If it’s not the FTX fiasco, it is a trillion-dollar market crash. Now and then, there’s always an event that justifies people’s distrust of anything crypto-related.

But in stablecoins, a ray of hope emerged within the crypto market storm. Whether the market goes up or down, stablecoins, as the name implies, remain stable, retaining the value of the currency they’ve been pegged to.

I've always thought those who see crypto as nothing more than an advanced form of gambling would soon begin to see the potential of a technology that could revolutionalise finance. However, as one of the worst crypto storms blew in 2022, we saw the largest stablecoin by market valuation — USDT — flinch, losing 0.5% of its value.

This dashed whatever little confidence some doubters were beginning to build in the crypto industry, but Tether’s CTO, Paolo Ardoino, believes the eight-year-old coin remains as sturdy as ever.

Tether’s creation

Tether is a blockchain company founded in 2014 by Reeve Collins, Craig Sellars, and Brock Pierce.

Tether used Taiwanese legacy banking partners to move fiat currency into cryptocurrency and vice-versa. As it got wide usage without KYC, the banking partners terminated their relationship with the blockchain company in 2017. However, banks in Puerto Rico and the Bahamas agreed to partner with Tether.

The bull run of 2017 popularised Tether’s stablecoin, USDT, and made it one of the most traded cryptocurrencies of all time.

In 2015, the company was acquired by the owners of the Hong Kong crypto exchange, Bitfinex.

What makes USDT stablecoins stable?

After USDT lost a little of its value in 2022, most people who used crypto solely as a means of cross-border transactions lost confidence in it. If there’s any chance that confidence will be regained in USDT or any other stablecoin, people need to know what makes stablecoins steady.

Be the smartest in the room

Give it a try, you can unsubscribe anytime. Privacy Policy.

In my interview with Ardoino, he said, “a few bad apples are not representing the beauty of the idea behind blockchain, behind cryptocurrencies in general.” To him, stablecoins allow people to go beyond their speculations and see crypto for what it is.

He explained that Tether was created with extremely liquid assets backing it. "The most important feature of a stablecoin is to give back the money," he said.

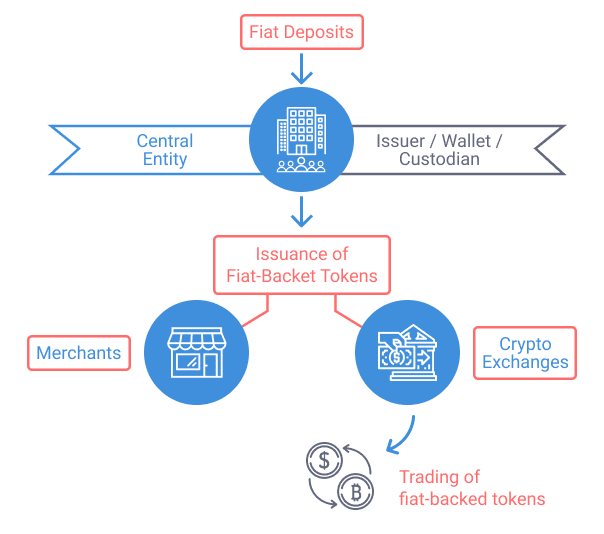

Imagine stablecoins as glass pebbles. If 100,000 glass pebbles were created to have a 1:1 value with the dollar, the creator of the pebbles needs to have a $100,000 reserve representing each glass pebble. For a stablecoin to maintain its stability, it must have a liquid asset for every coin in circulation.

According to Ardoino, you should be able to attend to people when they come to redeem their stablecoins for dollars.

“If you have a US dollar-based stablecoin like USDT, you cannot have Luna as your reserve; you need to have US treasury bills, you need to have cash deposits, and safe liquid investments that represent the dollar, so that whatever happens, you can fulfil redemption in dollars.”

When a $60 billion stablecoin crashes

How do we know that stablecoins have the backing they claim? We don’t; we just trust them. But the price of trusting the wrong stablecoin can be great.

In May 2022, the crypto market experienced one of the worst crashes ever due to the fall of the TerraUSD/UST stable coin.

Terra was a blockchain network created in 2018 by Do Kwon and Daniel Shin of Terraform Labs. They created TerraUSD to be an algorithmic stablecoin. Unlike Ardoino’s USDT, which needs the backing of assets like US dollars, TerraUSD was backed by a computer programme, and Luna, a cryptocurrency also created by Terraform Labs.

Before the crash in May, Kwon and Shin were considered heroes for their creation, particularly because Luna's meteoric rise made some people crypto millionaires in a short time.

However, trouble began to brew when $2 billion worth of TerraUSD was sold off. The sell-off shocked the market, making the coin which was supposed to be $1, drop to $0.91.

Some traders seized the opportunity to buy the coin at $0.91 and sell for $1, causing the coin to further depeg. More people sold off, and people stayed away from Luna, thus rendering it worthless.

How Luna crash affected USDT

Though USDT still exists, it was affected by Luna's market crunch. According to Ardoino, its survival was something even large traditional banks could not have pulled off.

After the Luna crash, the crypto market went into panic mode. Even though USDT fundamentally differs from TerraUSD, people seldom care about facts once fear sets in.

However, even the facts were not always on Tether’s side. A severe hole was punched into their story about having a dollar for every USDT in circulation.

