Trove Finance has acquired UCML Securities, rebranded as Innova Securities, to bring brokerage services in-house, strengthen compliance, and improve trade execution for its growing user base.

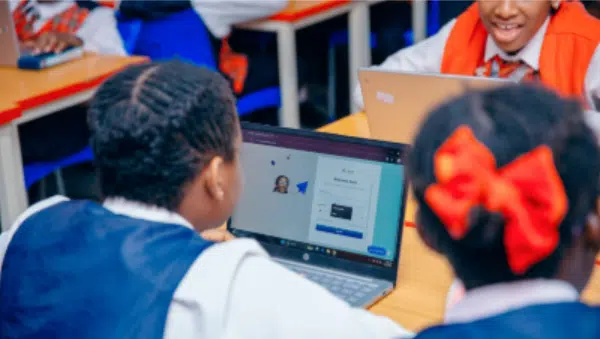

Transforming African Education: Bildup AI Launches “AI in Every Classroom” Initiative

A New Era for African Education: Bildup AI Ushers in…

Top Stories

Born from a failed charity effort, Africa Impact Initiative backs market-creating businesses across Africa. Its patient model prioritises sustainability, offering capital, diaspora networks, and long-term support.

On today’s Techpoint Digest, we discuss Apple’s “Campos” AI chatbot as a replacement for Siri, KollegeScouts is rethinking how Nigerians get into university, and Kenya’s High Court rejects Worldcoin.

Born from a personal experience, Kollegescout wants students to search and compare Nigerian universities. filter institutions by location, tuition fees, and admission criteria.

The Secretary-General of the AfCFTA, and Nigeria’s Minister of Finance and Coordinating Minister of the Economy, will lead key conversations at the Africa Business Convention (ABC) 2026, scheduled for February 3–4.

Brand Press:

Motivair by Schneider Electric, a leading innovator in liquid cooling…

OneDosh has closed a $3M pre-seed to build the stablecoin-powered…

Finlogic has obtained an IMTO license from the Central Bank…

HelpMe AI prioritizes simplicity and accessibility. “HelpMe AI is designed…

Nigerian fashion retail brand Agu.ng is proving that growth in…

Heirs Insurance Group launches its first Hackathon, inviting Nigerian students…

In a market filled with payment apps, wallets, and delayed…

Fewticket is solving ticketing failures with an offline-first platform, proven…

In the competitive world of Nigerian fintech, where customer acquisition…

Fembol Group, one of Nigeria’s fastest-growing logistics and supply chain…

You can post on Techpoint Africa too!

Post hereMotivair by Schneider Electric, a leading innovator in liquid cooling…

OneDosh has closed a $3M pre-seed to build the stablecoin-powered…

Finlogic has obtained an IMTO license from the Central Bank…

HelpMe AI prioritizes simplicity and accessibility. “HelpMe AI is designed…

Nigerian fashion retail brand Agu.ng is proving that growth in…

Heirs Insurance Group launches its first Hackathon, inviting Nigerian students…

In a market filled with payment apps, wallets, and delayed…

Fewticket is solving ticketing failures with an offline-first platform, proven…

In the competitive world of Nigerian fintech, where customer acquisition…

Fembol Group, one of Nigeria’s fastest-growing logistics and supply chain…

You can post on Techpoint Africa too!

Post hereOther highlights

On today’s edition of Techpoint Digest, we talk about NCC licencing seven new ISPs in Nigeria, why she chose tech over oil and gas, and how Nigeria is leading the world in AI use.

Jane Egerton-Idehen started in tech earning ₦36k as a corps member, running 24/7 satellite shifts for extra pay. Now MD/CEO of NIGCOMSAT, she advises: chase challenging opportunities and skills first, financial growth will follow.

Terra Industries’ seed round reignited claims that African VCs lack ambition, but a closer look suggests the story is less about fear and more about structural constraints.

On today’s Techpoint Digest, we discuss Congo’s plans for a new subsea cable to address Internet disruptions, X, and Paystack’s evolution beyond a payments company.