2018 was the year of fintech startups in Nigeria, especially with respect to funding activities as well as prominent industry moves and regulations.

In December 2018, Trium Networks CEO and Open Banking Nigeria trustee, Adedeji Olowe, in a Twitter thread, pointed out some of the interesting things that he expected to happen within the fintech space in 2019.

Suggested Read: Payment Service Banking will flop; 2019 financial prediction by an expert

Some of his predictions actually came true, whether directly with the aid of regulation or not.

Olowe expected inter-bank transfers would become higher than ATM cash transactions for the year.

Interestingly, interbank transfers already had higher values than ATM transactions according to Nigeria Inter-Bank Settlement System’s electronic payments fact sheet (PDF) for 2018.

Payment Service Banks (PSBs) would flop?

It was also expected that PSBs, whose regulation and guidelines were released last year, would fail. After its introduction, both MTN Nigeria and Airtel Nigeria revealed their plans to get a licence.

And earlier in the year, an official of Airtel Nigeria revealed that the telecom company had already started recruiting in preparation for the launch of its PSB. This somewhat pointed to the fact that the telco might launch before MTN that indicated an interest in the licence first.

Suggested Read: Why Payment Service Banks might not impact Nigeria’s financial inclusion drive

As of now, none of the telcos has launched a PSB. But the Central Bank of Nigeria (CBN) recently granted three approvals in principle (AIP) for new PSBs.

It’s too early to agree whether PSBs have flopped or not.

The Shared Agent Network Expansion Facilities (SANEF)

SANEF was expected to become a surprising success.

Prediction #3 SANEF becomes a surprising success. If you don’t know what SANEF is, don’t ask me. #10fintechpredictions2019

— Adédèjì Olówè (@dejiolowe) December 24, 2018

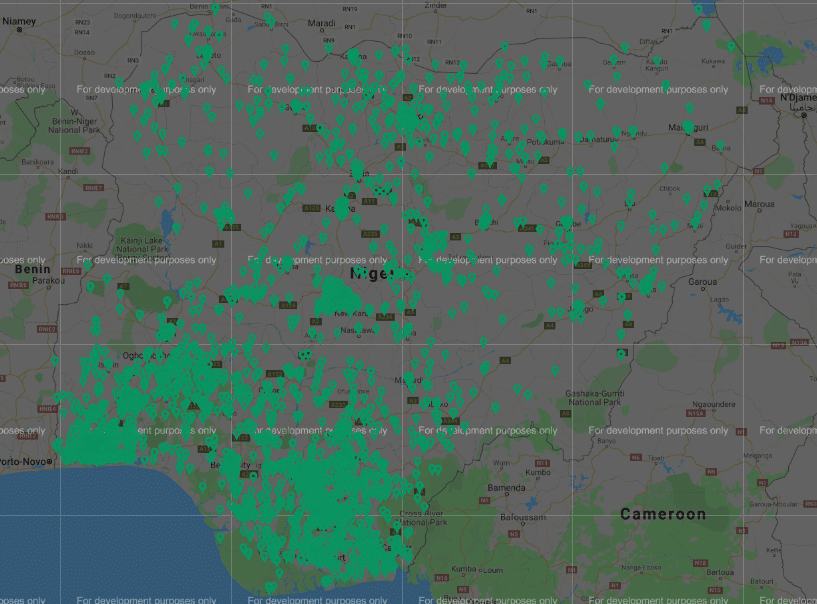

The Shared Agent Network Expansion Facilities (SANEF), a 500,000 payment agents initiative, was introduced last year with the aim of increasing access to financial services.

Stakeholders at the December 2018 edition of PoS Innovation Summit pointed out that the programme was already yielding expected results and the current state of SANEF’s agent locator map was proof that the programme had attained some level of success.

On data breach or fraud

Olowe also predicted that there would be a massive data breach or fraud that would hit fintechs and give the apex bank the sort of power to sanction some players in the industry.

While a data breach within the fintech space would have been an avenue for the CBN to display its regulatory power, it didn’t happen in 2019.

Prediction #4 A massive data breach or fraud hits some fintechs and @cenbank will almost beat them to death for it #10fintechpredictions2019

— Adédèjì Olówè (@dejiolowe) December 24, 2018

The about-turn

Prediction #9 @cenbank does an about-turn on the new licensing regime because no fintech has N5B to play with #10fintechpredictions2019

— Adédèjì Olówè (@dejiolowe) December 24, 2018

One of the major highlights of the fintech space in 2018 was an exposure draft of the licensing regime for players within the payment industry which they kicked against.

The draft pegged minimum shareholders fund (SHF) to provide payment services in the country between ₦100 million ($275,584.60) to ₦5 billion ($13,779,230). It was predicted that CBN would do an about-turn on the licensing regime.

All through the year, the licensing regime was never implemented, raising questions about whether the apex bank was considering a review of the exposure draft.

Inter-bank transfers

Olowe also predicted that there would be a reduction in the inter-bank transfer charge from ₦52.50 (VAT inclusive) to ₦20. Earlier in 2019, Kuda Bank — a mobile-only bank — came into the market allowing free inter-bank transfers.

Prediction #6 Interbank transfer becomes N20. Trust me, I will throw a party for this even though I know @eniolorunda will kill me. Not my fault, it’s what the Oracle is saying #10fintechpredictions2019

— Adédèjì Olówè (@dejiolowe) December 24, 2018

The digital bank is currently allowing 25 free transfers to other banks every month and charging only ₦10 for subsequent inter-bank transfers, which is even half of Olowe’s predicted fee.

This move by Kuda Bank cannot be credited to any directive from the apex bank. Interestingly, OPay initially charged ₦10 for inter-bank transfers before it started charging 2% on transfers, and later settling for a ₦45 charge for the first transaction of the day and 1% for subsequent ones.

In December 2019, the CBN released a revised guide to charges by financial institutions which should take effect from January 1, 2020. In the guide, electronic fund transfers of ₦5,000 and below will cost ₦10 while transfers from ₦5,001 to ₦50,000 will cost ₦25, and amounts above ₦50,000 will attract a ₦50 charge.

Olowe also predicted that transfers of ₦1,000 and below would be done at no cost. That didn’t happen, with the closest thing to it being Kuda Bank’s free transfer which doesn’t have a maximum transfer value.

Prediction #7 Micropayments (transfer of N1,000 and below) become free because @cenbank will tell banks to do so. They did it for ATM withdrawals and the world didn’t end #10fintechpredictions2019

— Adédèjì Olówè (@dejiolowe) December 24, 2018

Public opinion is that the likes of Kuda Bank would feel the impact of the revised charges. Nevertheless, at the moment, its customers still have 25 zero-fee transfers every month.

The big players actually came

According to Olowe, “international players go big with payments, loans and other random things.”

This happened with the OPaycalypse. Opera entered the Nigerian payment market in 2018 by acquiring a controlling stake in a Nigerian mobile money platform, PayCom.

Suggested Read: OPay, ORide and the effects of a $50 million war chest

In 2019 Opera went all in, starting with the launch of a motorcycle hailing product — ORide — in its mobile payment product, OPay.

Opera has gone ahead to add other services to its payment platform, from bus to tricycle and car-hailing, among others like food and loans.

PalmPay entered the Nigerian market towards the end of 2019 but at the moment, it’s basically a payment platform that allows only deposits, bank transfers, airtime top-up, and bill payments.

It seems like a big win for the predictions for the fintech space in 2019. And with the impending revised charges for financial institutions that will take effect in January 2020, the fintech space would be an interesting one to watch in the coming year.