Startups

In nearly a decade, hundreds of entrepreneurs have emerged with innovative startups across the African continent. We provide insights on their experiences and highlight the activities of investors who fund them.

Top stories

Moniepoint investor, Development Partners International, has taken over Egypt’s Nclude Fund, marking a major leadership shift and strengthening its African footprint.

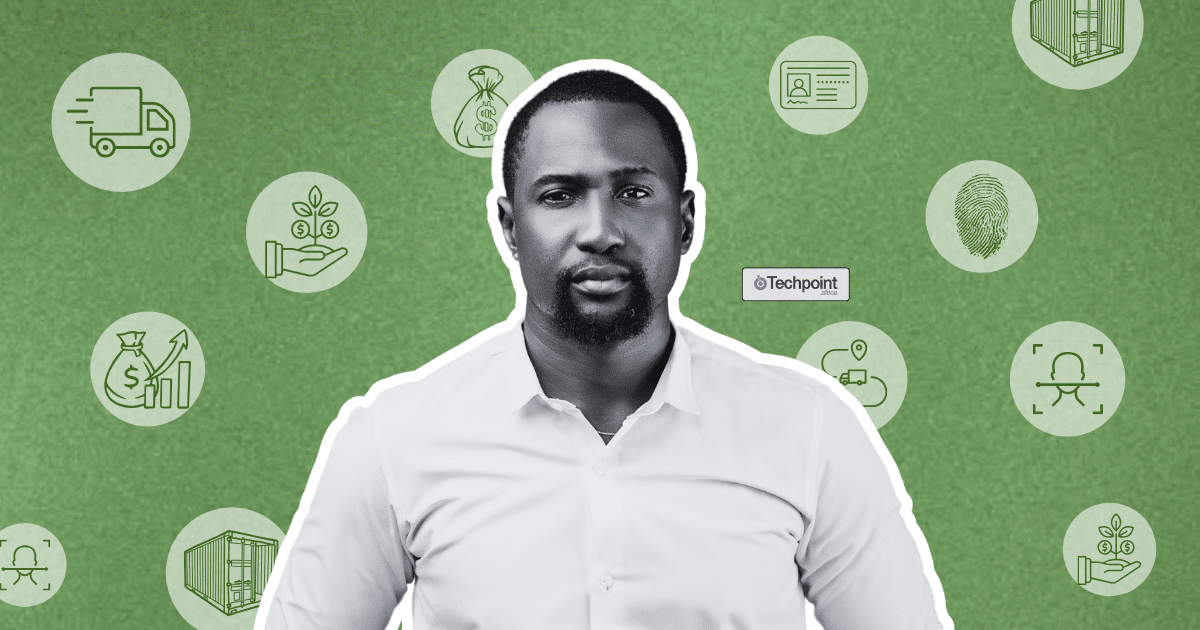

Oluwatomi Solanke has built three startups in a decade, but it’s Trove Finance Finance, a pioneering investment platform, that he’s best known for. In this article, he reflects on past failures, building with purpose, and how Trove Finance quietly hit profitability.

Umba, a digital bank in Kenya, has secured $5M in funding from Star Strong Capital to grow its loan book. With a sixfold revenue increase driven by vehicle and SME financing, the fintech is poised to expand its offerings and solidify its position in Kenya’s market.

PayTic, a Moroccan fintech startup, has raised $4 million to scale its payment automation solutions across North and Sub-Saharan Africa.

USADF’s $51M funding cut reveals African startups’ overdependence on foreign aid, prompting urgent calls for local, sustainable financing to support businesses.

LetsChat’s 2024 shutdown highlights the challenges of building social media in Africa, but Fusion remains hopeful. Focusing on communities, events, and finance, it aspires to become Africa’s WeChat.

Nigerian mobility startup, Shuttlers added 20 new CNG-powered vehicles to its fleet in Q1 2025. Having completed 1,484 trips with the buses, it wants to reduce costs for customers while ensuring environmental safety.

This guide simplifies the entire process of registering a business in Nigeria, which enables foreign business owners and investors to navigate the system easily.

African startups must carefully consider their next best market when it comes to expansion. And very often, the next best market is not within the continent.

Backed by a $100 million investment, South African healthtech hearX has finalised a merger with Eargo to provide accessible hearing solutions.

