Despite the challenges facing the widespread adoption of e-payment channels, Nigerians appear to be increasingly embracing digital payments as evidenced by the massive increase in the use of e-payment channels.

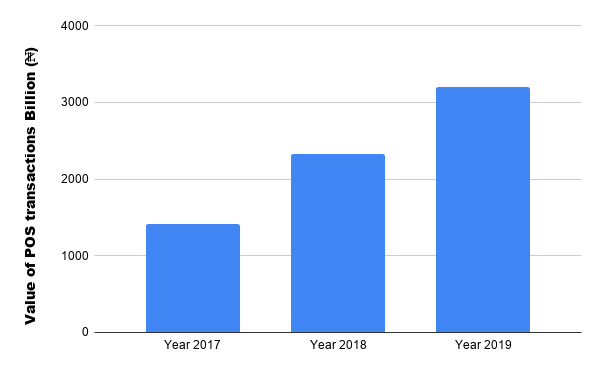

According to statistics from the Nigerian Inter-Bank Settlement System (NIBSS), the value of point of sale (POS) transactions amounted to ₦3.2 trillion ($8.854 billion) in 2019 as the total volume of the transactions hit 438 million within the same period.

Apparently, the value of POS transactions rose by ₦882.03 billion ($2.44 billion), a 37.9% increase from ₦2.32 trillion ($6.4 billion) in 2018 while the volume increased by ~152.8 million, a 53.4% increase from 285.8 million also in 2018.

Once more, the festive period of December recorded the highest number of POS transactions (₦372.687 million) for the year 2019, increasing by 67% from January 2019 which recorded ~₦223 million ($614,289) worth of POS transactions.

Also, mobile inter scheme transactions in 2019 reached ₦828 billion, up by a massive 536% from ₦292 billion recorded in 2018. Similarly, the month of December recorded the highest number of mobile transfers with ₦148.9 billion up by 122 million from 26.8 million in January.

Suggested Read: 2018: Nigerian banking system did ₦80.4 trillion in inter-bank transfers

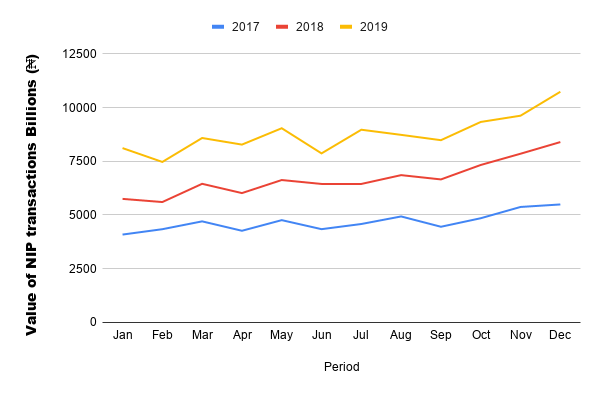

For NIBSS instant payments (NIP) — which normally includes POS, mobile, Automated Teller Machines (ATMs) and Unstructured Supplementary Service Data (USSD) — a significant increase was recorded as transactions hit ₦105.2 trillion in 2019, up by 30% from ₦80.4 trillion ($222.3 billion) in 2018.

The festive season recorded the highest number of transactions across all platforms, while February accounted for the lowest in the year, a similar trend to previous years.

The festive season coincided with the Central Bank of Nigeria’s (CBN) reduction of bank transfer charges from ₦52.50K (with Value-added Tax) to ₦10 for transfers of ₦5000 and below, ₦25 for transactions of ₦5001-₦50,000, while those above ₦50,000 remain at the standard price.

Also within the same period, payment of ₦50 stamp duty on POS transactions above ₦1000 was reportedly said to be the responsibility of the merchant and not the customer.

However, issues with USSD charges for bank transfers remain unresolved as telcos and Nigerian banks have not yet reached suitable resolutions.

However, the recently signed Finance Act has raised the bar for Stamp duty charges from ₦1000 to ₦10,000 and we may be set to witness an increase in the adoption of cashless payment channels.