When I first got into crypto trading, I quickly realized one thing: Emotions can ruin everything. One minute, I was holding strong. The next, I was panic-selling because the market dipped. So, when I heard about Cryptohopper, a bot that trades automatically based on market trends, I was intrigued. No more second-guessing? No more emotional trades? Sounded perfect.

But, of course, I had my doubts. Can a bot really make smarter decisions than me? Will it actually help me profit, or will it just drain my funds with bad trades?

So, I decided to give it a shot. I set up my account, tweaked the settings, and let it run. Would it make smart trades and grow my portfolio? Or would it crash and burn? I had no idea, but I was about to find out.

Here is my honest Cryptohopper review!

What is Cryptohopper?

Cryptohopper is an automated cryptocurrency trading platform designed to help traders execute trades without constant manual monitoring. It connects directly to major crypto exchanges, allowing users to set predefined strategies that the bot follows in real time. The goal is to take advantage of market movements efficiently, minimizing emotional decision-making and reducing the risks associated with impulsive trading.

Launched in 2017 by Dutch entrepreneurs Ruud and Pim Feltkamp, Cryptohopper was created to simplify trading for both beginners and experienced traders. The platform operates using algorithmic trading, scanning the market 24/7 to identify potential opportunities. Users can either create their own trading strategies or follow those developed by professional traders through the marketplace.

Cryptohopper is a cloud-based system, meaning it runs continuously without needing a personal device to stay online. It also supports multiple exchanges, enabling users to manage their portfolios across different platforms from a single dashboard. With its combination of automation, customization, and accessibility, it aims to provide a more efficient way to trade cryptocurrencies.

Getting started with Cryptohopper

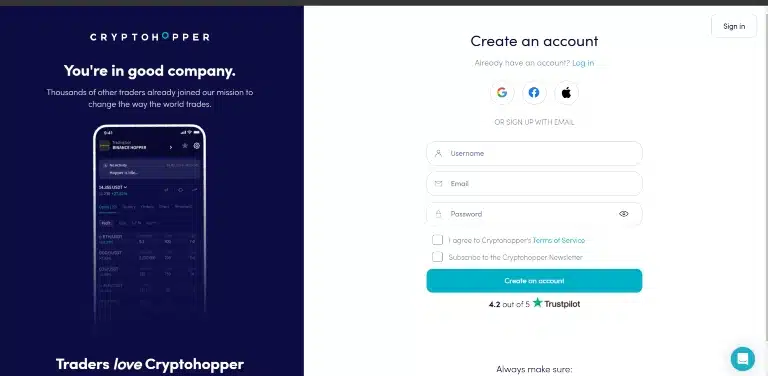

When I decided to explore automated crypto trading, Cryptohopper’s 3-day free trial seemed like the perfect opportunity to try it out without any financial commitment. The sign-up process was straightforward: I provided my email, created a password, and was promptly granted access to the platform.

