Good day,

Today, I'm discussing:

- Africa's Blockchain Bitmama

- Wave's $1.7b valuation

- Vahlid combating online scam

Meet Africa's Blockchain Bitmama, Ruth Iselema

It is often said that challenges can be opportunities in disguise. Clichés like these resonate more when people live them out. And Ruth Iselema, Founder of Bitmama, a crypto exchange platform, lived it out.

I mean, how does a trained pharmacist enthusiastic about computers and entrepreneurship delve into the Blockchain space, get scammed of ₦250,000 while trading Bitcoin, and then build a prominent crypto exchange platform some years later?

Making bold moves. With the backing of supportive parents and having interacted with Blockchain communities on WhatsApp and Telegram, Iselema was convinced about her idea. And in 2018, she left the city of Port Harcourt for Lagos to be in the spaces where Blockchain was gaining ground.

Our Chief Servant, Múyìwá, had a sit-down with her, and she talked about everything, from the struggles of building a business to hiring, scaling, and much more.

Read the article here or watch the video here.

Senegal-based, fintech, Wave, becomes a Unicorn

What happened? Well, the Unicorn wave didn't bypass the Francophone African region. US-founded, Senegal-based mobile money provider, Wave, raised $200 million in its just-concluded Series A round bringing its current valuation to $1.7 billion and making it Francophone Africa’s first Unicorn.

This round — which saw participation from previous investors, Partech Africa and Sam Altman, Y Combinator's ex-CEO — was led by Sequoia Heritage, Founders Fund, early-stage VC firm, Ribbit Capital, and global fintech platform, Stripe.

Be the smartest in the room

Give it a try, you can unsubscribe anytime. Privacy Policy.

Some background gist. Founded as Sendwave in 2014 by two Americans, Drew Durbin and Lincoln Quirk, the mobile money provider, Wave, kicked off operations as a medium for making payments from Europe and North America to African and Asian countries. In 2020, Sendwave was acquired by global fintech giant, WorldRemit, for ~$500 million, cash and stock inclusive.

A tug of mobile money war. For Durbin and Quirk, the mission had always been to lower the cost of mobile money transactions in Africa, and Wave, which was already in the works while they ran Sendwave, launched in Senegal in 2018. Following Sendwave's acquisition, the duo fully focused on the mobile money provider.

They broke into the market, charging a 1% fee for deposits and transfers and instant refunds in cases of problems with transfers. In June 2021, Orange, a leading telecom and mobile money provider in Senegal, responded to the competition by blocking the purchase of Orange phone credits on Wave. Currently, the dispute has been taken up by Senegal's telecom regulator.

Present in two African countries, Wave boasts of a user base nearing 5 million in Senegal, and it plans to mirror this growth in Ivory Coast, where it put down its roots in April 2021.

Fun fact. This Series A makes Wave Africa's sixth Unicorn, sharing the pedestal with Jumia, Fawtry, OPay, Flutterwave, and Interswitch.

Vahlid is looking to combat scams in the online retail marketplaces

If we called for people to come forward and recount their bad experiences shopping online, we'd run out of time to hear all the sad tales buyers and sellers would narrate.

