Governance & Policy

Regulations, laws, directives and policies, that affect African startups, the financial sector, telecoms, cyber security, among others. It’s unpredictable nature either enables, stifles or is neutral on innovation

Top stories

Meta says a controversial chat alert seen by Nigerian users was part of a global anti-scam test and not targeted at any country.

A Federal High Court has ruled that the FCCPC overstepped its bounds in challenging MultiChoice’s price hike, violating the company’s right to fair hearing.

PayShap is South Africa’s instant payment system. But despite being designed for fast, low-cost payments, PayShap’s uptake remains low, especially among the low-income users it was meant to serve.

Kenya orders Worldcoin to delete citizens’ biometric data, setting a bold precedent for digital privacy and data sovereignty in Africa.

Meta may shut down Facebook and Instagram in Nigeria over nearly $300 million in fines and strict data rules that it deems unrealistic.

The CBN has slammed Paystack with a ₦250m fine for running its Zap app without the proper licence, spotlighting the regulator’s firm stance on fintech compliance in Nigeria.

Meta has been fined $220 million by Nigeria’s FCCPC for discriminatory data practices, with a 60-day deadline for compliance.

The world is five years away from the SDGs deadline, and African technology companies are making significant contributions to reaching the set goals.

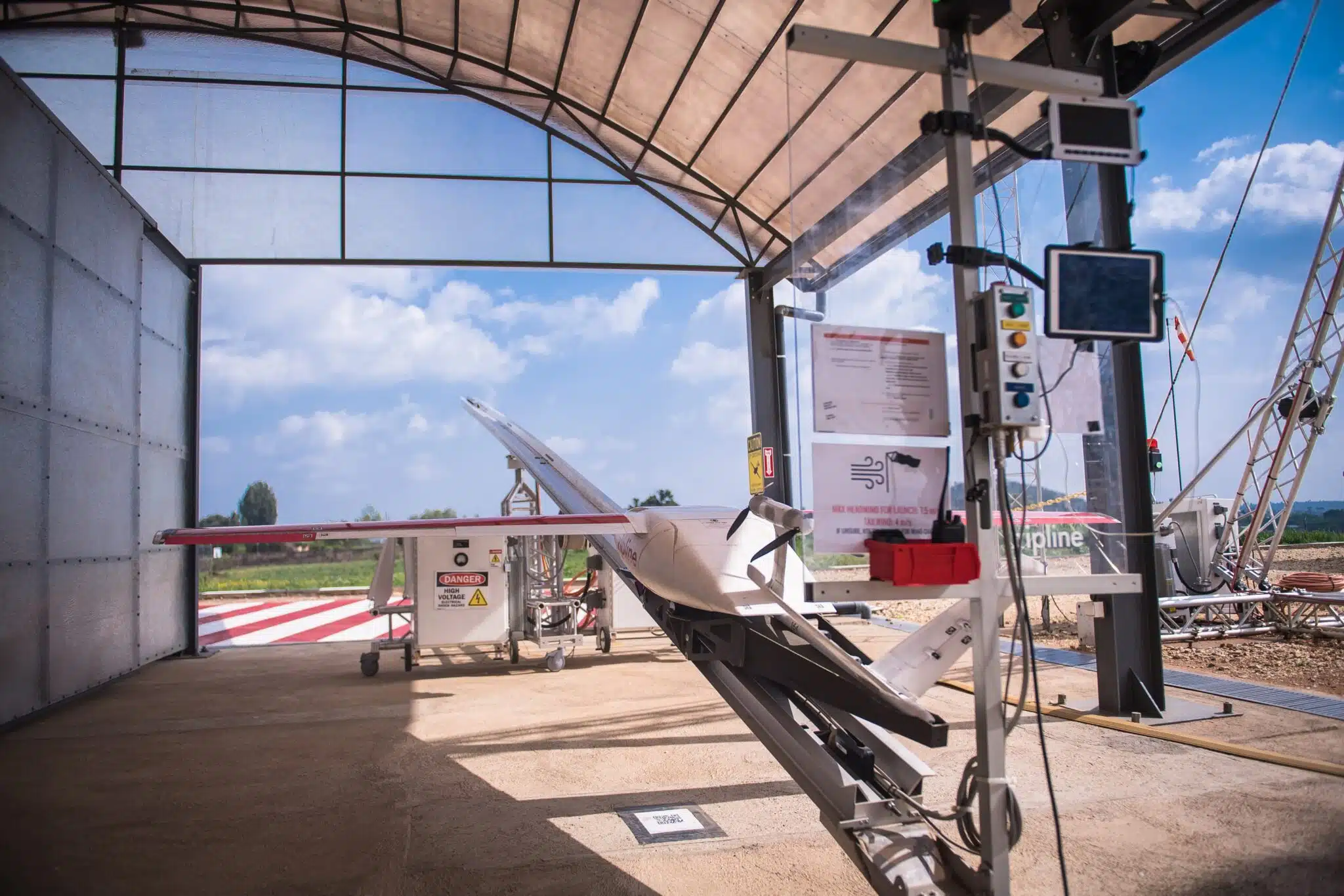

Ghana partners with Zipline to deliver essential health supplies via drones after USAID programme disruptions.

From tracking public spending to monitoring elections, these Nigerian startups are using technology to make government more transparent, efficient, and responsive to citizens’ needs.

The House of Reps has ordered Remita to refund ₦182.77bn to the FG following an audit. This comes as the government introduces TMRAS to improve transparency in public fund management.

South Africa has suspended new SASSA card issuance over compliance concerns, affecting over 1.3 million grant recipients. A temporary extension of old cards offers relief, but the crisis highlights deeper problems in the country’s public service systems.

Starlink has secured a 10-year license to operate in Lesotho, boosting rural internet access while regulatory hurdles continue to block its entry into South Africa.

South Africa’s Competition Tribunal is set to investigate a potential merger between MultiChoice and the SABC, even as the national broadcaster contends with ongoing challenges related to a proposed acquisition by Canal+.

Ghana is the latest African nation planning to regulate digital speech, with a new bill targeting misinformation. Critics worry it could suppress free expression ahead of elections.

Kenya’s new bill to regulate stablecoins and crypto services could redefine fintech operations, with startups facing compliance requirements but gaining market legitimacy.

In this article, we take a closer look at 10 African countries currently facing serious safety concerns to better understand the complex situations unfolding within their borders.

South Africa has launched a R15 billion smart city project in Shongweni, aiming to create over 23,000 jobs and transform the region’s development path through tech-driven urban planning.

South African shoppers could soon face higher prices on Temu and Shein as SARS moves to end tax breaks on low-value imports, aiming to support local businesses.

Despite grappling with an energy shortage, Nigeria plans to ban the importation of solar panels, a move that could potentially reverse much of the progress made in the sector.