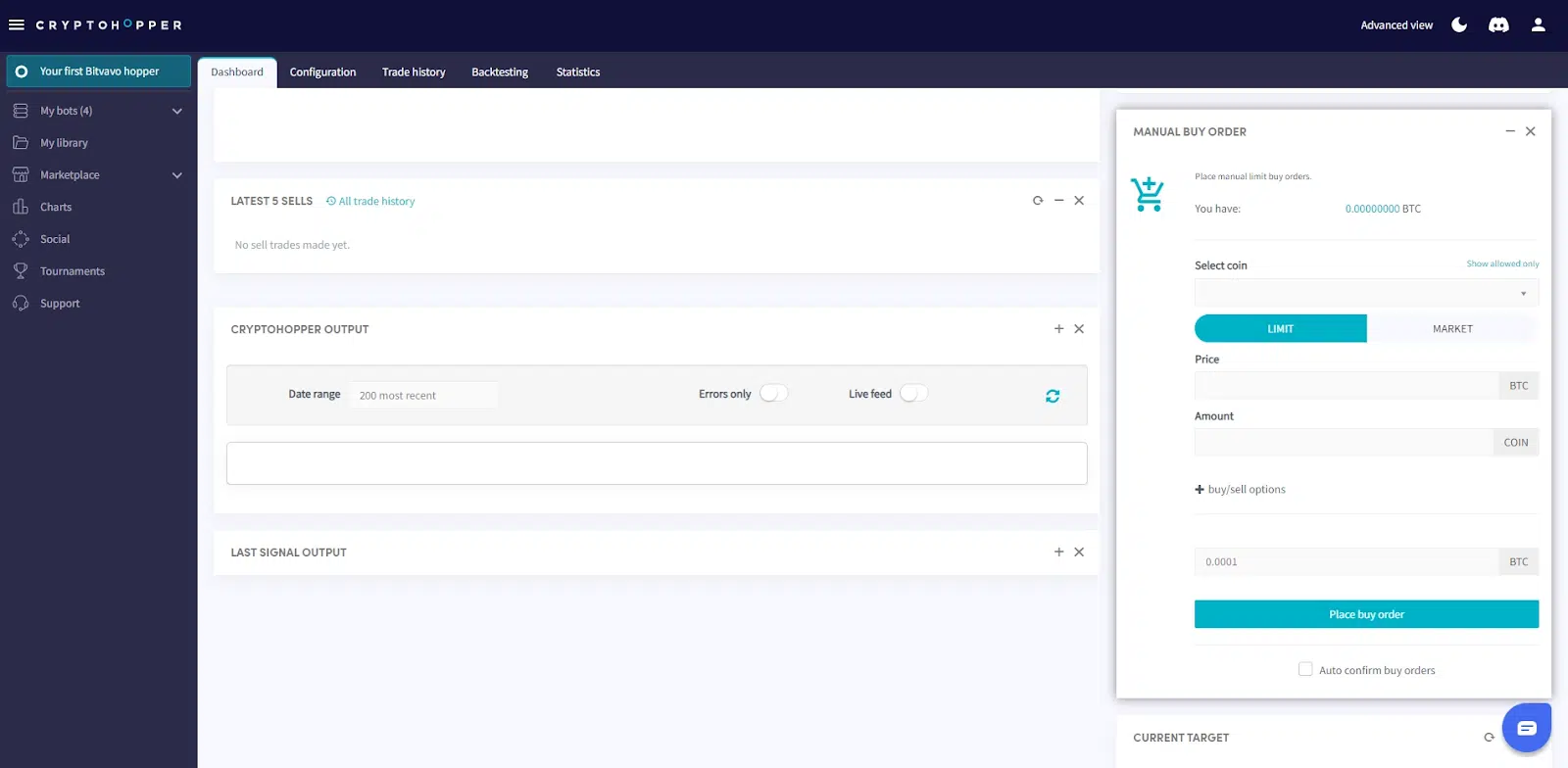

Upon entering the dashboard, I was greeted with a clean and organized interface. The main menu on the left side offered various options, including configuring my trading bot, accessing the marketplace for strategies, and viewing performance reports. Despite the intuitive layout, I quickly realized that the platform’s depth could be overwhelming for someone without prior trading experience.

Setting up my first trading bot required connecting my exchange account via API keys—a process that, while standard in crypto trading, might be daunting for newcomers. The platform did provide guides to assist with this setup, but I found myself cross-referencing external tutorials to ensure accuracy.

Navigating through the various settings, I noticed an array of customizable options, from selecting specific trading strategies to configuring risk management tools. While this level of customization is a boon for experienced traders, it could pose challenges for beginners trying to determine optimal settings.

One positive aspect during onboarding was the availability of pre-configured templates and the option to copy strategies from seasoned traders through the marketplace. This feature provided a starting point, allowing me to observe and learn from established trading approaches.

In summary, while Cryptohopper offers a robust platform with extensive features, the initial setup and configuration may present a steep learning curve for those new to crypto trading. However, for traders with some experience, the platform’s flexibility and range of tools can be highly advantageous.

Key features and functionalities of Cryptohopper

Cryptohopper offers a comprehensive suite of tools designed to enhance the cryptocurrency trading experience. Let’s look at some of its key features:

- Automated Trading

At the core of Cryptohopper is its automated trading capability. Users can set up trading bots that operate 24/7, executing trades based on predefined strategies. This continuous operation ensures that trading opportunities are not missed, even when users are not actively monitoring the markets.

