Key takeaways:

- Bitcoin, the flagship cryptocurrency, has cracked an all-time-high of $72,000 signifying a bull run in the crypto market. However, it is risky for beginners to invest in the market during this bull run.

- From phishing scams to downloading the wrong kind of wallet, the risks associated with making money from crypto go beyond buying the wrong coins.

- There are steps to follow based on your knowledge level and your risk appetite.

After the death of FTX — the $32 billion crypto exchange — in 2022, the crypto market suffered a huge hit. Other massive losses in the year such as the bankruptcy of Celsius, a $25 billion crypto lending platform, and the crash of TerraLuna decimated the market with losses worth over $2 trillion.

Bitcoin which was flying high at $69,000 in 2021, dropped to $15,00 in 2022 and we had to ask the question, is crypto dead?

However, the crypto market has responded and it is very alive, going from a $760 billion market cap in 2022 to $2.72 trillion today.

The market is now in a bull run, a state where the crypto market experiences significant growth.

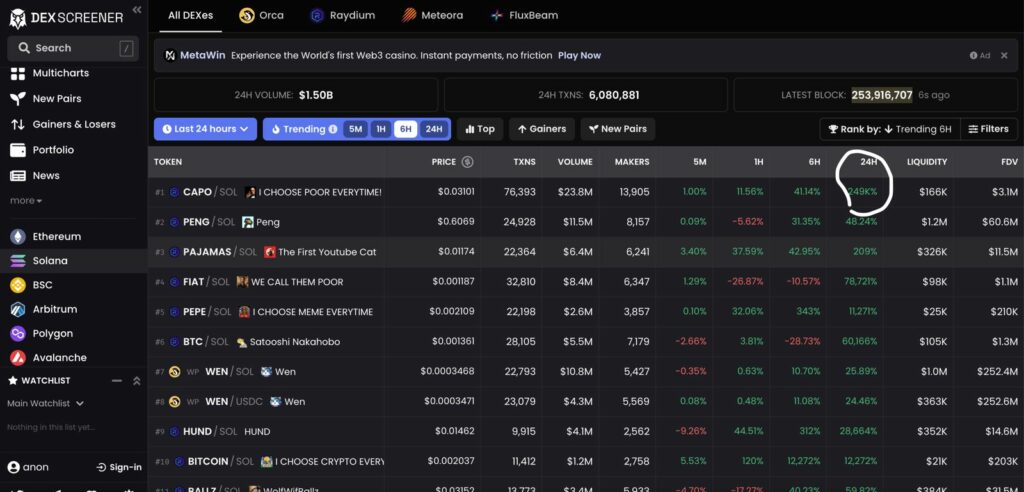

For example, a crypto token based on US President Joe Biden gained 1,049% value in one day which means if you invested $100, you would have made over $1,000 from it on the same day.

Some tokens even do as much as 200,000% in a single day, allowing holders to possibly make millions in a matter of hours.

However, according to Victoria Abiodun, a blockchain writer and teacher, it is not that simple. While the value of the crypto market increases during a bull run, the risks also increase, so if you want to make some money from it, it’s best to do it safely.

How to safely make money from a crypto bull run

There’s always a buzz around crypto during a bull run. News about bitcoin reaching a new all-time high (ATH) and people making insane amounts of money tend to generate a fear of missing out (FOMO).

However, it is important to note that the reality of the market isn’t always the same as what you see on social media and in news headlines.

You could make a mistake by purchasing your crypto the wrong way or clicking on the wrong website.

I reached out to two people, Abiodun and expert trader and crypto influencer, Ademi, who shared steps to making money from a crypto bull run as a beginner.

Decide where your capital is coming from

Abiodun’s advice for a crypto beginner is to first decide if they have the capital to enter the market. For those who do, the next steps are straightforward, but for those who do not, there are ways to source capital within the crypto space.

The first way to earn capital to invest in crypto is to build a career within the space. While this might be a long route, Abiodun says it is how she got in.

“I earned my first crypto working.”

She recommends joining Superteam, a community that is part of a popular blockchain ecosystem called Solana. Superteam has sub-communities in nine countries including Nigeria — the only African country — and helps members learn and earn simultaneously.

But if you do not want to earn by working in the crypto space, Abiodun has another solution — testnet farming.

A testnet is a blockchain project still in the test phase. It is a sandbox environment that allow developers to build and experiment with new features before rolling out the project on the live blockchain called the mainnet.

Testnet farming is a way of earning crypto without any monetary investment. It involves looking for crypto projects that haven’t launched yet — still in testnet — and participating in testnet activities which include performing transactions and providing feedback on the project.

In return, you earn tokens which could be valuable and even accumulate more value after the project’s mainnet launch.

