On Monday, November 14, 2022, Yele Bademosi, CEO of Nestcoin, announced that a significant portion of its $6.45 million raise in 2021 had been lost in the FTX crash.

FTX, the crypto exchange founded by Sam Bankman-Fried, went bankrupt after news broke that customers’ funds were used for trading in Alameda Research, its sister company.

In the announcement, Bademosi revealed that while Alameda Research only had less than 1% equity in the company, Nestcoin used FTX as a custodian for most of its fund, including cash and stablecoins.

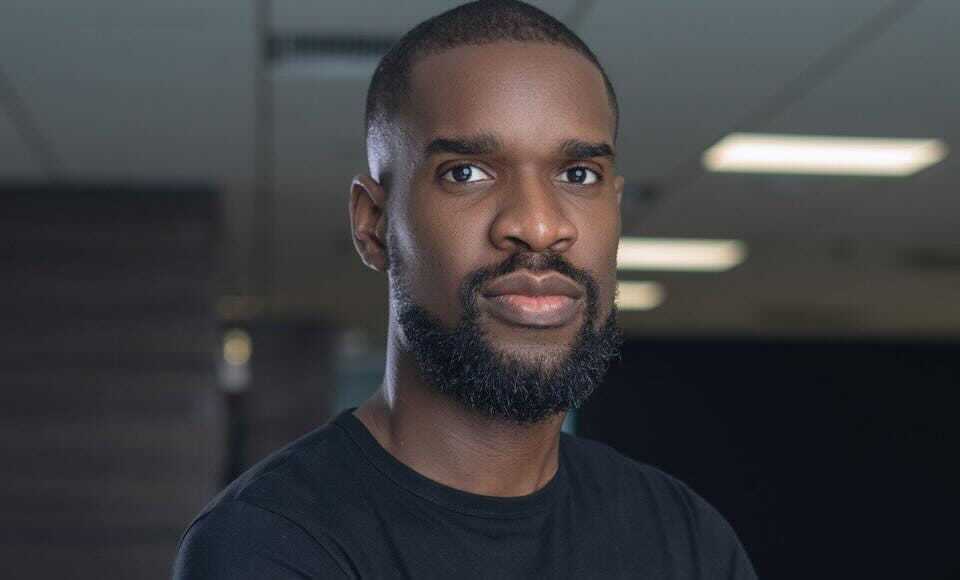

In an interview with Techpoint Africa, Bademosi recounted how he wouldn’t wish last year’s events on his worst enemy. Even after years as an entrepreneur in Africa’s tech space, he said, “It was by far one of the most difficult things that has ever happened to me.”

“I’ve read The Hard Thing About Hard Things before, it definitely felt different reading it again.” Reading about the difficult things entrepreneurs go through is one thing, but going through them yourself is another.

On receiving the news, his first reaction was disbelief, but that soon gave way to his need for immediate action.

“The next thing was, what do we need to do? What does this mean for the business? And how do we ensure that we’re able to continue this journey that we just started?”

Bademosi and the leadership team found solace in the fact that no customer funds were lost to the FTX crash. Having a team willing to stand by him through thick and thin was also instrumental to the company’s survival during such a difficult time.

Speculations, questions, and lessons

Nestcoin’s decision to keep millions of dollars in a centralised exchange became perhaps the most popular question after the incident.

Some insisted that large amounts of crypto should be kept in cold storage — an offline physical wallet that is completely secured by the owner.

Others felt that perhaps, FTX, being an investor in Nestcoin, mandated that the funds be kept in its coffers.

Bademosi, however, said that at the time, the team was only paying attention to keeping investors apprised of the situation and keeping the startup afloat.

“One thing we didn’t do was pay attention to anything that was being said, and that is because we decided to be transparent and open with our community on what has happened so that we could get back to building.” In short, it was a chapter the team wanted to put behind them.

For Bademosi, the events of November 2022 re-emphasised the importance of having a great team.

“The one thing that is in your control as an entrepreneur is the people that you work with. And I do think that we have such an incredible group of people working at the company. The resilience that the team showed was, and is incredible.”

Another lesson was focusing on what is within your control.

“There’s a lot of things that are not within your control that don’t move the needle. If you’re an hyper-critical person, it is easy for you to put a lot of pressure on yourself, but you need to remember that there are a lot of different factors in outcomes.

“You can only focus on what is ahead of you.”

The pivot to Onboard

Nestcoin was created to be an incubator; a company with several crypto products that also invested in other crypto/Web3 companies. The mission was to educate people about crypto, while creating outlets to help them profit from cryptocurrency.