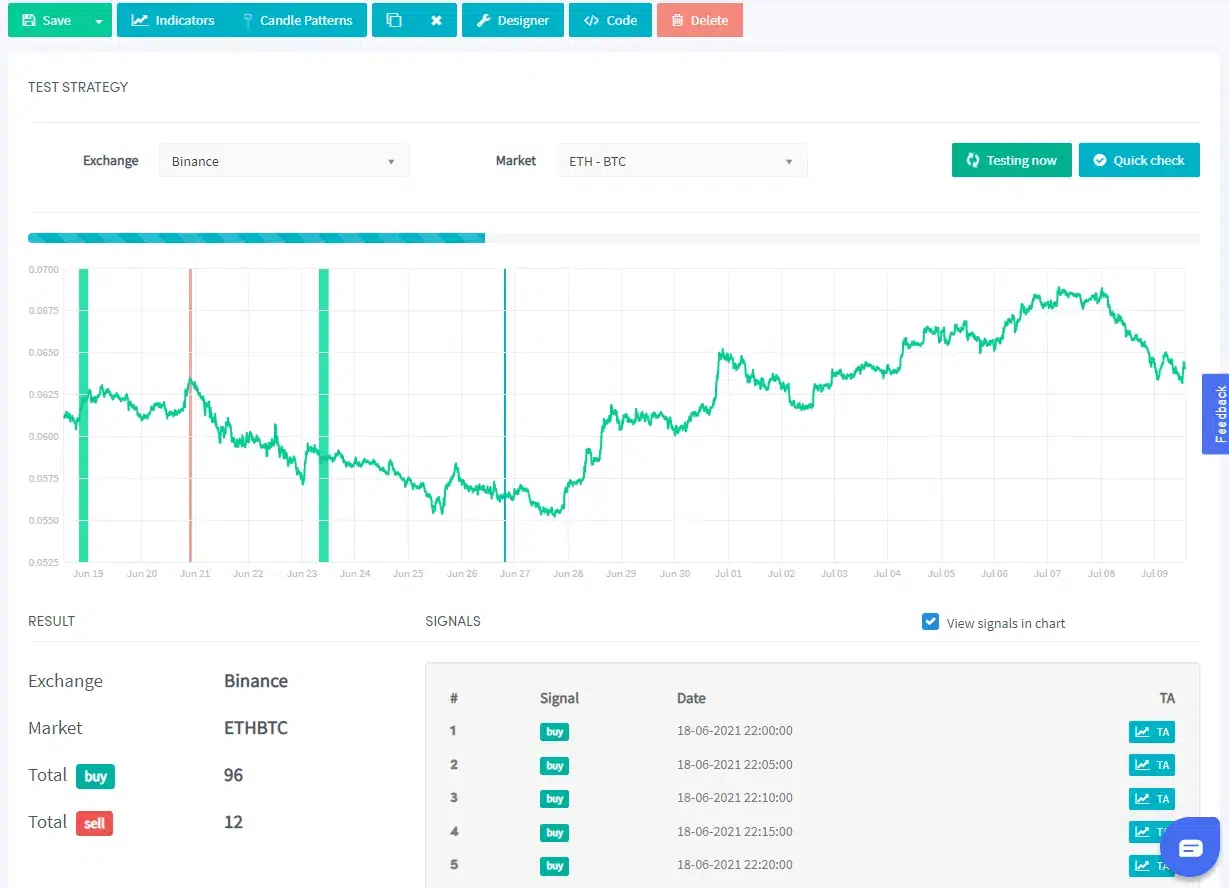

- Strategy Designer and Backtesting

Cryptohopper provides a Strategy Designer tool, allowing users to create custom trading strategies using a variety of technical indicators. Once a strategy is developed, users can backtest it against historical market data to evaluate its potential effectiveness before deploying it in live trading.

- Marketplace for Strategies and Templates

For those who prefer ready-made solutions, Cryptohopper’s Marketplace offers a selection of strategies, templates, and signals developed by professional traders. Users can browse and purchase these resources to implement in their own trading bots, providing an opportunity to leverage the expertise of others.

- Paper Trading

To facilitate risk-free practice, Cryptohopper offers a paper trading feature. This allows users to simulate trades and test strategies in real market conditions without using real funds, making it an excellent tool for learning and experimentation.

- Trailing Features

Cryptohopper includes advanced trailing features such as Trailing Stop-Loss and Trailing Stop-Buy. These tools enable the bot to follow price movements and execute buy or sell orders automatically when the price changes direction, helping users capitalize on market trends.

- Algorithmic Intelligence (AI)

The platform incorporates AI capabilities that allow the bot to recognize market trends and adjust trading strategies accordingly. This adaptability aims to enhance trading performance by responding to changing market conditions in real-time.

