Ecosystem

Top stories

British International Investment (BII) has invested $20 million in the Aliko Dangote-backed Alterra Africa Accelerator Fund to boost mid-cap tech and telecom firms in Africa.

Artificial Intelligence is changing the way businesses are run. In Nigeria, women led businesses could see drastic growth through AI skills with a new partnership by Nimbus Aid Foundation and ALX Nigeria.

Bernard Laurendeau, Managing Partner of Laurendeau & Associates, discusses how Africa can benefit from stronger ties with Japan, focusing on financial services, technology, and consumer goods.

Helios Investment Partners targets $750M for its fifth fund, with backing from IFC and EIB. The fund will focus on digital infrastructure, fintech, and tech-enabled sectors across Africa.

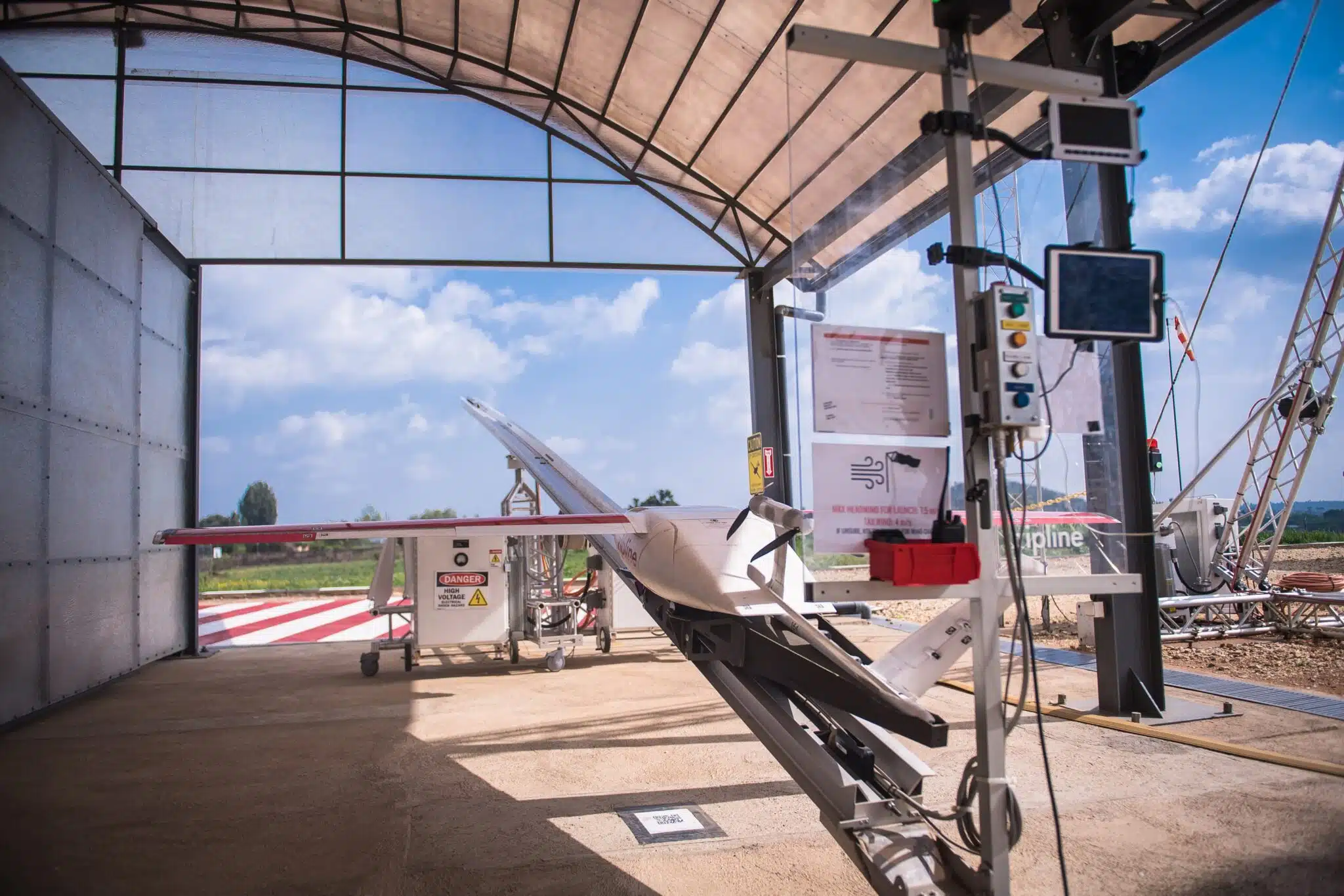

Zipline is expanding its drone delivery services to five more Nigerian states, revolutionizing healthcare logistics by ensuring faster, more efficient medical supply distribution.

LoftyInc Capital has hit the first close of its third fund. Backed by major development finance institutions, the firm aims to help African startups scale to Series A.

Dozy Mmobuosi is making a pivot towards artificial intelligence (AI) in agriculture, even as he faces significant legal challenges from the U.S. Securities and Exchange Commission (SEC).

Madica has invested $800,000 in four African startups through its investment programme, offering funding, mentorship, and support to enhance the continent’s entrepreneurial ecosystem.

Nigeria’s edtech industry is projected hit $400 million in 2025, but the infrastructure gap required to get there will require more than the projected amount.

Driven by an uptick in the adoption of its cloud and AI services, Microsoft’s Q4 2024 earnings rose by 12% to $69.9 billion

Swedish development finance institution Swedfund has invested $41 million into the Emerging Africa and Asia Infrastructure Fund to bolster climate-resilient projects.

Purple Elephant Ventures (PEV) has raised $4.5 million in seed funding to revolutionise African tourism through innovation.

Under its revamped strategy, DOB Equity has announced its first investment in Spouts International, a Ugandan company revolutionising access to clean water through its innovative ceramic water filters.

Adebayo Ogunlesi, the Nigerian-born business magnate, has joined OpenAI’s Board of Directors, adding his extensive expertise to the world-renowned artificial intelligence research organisation. Here are 10 key facts to know about Ogunlesi and why his appointment is significant: Adebayo Ogunlesi’s journey is a testament to the power of vision, education, and strategic thinking. His role…

Global startup accelerator Techstars has announced its expansion into Botswana, marking a significant milestone for the Southern African startup ecosystem.

When Adewale Yusuf, founder of Techpoint Africa, first approached me in November 2014 about the new publication he was working on, I told him I was done with tech journalism. A few weeks later, he followed up. I finally agreed to meet with him at, if my memory serves me right, the now-defunct iDEA Hub.…

In 2024, fintech dominated Africa’s tech ecosystem with two unicorns, while stablecoins played an increasingly important role in cross-border payments.

Seedstars Africa Ventures I raises $42 million in first close to empower African startups, targeting 10,000 jobs and innovation in cleantech, financial inclusion, and Internet connectivity.

According to a report released by Caribou Digital and the MasterCard Foundation, innovation clusters are shaping the future of the African AI ecosystem, boosting the continent’s long-term economic growth.

Chinese eCommerce platform, Temu is making inroads into Nigeria with a marketing blitz, but what does this mean for Nigeria’s eCommerce sector?