In 2019, a lawyer in New York alleged that Bitfinex — Tether’s sister company — used $700 million of Tether’s reserves to cover up an $850 million loss.

This meant that Bitfinex had access to Tether’s reserves, which are supposed to help USDT stay pegged to the dollar.

Bitfinex responded, saying the court filings were written in bad faith. However, by 2021, New York’s Attorney General, Letitia James, said it found that Tether sometimes held no reserves to back its cryptocurrency’s dollar peg.

Tether and Bitfinex finally agreed to settle with the Attorney General’s office to the tune of $18 million.

Luna’s crash in 2022 put Tether’s reserves to the test.

“Tether is the biggest gateway when it comes to fiat money in the crypto industry. A lot of people wanted to redeem Tether, and were able to redeem $7 billion in 48 hours. That was 10% of our reserves.”

To give context, Ardoino mentioned how American bank Washington Mutual (WaMu) went bankrupt after it paid out 11% — $16.7 billion — of its reserves in ten days.

This made the bank unable to conduct day-to-day activities. However, the drop in the value of prices of homes in the US and its largely poor customer base also contributed to the bank's bankruptcy.

WaMu paid out 11% of its reserves in ten days, but Tether had to pay out 10% in two days.

According to Ardoino, the payout continued for a month and three days, during which Tether paid out 25% of its reserves -- over $20 billion.

For more context, a $6 billion withdrawal surge on FTX was part of what led to the crypto exchange's bankruptcy.

To Ardoino, Tether’s ability to fulfil all the withdrawals means that the company’s reserves are genuine.

Interestingly, some withdrawals were not borne out of fear, they were simply ways for some actors to make money off the market panic.

For retail crypto traders like me, stablecoins help us get into and out of the market.

If I’ve made a profit of $100 on a bitcoin trade, for example, I’ll trade that profit for its USDT equivalent, so I don’t lose my profit due to market volatility. I can then sell that $100 USDT for naira.

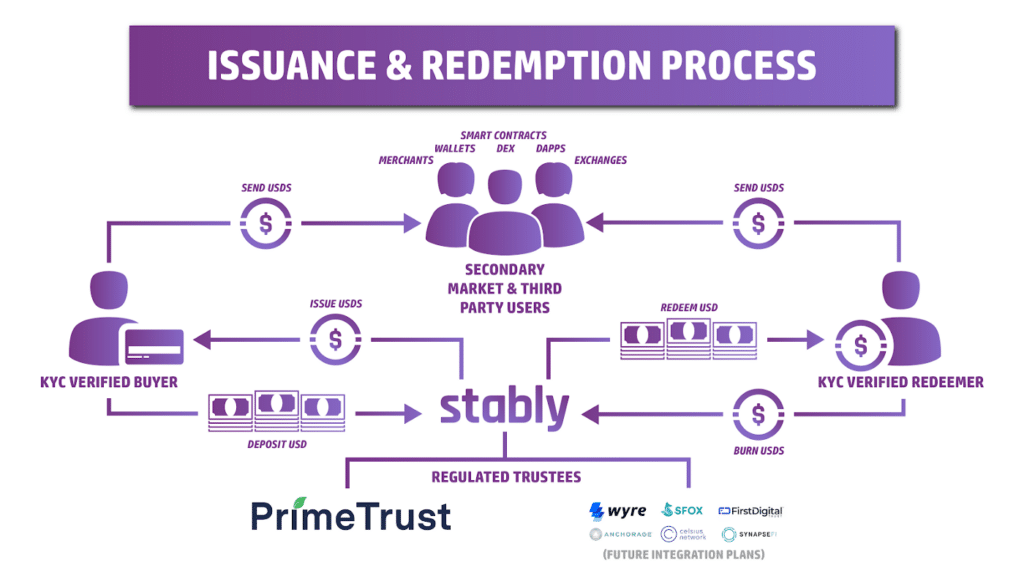

But institutional traders or investors who deal in larger amounts of money go to what Ardoino describes as the USDT primary market to change their USDT for actual dollars. Transactions in this market cannot be less than $100,000, and you must be registered to use it.

When the value of USDT dropped in May 2022, people bought it for less than $1 on the secondary market and traded it for $1 on the primary market.

“Tether always redeemed and honoured redemptions at $1. So you come with your Tether tokens to our platform, you signup, and we pay you $1 for every USDT. Then there is the secondary market, these are the exchanges, and people can sell Tether for any amount.

“Fir Tree and other hedge funds didn’t believe that Tether had all the money (reserves), so what they did was borrow large quantities, we’re talking hundreds of millions of dollars of USDT from companies like maybe Genesis, and sell below $1 on secondary markets to cause an issue. That is how we ended up redeeming $7 billion.”

Selling USDT below its usual price created artificial pressure on the asset in secondary markets. This made arbitrageurs — people who profit off price inconsistencies in different markets — take advantage of the situation.

Fun fact: Genesis — one of the companies lending USDT to hedge funds — recently filed for bankruptcy.

“Before attacking a company like Tether, you should really make sure you understand how it works because we’re solid and resilient, and we’ve proved that in the last eight years.”

On February 2, 2023, The Wall Street Journal (WSJ) published an article that will once again test the blockchain company's resilience. The WSJ alleged that only four people controlled 86% of Tether in 2018.

Controversies and scandals have trailed this stablecoin company for the past eight years, but Ardoino is confident in the reserves and the company's leadership. He believes it will be around for a long time.