In recent times, less than stellar numbers have been posted by eCommerce platforms, and for companies like Jumia, it has been an uphill race towards profitability.

Currently only present in six markets: Nigeria, Egypt, Morocco, Ivory Coast, Ghana and Kenya, last year, the company exited Rwanda, Tanzania and Cameroon, stating that it wants to focus on markets that presented the best long term growth potential.

Suggested Read: Jumia becomes smaller as Jumia Travel is said to be taken over by Travelstart

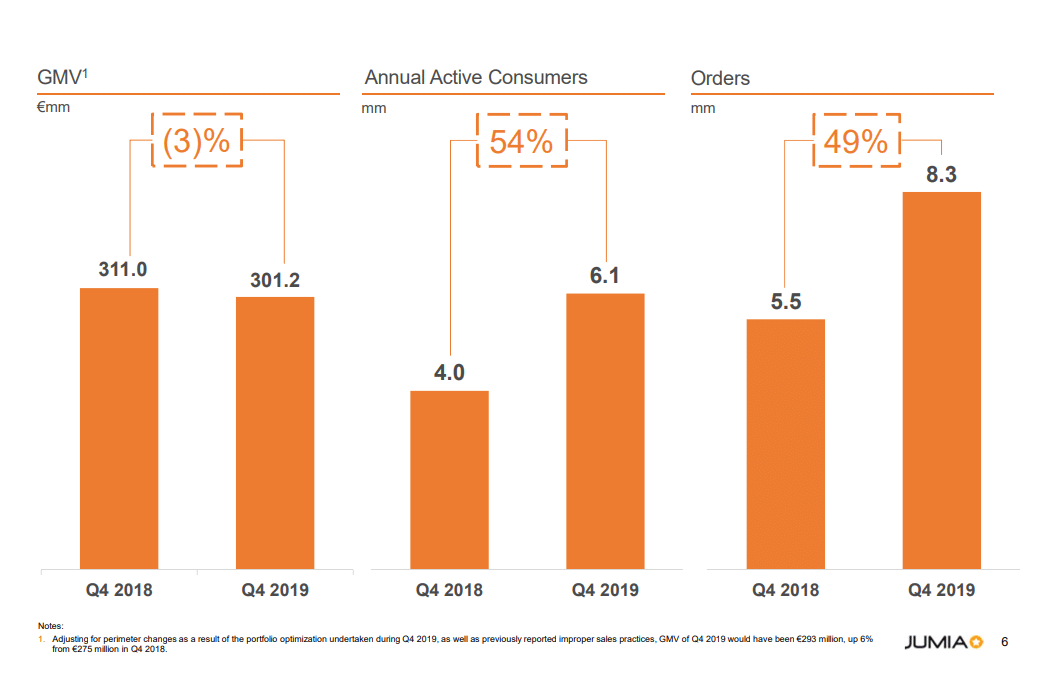

Jumia, in its financial results for the year 2019, records that it now has 6.1 million active consumers as of December 2019 a 54% increase compared to 4 million in December 2018.

Orders reached 8.3 million in Q4 2019, up 49% from Q4 2018. For the full year 2019, orders increased by 85% to 26.5 million in 2019, compared to 14.4 million in 2018.

In Q4 2019, the company’s gross merchandise volume (GMV) decreased by 3.3% to €301 million from €311 million in 2018.

However, for full-year 2019, GMV amounted to €1.1 billion, a 33% increase from €828.2 million in 2018.

It is important to point out that Jumia reports GMV, annual active consumers, and orders on a gross basis, regardless of cancellations, failed deliveries and post transaction returns.

Also, for the year 2019, announced a gross profit of €24.8 million in Q4 2019, a 64% increase from 15.2 million in 2018, and 75.9 million for the full year 2019, 72% higher than the 44.2 million reported in 2018.

The increased gross profit earnings do not seem to be wholly caused by the reported number of active users and orders as the company attributes this to the increased monetisation of its platform, enhanced promotional discipline and reduced emphasis on consumer incentives.

According to the eCommerce giant, despite a 38% increase in fulfilment expense in Q4 2019, the company’s gross profit after fulfilment expense was positive at €1.0 million compared to a loss of €2.1 million for the same period in 2018.

However, despite improved margins in gross profits, Jumia records an operating loss of €61.1 million in Q4 2019, a 15% increase from €52.9 million in Q4 2018.

Consequently, operating loss for the full year 2019 reaches €227.9 million, 34% higher than €169.7 million in 2018.

Jumia attributes this loss to an increase in general and administrative expense, as well as fulfilment expense: both frequently cited causes by the eCommerce company.

Is Jumia slowly building the next Alipay?

Jumia, like our editor, Yinka somewhat predicted in an earlier article, recorded higher losses in 2019 than it did in 2018. But the impressive numbers reported by Jumia for JumiaPay led us to speculate that the payment platform could be its saving grace.

Suggested Read: Could JumiaPay save the Amazon of Africa?

Jumia Co-CEOs, Jeremy Hodara and Sacha Poignonnec have recently made a case for the success of JumiaPay, citing the successes of Aliexpress’ Alipay and Ebay’s Paypal as evidence that a payment platform can be successfully built off a company with a solid structure.

According to Jumia’s earnings report, about 2.4 million transactions were recorded for JumiaPay, more than the total number recorded in the whole of 2018.

For the full year 2019, JumiaPay’s transactions increased by 278% from 2.0 million transactions in 2018 to 7.6 million transactions in 2019.

In terms of value, Jumia reports a 57% increase from €29.1 million in Q4 2018 to 45.6 million in Q4 2019, taking the total value of JumiaPay transactions for the full year 2019 to €124.3 million, up 127% compared to 2018.

Jumia also reports that on-platform penetration of JumiaPay as a percentage of GMV reached 15.2% in the fourth quarter of 2019 compared to 9.4% over the same period in 2018.

Jumia claims that the increased adoption of JumiaPay is a result of its continuous education of consumers, as well as a number of marketing initiatives. But it is important to note that cancellations, as well as returns, are factored in this figure

However, Jumia’s general numbers are in keeping with the widespread adoption of e-payment channels as reported by the Nigeria Inter-Bank Settlement System (NIBSS).

The jury is still out on the possibility of having a truly profitable eCommerce platform in the mould of Jumia and its close competitor, Konga. But given the relative popularity of financial platforms in Africa, a payment channel such as JumiaPay could change the narrative.