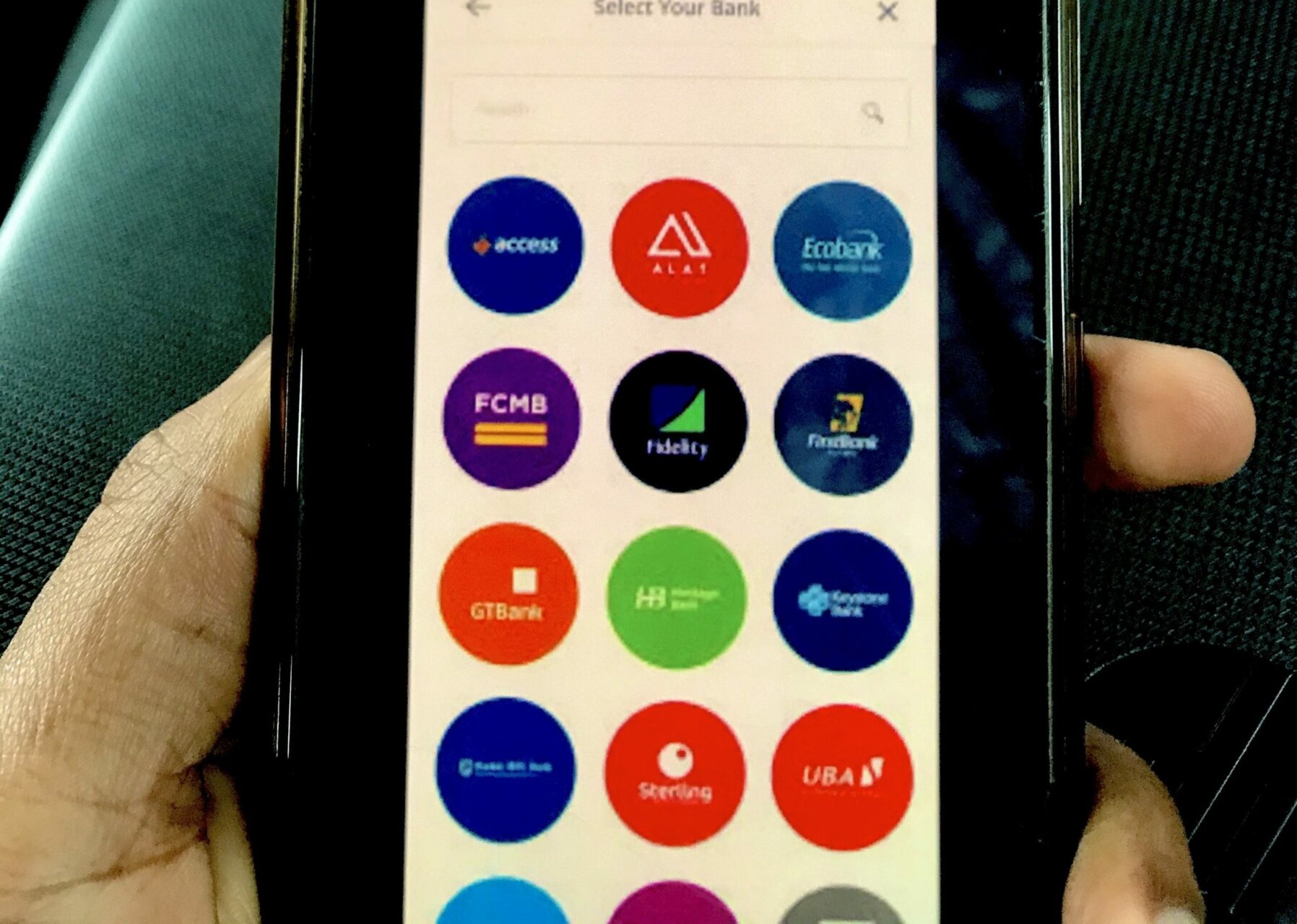

Marketplace heartache. The problem of online scams and fraud in the eCommerce marketplace is a global malady, and a Juniper research report reveals that it is projected to cost online retailers across the world a whopping $20 billion in 2021 alone. This problem is what Vahlid, a Nigerian escrow service startup, is looking to solve.

What they do. Vahlid protects buyers and sellers by acting as a middleman in the online retail marketplace.

Read more here: Fintech escrow service provider, Vahlid, wants to protect your money in online retail transactions

In case you missed it on Techpoint Africa

- South Africa’s 5G network might be on shaky ground; here’s why

- From designing album covers for Adekunle Gold and Blaqbonez, Anthony Azekwoh took a chance on NFTs and made a killing

What I'm reading/watching

- Idea Generation. Read.

- How To Be More Productive by Working Less. Read.

- Before You Quit Your Job, Watch This. Watch.

Opportunities

- Terawork is hiring a female Content Marketing specialist. Apply here.

- uLesson is a social media content creator. Apply here.

Have an amazing day ahead!