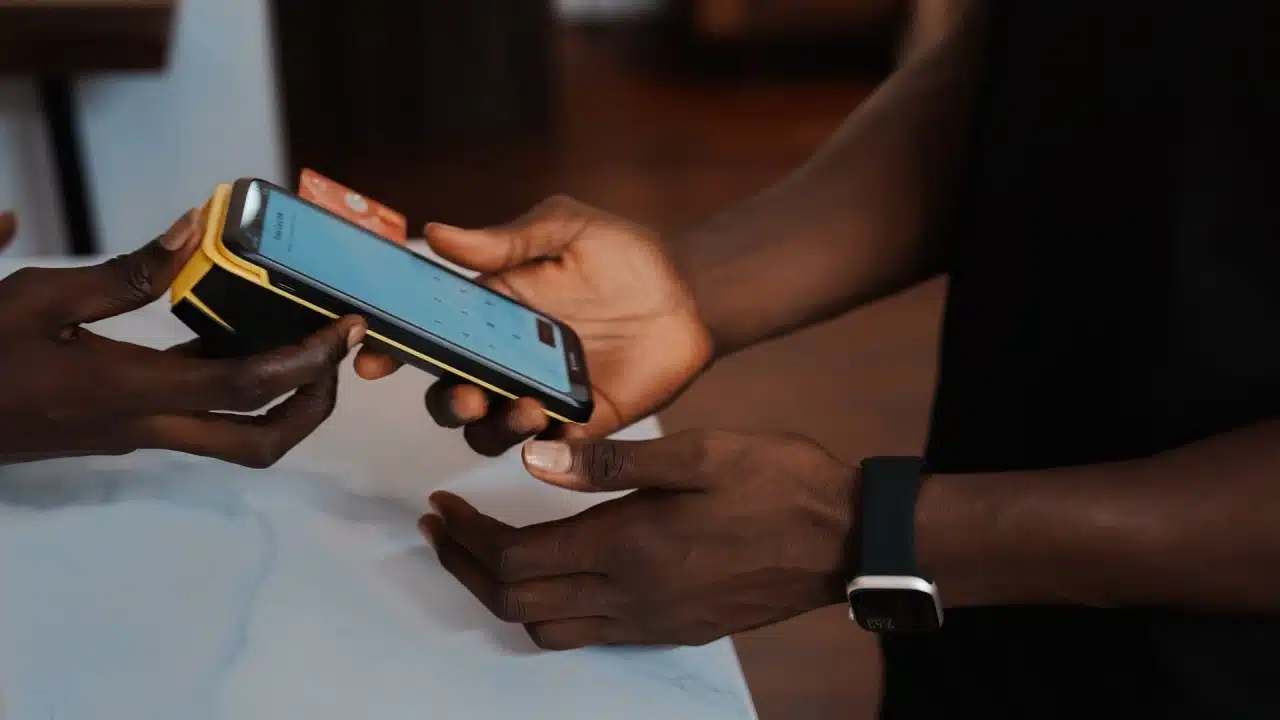

Barely two months after announcing the completion of its Series C round, Moniepoint is deepening its grip on Nigeria’s business landscape with an integrated inventory-management and POS solution called Moniebook. The new product gives merchants real-time visibility into their sales, customers, payments, and stock levels.

According to Babatunde Olofin, Managing Director of Moniepoint MFB, Moniebook is designed to serve as a growth partner and a single source of truth for entrepreneurs who want more control over their operations.

Moniebook marks the fintech’s latest attempt to diversify its revenue streams beyond its agency banking roots. In the past two years, Moniepoint has expanded aggressively into retail banking, offering accounts, debit cards, and payment services to individuals and businesses. Today, it claims a combined 10 million customers across personal and business banking, processing more than $250 billion in annual payments.

The company has also been stretching beyond Nigeria’s borders. It recently launched a remittance product in the United Kingdom targeting the African diaspora, and its messaging has increasingly centred on “financial happiness for Africans everywhere” — a slogan that reflects an ambition that now extends beyond payments.

With Moniebook, Moniepoint is positioning itself not just as a financial services provider but as a full-stack business-enablement platform. Access to Moniebook starts at ₦6,000 per month, placing it within reach of small and growing businesses.

Moniepoint’s playbook mirrors that of another major Nigerian fintech, PiggyVest. Since launching in 2015, PiggyVest has become the de facto market leader in the digital savings space, boasting nearly six million users. Like Moniepoint, it has spent the past few years strengthening its infrastructure, bringing payments and wallet services in-house to support its growing ecosystem.

Its boldest move yet has been the introduction of PiggyVest Business, a product that extends its savings and investment ethos to entrepreneurs.

“We’re helping individuals save and invest on PiggyVest. We want to help businesses save and invest using PiggyVest Business,” Co-founder and CMO Joshua Chibueze said in October.

The strategy is straightforward: a significant portion of PiggyVest users reportedly run or work in small businesses, so offering tools that help those businesses thrive creates additional value for users and deepens their engagement with the platform.

Victoria Fakiya – Senior Writer

Techpoint Digest

Stop struggling to find your tech career path

Discover in-demand tech skills and build a standout portfolio in this FREE 5-day email course

Both fintechs are now pushing beyond their core products, betting that the future lies in providing end-to-end support for Africa’s entrepreneurs.