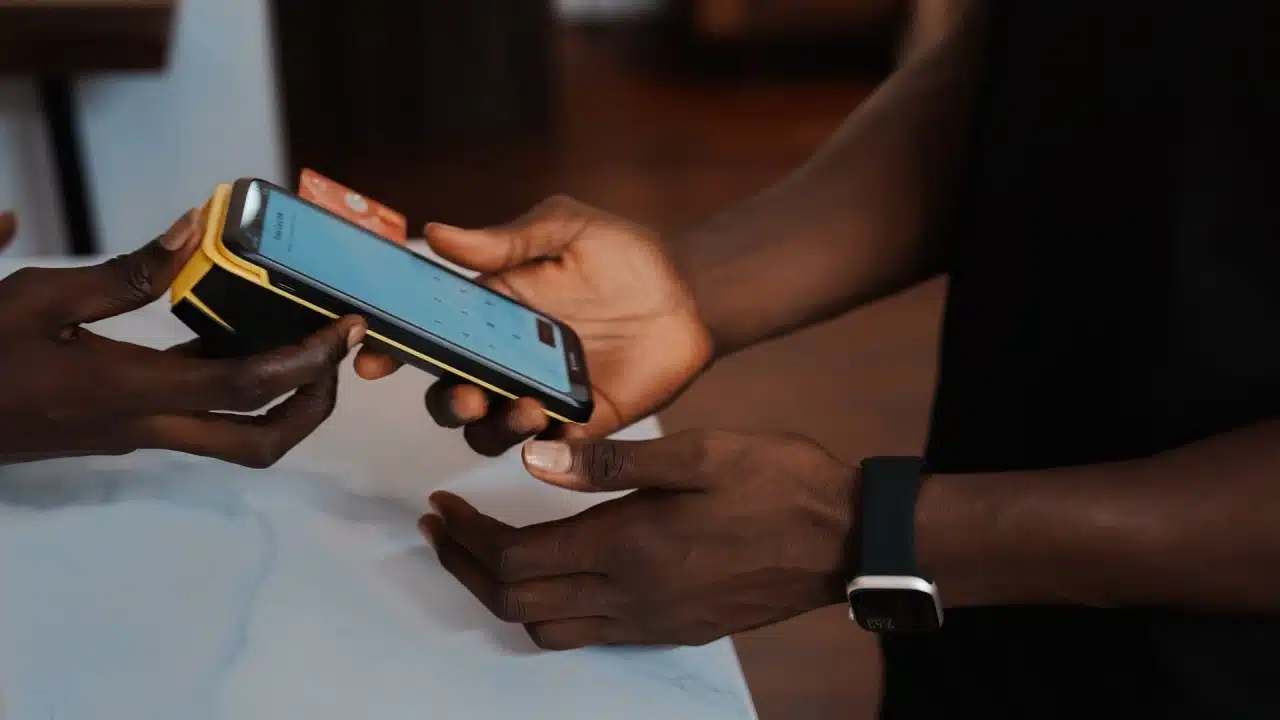

Moniepoint says it processed 8 in 10 in-person payments in Nigeria, ₦412 trillion and more than 14 billion transactions in 2025.

Nigerians may resent PayPal, but with the naira under pressure, startups like Paga are prioritising global reach and dollar inflows.

PayPal is back in Nigeria after two decades, but the fraud that drove its exit haven’t disappeared. What has changed, why Nigeria is now worth the risk?

Paga and PayPal have launched live account linking in Nigeria, allowing users to receive international payments via PayPal and withdraw funds locally in naira through Paga,

Trove Finance has acquired UCML Securities, rebranded as Innova Securities, to bring brokerage services in-house, strengthen compliance, and improve trade execution for its growing user base.

Mono plans to launch a treasury management tool in 2026 after its acquisition by Flutterwave, aiming to expand across Africa with new enterprise solutions.

As funding slows and regulation tightens, African fintech leaders say the future belongs to infrastructure players, compliant operators, and firms built for scale.

PiggyVest crossed 6 million users in 2025, paying out ₦1.3 trillion as it expanded its infrastructure and business-focused products.

CBN mandates dual connectivity for all PoS transactions, forcing banks and PSPs to link with NIBSS and UPSL within 30 days.

With AI that understands Yoruba, Igbo, Hausa, and Pidgin, Agentpesa wants to make digital banking as easy as chatting, sending voice notes, or snapping a photo of account details.