It appears Airtel Nigeria is beating MTN to the launching of a Payment Service Bank (PSB) in Nigeria.

Apparently, Airtel is currently recruiting hundreds of people in preparation for the launch of its PSB, which the telco indicated interest in owing last year. This was made known by an Airtel official at the L & D Leaders’ Conference yesterday in Lagos.

Early 2018, the Central Bank of Nigeria (CBN) and the Nigerian Communications Commission (NCC) signed a memorandum of understanding which is expected to consider telcos to play directly in the nation’s payment system.

In October, the apex bank released the guidelines for licensing and regulation of PSBs in the country, which enables telcos own the licence through a subsidiary. In November, MTN Group CEO, Rob Shuter revealed that the company would be applying for a licence towards launching this year.

After about a month, Airtel followed suit with a revelation of its readiness in securing the licence and establishing the bank this year as well.

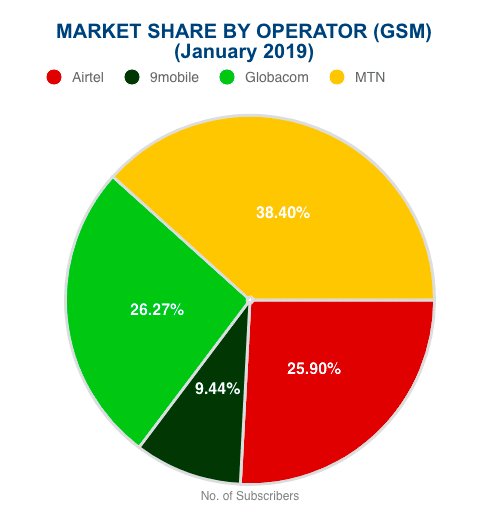

If Airtel eventually launches before MTN, since it’s currently recruiting, Airtel could have the first-mover advantage despite currently being only the third largest telecommunications operator with respect to subscriber base in the country.

Both Airtel and MTN have a strong network of outlets and shops across the country which they are banking on to provide financial services using the PSB licence.

Do note the services to be provided by a PSB are limited to only high-volume, low-value transactions in remittance services, micro-savings, withdrawal services and investment in FGN and CBN securities. The bank can only serve individuals as well as small businesses.

An industry expert last year predicted that the PSB initiative will flop this year. And there are concerns about the framework that point to the possibility that PSBs might not have a great impact on the financial inclusion drive of the Central Bank of Nigeria (CBN).

Evidently, both the apex bank and concerned industry stakeholders would have to wait for months or years after a couple of companies must have launched their PSBs to measure its impact in the country.