Abiodun says one of the sure ways you can find these testnet projects is to follow crypto influencers that specialise in sharing info about them on social media.

You can also find testnet projects on ICO DROPS or CoinMarketCap’s event calendar. Testnet farming is also similar to airdrop farming.

Project owners use airdrops to incentivise community members to perform activities such as following the project’s social media and inviting more people to join. It is the same way new businesses give free samples to get new customers.

As an early member of the project, you can keep getting rewarded for the foreseeable future.

Learn how to buy crypto

If your capital is coming from your pocket, Ademi suggests that you learn how to buy cryptocurrencies. A ten-minute YouTube video should do the trick or you could follow these simple steps:

- Sign up on a trusted crypto exchange with peer-to-peer (P2P) trading.

- Find the P2P feature and exchange your naira for a stablecoin like USDT.

- Trade your USDT for the crypto token of your choice.

You can stop there or you could go deeper by learning some crypto trading intricacies here.

Decide which crypto to buy

Deciding which cryptocurrency to buy is perhaps the hardest decision to make for crypto newbies and even some professionals. Naturally, people would go for the best-performing crypto tokens, but Ademi says the top 20 altcoins are your safest bet.

Altcoins are all crypto tokens besides bitcoin and Ademi says they are a safer bet when it comes to profitability. Unlike bitcoin, they have relatively smaller market caps, which means you can make significant profits on small investments.

They’ve also been around for longer, which means they have easily verifiable fundamentals than newer tokens.

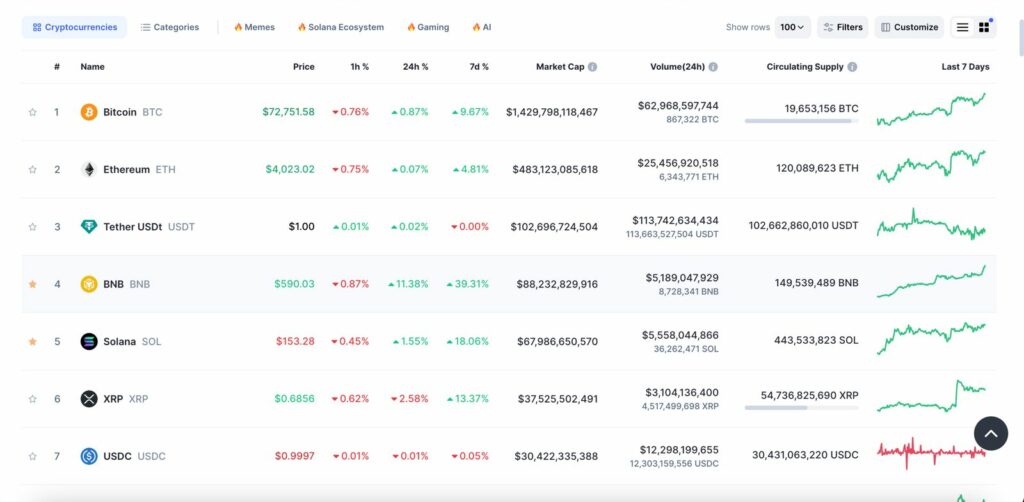

Visit CoinMarketCap and you’ll see a list of cryptocurrencies ranked from 1 to over 18,000.

Determine your risk appetite

While Ademi’s strategy of investing in the top 20 altcoins on CoinMarketCap is a safe way to take advantage of this crypto bull run, you might not see insane returns.

There are places where you can find crypto tokens that will give you as much as 200,000% profit in a matter of hours.

However, Ademi and Abiodun agree that playing on that side of the crypto market opens you up to a substantial amount of risk.

“Get ready to lose a lot of money,” Ademi says, because the bigger the reward, the bigger the risk.

To buy or trade these tokens, you’ll need to leave the safety of centralised exchanges like Binance, Bybit, or Quidax and interact with decentralised exchanges and protocols.

Abiodun emphasises the risk associated with this by narrating how she lost money by downloading the wrong wallet.

“I downloaded Metamask wallet from Google, and the moment I sent money to it, the money was out.”

According to her, there are fake Metamask websites that will pop up when you do a Google search to download the Metamask wallet.

In other cases, you could download the right wallet but accept scam airdrops that could drain your wallet of any asset in it.

These are some of the risks you’re open to when you play in the decentralised world of crypto. Abiodun advises that you visit the verified social media platform of the wallet you want to download, and click the download link from their profile.

Getting a decentralised wallet — which are most times browser extensions — is the first step to operating in the decentralised crypto space. You can then visit platforms like Dex Screener to find tokens to buy.

This is highly discouraged for a crypto beginner due to its risks and complexities, but if you have the money to burn while you learn, go for it.

Disclaimer: The contents of this article are not financial advice. Techpoint Africa is not responsible for any financial decision made based on this article.