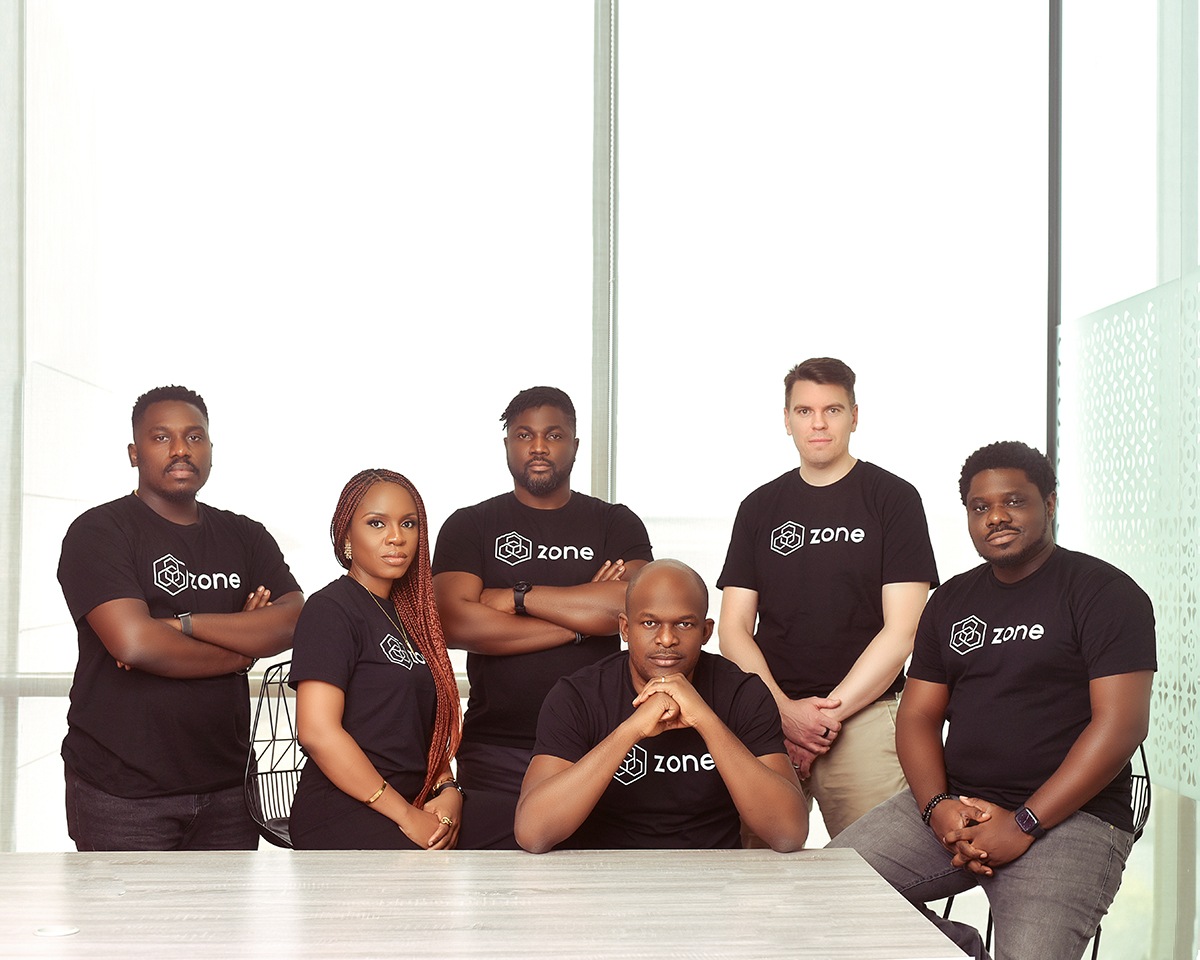

Nigerian fintech Zone has completed an $8.5 million seed round led by TLcom Capital and Flourish Ventures. Additional capital was raised from Digital Currency Group, Verod-Kepple Africa Ventures, Alter Global, and Endeavor Catalyst.

Co-founder and CEO Obi Emetarom views the startup's ability to raise capital in a tough funding environment as a testament to its value proposition.