- Exchange Integration

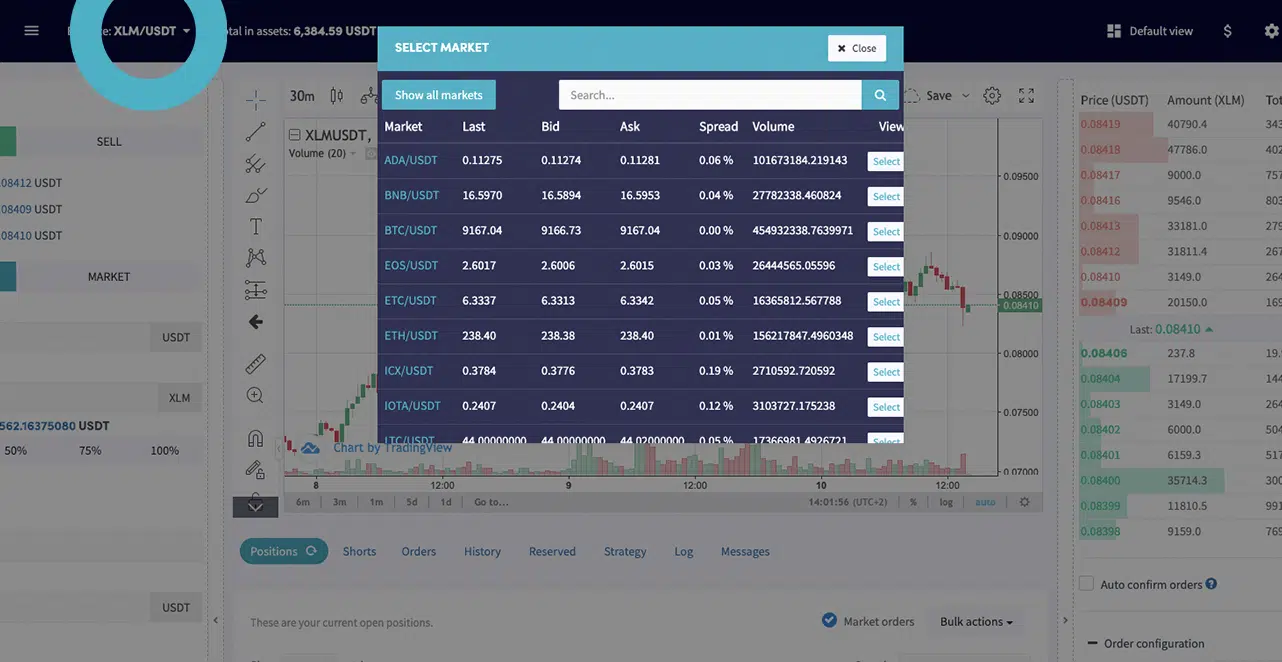

Cryptohopper supports integration with multiple major cryptocurrency exchanges. This compatibility enables users to manage their portfolios across different platforms from a single interface, streamlining the trading process.

- Risk Management Tools

To help users manage potential losses, Cryptohopper offers various risk management tools, including Stop-Loss, Take-Profit, and Dollar-Cost Averaging (DCA) strategies. These features allow traders to set specific parameters for their trades, aligning with their individual risk tolerance.

- Social Trading and Copy Trading

The platform facilitates social trading through its copy trading feature, enabling users to replicate the strategies of experienced traders. This feature is particularly beneficial for beginners seeking to learn from seasoned professionals.

- Mobile Accessibility

Cryptohopper offers mobile applications for both Android and iOS devices, allowing users to monitor and manage their trades on the go. This ensures that traders can stay connected to the markets and their bots anytime, anywhere.

Collectively, these features make Cryptohopper a versatile and powerful platform for cryptocurrency trading, catering to both novice and experienced traders.

My hands-on trading experience with Cryptohopper

Embarking on the journey of automated cryptocurrency trading, I decided to put Cryptohopper to the test across various market conditions. Here’s a detailed account of my experiences:

Bullish Market Phase

During a notably bullish period, I configured my Cryptohopper bot with a conservative profit target of 0.75% per trade. To my pleasant surprise, the bot not only met this target but often exceeded it, achieving profits of over 1% on several trades. This performance was consistent with reports from other users who observed similar profitability during bullish trends.