On the education front, Nestcoin had Breach (rebranded as Compass by Onboard), which can be described as a media product, which uses newsletters, articles, and podcasts to provide crypto education.

It also has Metaverse Magna. A gaming guild, which now operates as a stand alone company. It provides scholarships for Africans who want to play-to-earn in the metaverse. The company had other products that were either launched or were yet to be launched.

However, the focus for Nestcoin will now be on one product — Onboard.

Onboard is a non-custodial crypto wallet with the benefits of a custodial wallet.

For the crypto-uninitiated, custodial and non-custodial crypto wallets are the two classifications of cryptocurrency wallets. Essentially, you are either holding your crypto yourself (non-custodial) or someone is doing it for you (custodial).

A custodial wallet, as the name implies, is a wallet system where a centralised organisation like Binance or Quidax holds your crypto.

Deciding between custodial and non-custodial wallets is like choosing between using a bank or keeping your cash under your bed. With the bank, it keeps your money safe and provides you with other banking services, but it could also go under, freeze your account or have service outages.

Non-custodial wallets are the equivalent of keeping your cash under your bed, but in this case, you’re storing digital assets. It’s like carving out a space on the blockchain for yourself where only you have the key and you’re responsible for its safety.

While holding your key gives you full control of your crypto, you’re also at risk of making mistakes that could lead to huge losses.

In fact, crypto newbies are better off using services like Quidax and Bundle because they are less complicated and safer, and there’s access to a customer care service in the event of a mistake.

What Onboard is trying to do is merge the two.

Bademosi described it as having “the feeling of a custodial or traditional finance product with the benefits of a self-custodial or non-custodial product.

“This means that you always remain in control of your assets. If we went down today, your money is still with you so you don’t have to worry or think about that.”

Another advantage Bademosi noted is customer support and community.

However, the most interesting benefit is the ability to go from crypto to fiat directly on the platform. If you’re used to non-custodial platforms like MetaMask, you’ll notice that this is almost impossible, especially as an African.

The only drawback to this service, however, is KYC.

To be clear, Onboard is usable without KYC, however, access is only limited to sending, receiving, and storing crypto. Going from fiat to crypto or vice versa requires going through the full KYC process.

“In the world that we live in, you have bad actors. So if we build the protocol or exchange without doing KYC, we expose the product to being used by bad actors who might want to take advantage of what we’ve built. And so, to protect our users and community, we do KYC.”

The decision to focus only on Onboard was made because it was the product that tied everything Nestcoin did together.

Performing any crypto-related activity requires a wallet. Be it creating NFTs or trading, a cryptocurrency wallet is the entry point into all things crypto.

The inspiration also came from what Nestcoin had been through. According to Yele, the FTX event captured the ethos of what the company is all about — “giving people the power to be their own bank.”

But Africans don’t care about crypto any more

From the crypto winter to the fall of crypto companies, everything crypto-related has been getting terrible PR lately.

Some articles talk about crypto’s fall from grace and how many Africans are getting less interested in the Internet money’s promises.

Popular tech YouTuber, Marques Keith Brownlee (MKBHD) compared the advent of Artificial Intelligence (AI) to crypto, saying the AI revolution is making the digital currency revolution look dumber and dumber.

But Bademosi believes there’s a big misconception about the AI industry in comparison with crypto.

“People started working on AI in 1950, which is about 73 years ago. The CEO of OpenAI is 39 years old, he wasn’t even born when people started working on AI. AI has gone through multiple periods. Hype and boom cycles. Periods where a lot of money went into it.

“The second thing we don’t also realise is that the problem with crypto generally is not its lack of utility, but the restriction around the utility due to the nature of where the initial use cases are coming from.”

Crypto creates financial value, and where money is, regulations are strong. However, what happens when cryptocurrency gets to where AI is now?

“It will look like WhatsApp and WeChat, or mobile money,” Bademosi said.

On a recent visit to Nairobi, he observed mobile money use and realised that stablecoins are simply mobile money on the blockchain.

“It’s like mobile money meets open banking; that is what stablecoins are.”

Essentially, the crypto vision is still valid. However, the regulatory landscape needs to go through a few iterations. Changes that will take a long period of time.

And whether interest in crypto is high or low, the crypto/blockchain-focused entrepreneur said, “For me as a builder in the space, it does not change what needs to be done. If anything, I’m happy that there’s less hype so we can put our heads down and build.”