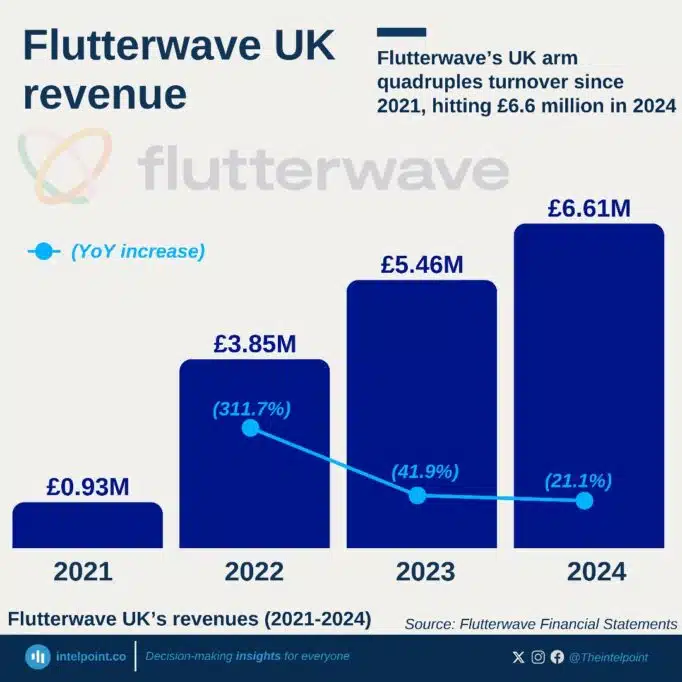

Flutterwave UK has reported a sharp decline in its financial performance for the year ending December 2024, posting a net loss of £2.27 million, up significantly from £485,000 in 2023, despite a 21% increase in turnover to £6.6 million.

The company’s operating profit fell by nearly 89%, dropping to £142,299 from £1.25 million the previous year. A major factor behind the decline was a rise in administrative expenses, which grew from £4.2 million in 2023 to £6.4 million in 2024. This may be tied to increased personnel costs, with headcount rising from 22 to 31 employees over the year.

Flutterwave UK also recorded a £2.6 million loss on disposal of investment, though the company declined to disclose details about the asset sold. This one-off event contributed significantly to the widened losses.

Cash reserves fell steeply from nearly £15 million in 2023 to just £743,000 in 2024. This sharp decline could reflect increased spending, the impact of operating losses, or broader challenges in generating cash within the UK arm of the business.

There were other notable shifts in its financial position. Amounts owed to the company dropped dramatically, from over £4.5 million to just £10,000, suggesting possible changes in customer payment cycles or internal accounting treatment.

While short-term liabilities have decreased, they remain substantial at over £12 million. Retained earnings also swung from a positive £1 million to a deficit of £1.25 million.

In 2023, reports indicated that Flutterwave was in talks to acquire Railsr, a British fintech firm. That deal, however, appears not to have gone through. The company has since continued to expand its cross-border payments services, securing licences in the US, Canada, and several African markets to strengthen its presence along high-traffic remittance corridors.

“In 2024, Flutterwave UK posted a positive operating profit. A one-off item from strategic investment disposals impacted the year-end result but not the underlying strength of the business. Our group’s half-year 2025 results tell the bigger story: margins doubled, enterprise payments grew 20% YoY, and key regulatory milestones were secured,” Flutterwave said in a statement to Techpoint Africa.

Speaking to Semafor earlier this year, CEO Olugbenga Agboola said the company is targeting profitability in 2025, though he declined to rule out the possibility of a sale.

Victoria Fakiya – Senior Writer

Techpoint Digest

Stop struggling to find your tech career path

Discover in-demand tech skills and build a standout portfolio in this FREE 5-day email course