Governance & Policy

Regulations, laws, directives and policies, that affect African startups, the financial sector, telecoms, cyber security, among others. It’s unpredictable nature either enables, stifles or is neutral on innovation

Top stories

The GSI was built to kill bad loans, but is it killing due diligence? A Lagos High Court awarded ₦2m to a student in a loan recovery case against Fidelity Bank. Here’s what it tells us about the CBN’s GSI framework.

Nigeria’s DICON has signed a joint venture with Terra Industries to boost local defence production, marking a major step in Nigeria’s push for sovereign military capability.

A lawsuit before Nigeria’s Competition Tribunal alleges Chowdeck inflated menu prices without clear disclosure, raising broader questions about commissions, transparency and pricing in the food delivery industry.

If you are juggling a 9-5 and a side hustle, here’s how to file your taxes before the March 31 deadline.

Worldcoin has deleted all biometric data collected from Kenyans after a High Court ruled the project’s data practices unlawful.

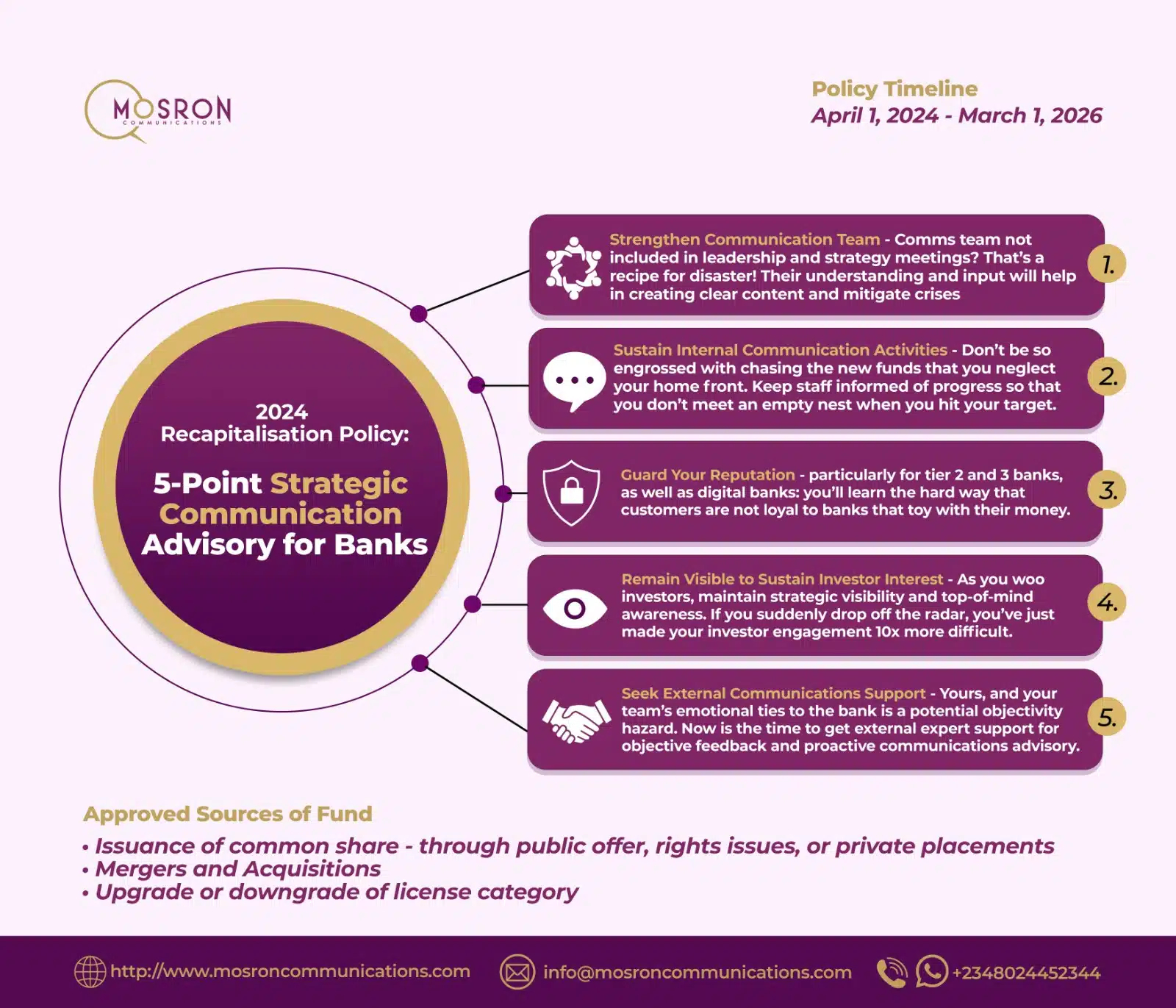

Industry analysts already anticipate a number of mergers as smaller banks struggle to meet the new capital thresholds.

Egypt has scrapped the duty-free phone allowance for travelers, citing booming local manufacturing. The move, effective Wednesday, has sparked criticism from lawmakers concerned about its impact on expatriates.

Nigeria’s SEC has raised minimum capital requirements for fintechs, virtual asset providers, and fund managers, tightening oversight as it seeks to strengthen market stability and investor protection.

Experts share their concerns over a Nigerian High Court ruling in Femi Falana’s court case against Meta.

“The third party didn’t exist” – Femi Falana’s lawyer explains why Nigerian court ruled against Meta

Here’s why a Nigerian court held Meta responsible for a false video posted on Facebook about Femi Falana.

Nigeria moves to pass its first AI law, seeking to balance innovation with safeguards and position itself as a continental leader in regulating artificial intelligence.

USCIS officers must make life-changing decisions on permanent residence, work authorisation, and even future citizenship based on documents they can read with absolute confidence

CBN mandates dual connectivity for all PoS transactions, forcing banks and PSPs to link with NIBSS and UPSL within 30 days.

The practical challenges are stark. It is often faster, and sometimes cheaper, for members of Africa’s tech ecosystem to meet in Lisbon or Paris than in another African capital.

CBN has revised its cash-related policies, scrapping deposit limits and setting new weekly withdrawal caps of ₦500k for individuals and ₦5m for companies. The new rules take effect Jan 1, 2026 as Nigeria continues its push toward a cash-lean, digital economy.

The era of playful banter and prize-led promos in financial ads is over. With its new circular, the CBN bans comparative claims and chance-based incentives. Here’s what it means for Nigeria’s financial marketing culture.

The CBN has issued draft guidelines tightening reporting, investigation and reimbursement rules for push payment fraud, requiring faster customer reporting and stricter timelines for banks.

NITDA has trained 3,600 teachers nationwide to boost digital literacy, equipping them as master-trainers for schools. The initiative expands Nigeria’s push to build a tech-ready workforce amid rising AI and digital-skills programmes across the country.

Nigeria’s payment infrastructure enters a new era with the NPS, an upgrade built for speed, security, innovation, and seamless global integration.

The EV bill wants more Nigerians to switch to electric vehicles, yet it overlooks critical market challenges.