"Our new investors and existing shareholders, including CCA, Lateral Capital, Constant Ventures, and V8, bring more than just financial backing, as their global scope and deep expertise make them invaluable partners for us. With their support, we are poised to accelerate our mission to connect every monetary store of value and enable real-time payments within and across geographical borders," he said.

Zone is one half of the Appzone Group, founded by Obi Emetarom, Emeka Emetarom, and Wale Onawunmi in 2008.

Initially, the Group built banking infrastructure and went on to serve over 400 microfinance and commercial banks in Nigeria.

However, it underwent a rebrand in 2022, with its cloud-based software as a service becoming Qore and Zone becoming its blockchain-powered payment infrastructure.

“In 2022, we obtained a switching license. In Nigeria, switching licences are not transferable, and we wanted to run the payment infrastructure business separately as a standalone. So, we spun every other business (the banking as a software business) out into another entity called Qore and rebranded Appzone into Zone,” Emetarom said.

Zone touts itself as the first regulated, decentralised payment network in Africa. During a conversation at the Techpoint Africa Blockchain Summit held in 2022, Emetarom argued that regulating cryptocurrencies is a necessary step for widespread adoption.

Despite the often hostile stance of Nigeria’s Central Bank regarding cryptocurrencies, Emetarom says Zone’s blockchain-based solution has been embraced by numerous players. It currently has more than 15 commercial banks using its services.

Join over 3,000 founders and investors

Give it a try, you can unsubscribe anytime. Privacy Policy.

“We started initially with the ATM payment channel, have processed up to $1 million monthly, and will start rolling out new products, what we call use cases. These new use cases will incorporate solutions for fintechs, and we will be integrating them into the network. We already have some big ones signed that we are not at liberty to disclose now until they are live.”

Zone says it will use part of this funding to connect more financial institutions in Nigeria. It would also conduct a pilot programme to test its cross-border payment solution ahead of 2025.

Lead investor, Flourish Ventures has previously invested in African fintechs such as Flutterwave, FairMoney, Bitnob, Paga, and Lendable. Zone hopes that experience will aid its entry into new markets.

"For the first time in Africa, Zone's technology enables direct communication between participants in the payment ecosystem," Ameya Upadhyay, Partner at Flourish Ventures, said in a statement. "We believe this is a fundamental leap that will allow customers to experience a completely new standard of reliability, speed, and cost efficiency at the ATM, at POS machines, and online," he added.

How Zone works

Zone is one of the few African-built blockchain networks. Unlike Bitcoin, Ethereum, or Solana, Zone is a regulated network that supports fiat, CBDCs, and eventually crypto transactions.

Essentially, Zone is a blockchain for fiat and not just crypto.

In a conversation with Emetarom, he said Zone was built to solve problems fiat transactions currently face, such as settlement and reconciliation. He said some powerful features of the blockchain, such as its peer-to-peer nature, allow for more speedy transactions.

“Rather than the star network architecture — hub and spoke — we now have a mesh.” This means that transactions between people are directly connected without any third party.

Another feature Zone brings from the world of crypto to fiat is the ledger system that allows anyone to check the status of a transaction. Like crypto transactions, either party can confirm if a transaction has been completed.

This level of visibility is the kind of experience Zone is bringing to Africa’s financial sector. However, beyond providing a better financial experience, the network will also prevent fraud and streamline operations.

But while Zone has brought the power of blockchain to fiat, it has had to compromise on one of the major tenets of blockchain technology: decentralisation.

Emetarom explained that while the architecture is decentralised, the company has to maintain a level of centralisation because of regulation.

“We don’t believe that you’re ever going to get mass adoption of decentralised services without regulation.”

Regulation of blockchain-powered services has been a major issue for Nigeria and many countries all over the world. Zone’s way around this, making sure there’s central oversight by regulators.

According to Emetarom, Zone is compliant with existing compliance guidelines, meaning that there is no need for regulators to create new guidelines for the technology.

Interestingly, the company plans on bringing more blockchain innovations, such as decentralised finance, within the purview of regulators, a move that could see it go on an Africa-wide expansion in a few years.