Whether financial technology (fintech) is a threat to the banking sector or not, one obvious fact is that Nigerian Internet startups that deliver financial services are getting more attention as well as funding opportunities from both local and foreign investors.

It’s probably the year of fintech in Nigeria. SureRemit — a Nigerian cash remittance startup — earlier in the year raised $7 million in an initial coin offering (ICO).

Worthy of note is that CowryWise — one of the fintech startups featured in the Nigerian Startup Funding Report for Q2, 2018 — was recently accepted into Y Combinator for the Summer 2018 Batch.

Of the 42 startups that got one form of funding or the other in Q2 2018, 12 are providing financial services.

And of the top funding in terms of value, financial services had two entries while logistics, media and services got one entry each.

Also, 75% of the funding in value for the quarter went to financial service providers, an indication that investors are keenly interested in the Nigerian financial services space and their understanding of addressing the challenges in the sector.

Maybe the nation will achieve the financial inclusion target of 80% set by the Central Bank of Nigeria (CBN) for the year 2020 going by the level of attention that the sector is getting.

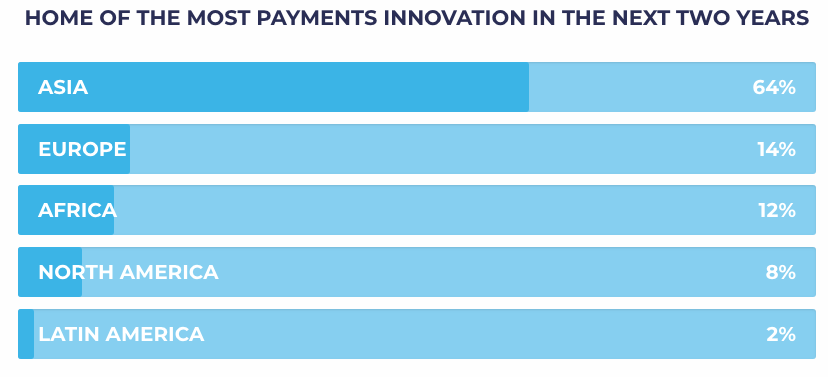

According to the Africa Payments Innovation Jury 2017, 12% of the global payment innovation in the next two years will be in Africa.

Insurtech is the next big thing

One of the startups that got funding in Q2 2018 was CompareIN — an insurance policy comparison platform.

The Nigerian insurance market is probably one of the sectors of the financial service industry that still present a great deal of potential as its penetration, according to Agusto & Co, was less than 1% as at 2015.

In spite of low penetration, the activities within the sector are still basically at the mercy of the big insurance companies using the brick and mortar model.

Airtel Nigeria at a time was offering insurance service to its subscribers through the USSD channel but apparently, the service was discontinued.

There’s the need for the National Insurance Commission (NAICOM) to consider mobile technology towards driving insurance penetration in the country.

Banking services

Three of the startups that got funding in the quarter offer basic banking and payment services while another two are offering quick collateral-free loans to people and loans to businesses.

Every commercial bank in Nigeria has a mobile application but the sector keeps welcoming mobile solutions targeted at customers within and outside the banking system.

It appears there won’t be an end to the support for the banking sector, at least for now. And considering the rate of financial exclusion in Nigeria, the Central Bank of Nigeria (CBN) and the commercial banks need all the help they can get.

Startups with solutions that allow merchants and businesses to accept payments, keep track and manage their books of accounts are also attracting investment.

Cryptocurrency had an entry in Q2 2018, with Microtraction giving seed funding to Bitkoin Africa — a platform that enables people to buy and sell digital currencies. With this investment, Microtraction is banking on the future of cryptocurrency in Nigeria, and Africa by extension.

The reason for backing Bitkoin Africa, according to Yele Bademosi, founder of Microtraction, is that the development tools and languages for blockchain and digital assets are rapidly evolving.

Will more companies entering the cryptocurrency space be enough reason for CBN and other relevant government agencies reconsider their stand on digital currency in Nigeria?

Suggested Read: The crackdown on cryptocurrency: Why Nigeria should switch sides

On the account that almost every sector in the Nigerian financial industry is largely under-served, players in the financial service industry would continue to get the attraction.

Six years after the introduction of the cash-less policy by the CBN, Nigeria is still predominantly a cash-driven society.

Fintech is, no doubt, having its moment with banks collaborating with fintech startups for their service delivery. Aside from addressing the dearth of financial inclusion, other services that beckon for innovative solutions include currency exchange, investment services as well as insurance.