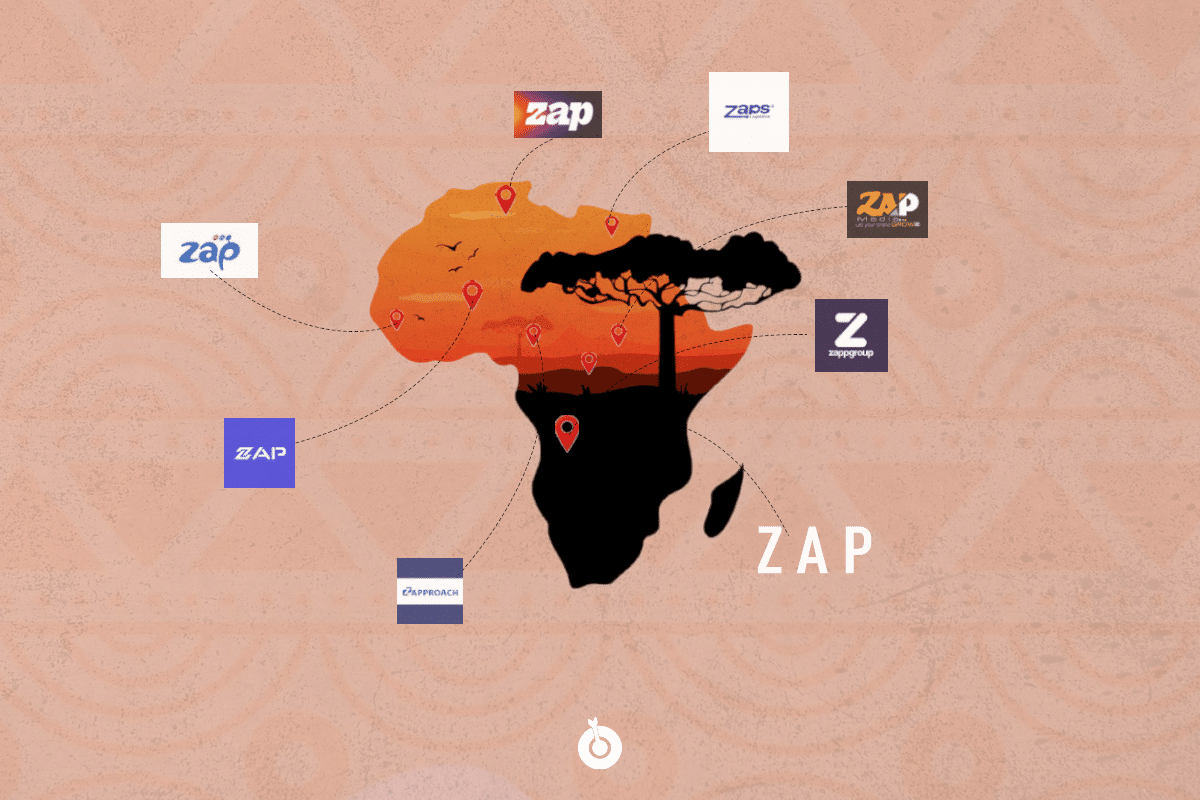

While Paystack and Zap Africa have not proven that either of them have trademark rights to Zap, sources reveal that the trademark registrations may have been erroneous.

Paystack’s new product, “Zap,” has sparked controversy over its name. While some claim its originality, many other companies also use it. Here are eight brands with “Zap” in their names.

Cleva has obtained an International Money Transfer Operator (IMTO) licence from the Central Bank of Nigeria, yet concerns persist regarding the scope of activities the apex bank permits for fintechs.

Stakpak, an AI-powered DevOps platform, helps developers automate infrastructure tasks. With $500K in pre-seed funding, the startup aims to save businesses time and costs in DevOps management.

AltSchool has launched AI for 10M Africans initiative to help people across the continent learn to use AI in multiple languages including Arabic, French, Portuguese, and Igbo.

Starting in Q2 2025, AltSchool Africa will roll out hybrid programmes aimed at enhancing learning outcomes for its students.

This guide outlines the key steps for foreigners starting a business in Nigeria, including company registration with the Corporate Affairs Commission (CAC), tax compliance, banking requirements, and sector-specific regulations.

VC: Funds growth, manages exits (M&A, IPO) & restructuring for returns. Seeks strong teams, large markets, innovation. Exits provide capital. Restructuring fixes issues. Impacts markets & finance.

Convertible notes: Early startup funding. Loan converts to equity in future (funding round). Postpones valuation. Features: interest, maturity date, valuation cap, discount. Unlike SAFEs (no debt). Good for early stage but understand dilution risk. Seek legal advice.

Dilution: New shares decrease your ownership %. Necessary for startup growth funding. Occurs via investment, options, debt. Affects founders, staff, early backers. Reduce impact with smart planning. Use tools like Capboard to calculate.