Bearish Market Challenges

The outline shifted dramatically during bearish market conditions. Despite optimizing settings and employing various strategies, the bot struggled to maintain profitability. It frequently accumulated “bags”—assets purchased at higher prices that couldn’t be sold without incurring losses. This experience resonated with other traders who reported challenges in achieving consistent profits during market downturns, even after extensive optimization.

Scalping Attempts

Eager to explore different strategies, I ventured into scalping, aiming to capitalize on daily price fluctuations. However, this approach proved challenging. The rapid trades required for effective scalping often led to losses, and I found it difficult to consistently predict short-term market movements. This mirrors the experiences of other users who found scalping difficult to execute profitably using Cryptohopper.

Comparing Expectations with Reality

Throughout my usage, Cryptohopper’s performance in executing trades was prompt and reliable. The platform operated continuously without significant downtime, ensuring that potential opportunities were not missed due to technical issues. This reliability is crucial for automated trading, where timing can significantly impact profitability.

Initially, I anticipated that Cryptohopper would provide consistent profits across varying market conditions. While the bot performed admirably during bullish trends, its effectiveness diminished during bearish periods, highlighting the inherent challenges of automated trading in volatile markets. This underscores the importance of continuous strategy optimization and market monitoring to adapt to changing conditions.

In summary, my experience with Cryptohopper revealed that while the platform offers robust tools capable of capitalizing on favorable market conditions, it also requires diligent management and strategy adjustments to navigate less favorable environments effectively.

What i Liked about Cryptohopper

While Cryptohopper has a learning curve, it offers several strong features that make automated trading more efficient. From hands-free trading to advanced customization, here are the aspects that stood out to me the most:

1. Effective automation & user-friendly interface

Cryptohopper runs 24/7, executing trades without manual intervention. While not entirely beginner-friendly, the interface is well-structured for experienced traders. Helpful tutorials and guides make navigation easier, and once set up, the bot handles trades efficiently.

2. Customizable Trading Strategies

The platform allows full strategy customization using indicators like RSI, MACD, and Bollinger Bands. I could create my own strategy or buy pre-made ones from the marketplace. The backtesting feature helped refine strategies before live trading, reducing trial-and-error risks.

3. Reliable Multi-Exchange Support

Cryptohopper integrates with major exchanges like Binance, Coinbase Pro, and Kraken, allowing seamless trading from a single dashboard. API connections are stable, ensuring smooth order execution even during volatile market conditions—something many bots struggle with.

4. Time-Saving & Productivity-Boosting Features

Features like trailing stop-loss, DCA, and paper trading help manage risk and refine strategies without constant monitoring. Instead of spending hours watching charts, I could automate trades while focusing on other tasks, making trading much more efficient.

What i didn’t like about Cryptohopper

While Cryptohopper offers powerful automation, it’s not without its drawbacks. Some aspects of the platform could be improved, especially for beginners. Also, the bot’s performance depends heavily on how well you configure it. The result is only as good as your prompts. Here are the main issues I encountered while using it.

1. Occasional Delays or Inaccuracies in Trade Execution

While the bot generally executes trades efficiently, I noticed occasional delays, especially during high market volatility. Some users also reported that stop-loss or trailing orders didn’t always trigger at the expected price, leading to unexpected losses.

2. A Steep Learning Curve for Beginners

Cryptohopper is packed with features, but that also makes it overwhelming for newcomers. Setting up strategies, tweaking indicators, and optimizing settings require a solid understanding of trading. Beginners may struggle without prior experience or extensive research.

3. Issues with Certain Customization Features or Support

While the bot allows deep customization, some features, like AI-based strategies, felt unreliable. Customer support is also hit-or-miss—some users reported quick responses, while others experienced long wait times for help with technical issues.

4. Concerns Regarding Fees or Pricing

Cryptohopper isn’t the most expensive trading bot, but it’s not cheap either. The free trial is useful, but advanced features require a paid subscription. If you’re not making consistent profits, the monthly fees can add up, eating into potential gains.

Final verdict: is Cryptohopper worth it?

After spending time with Cryptohopper, I can say it’s a powerful tool—but only if you know how to use it. The automation, customization, and exchange support make it great for experienced traders. But if you’re a beginner, be ready for a steep learning curve. It’s not a “set it and forget it” bot; you need to fine-tune strategies and monitor performance.

Will I keep using it? Honestly, I’m on the fence. It’s useful, but the time required to optimize settings and tweak strategies makes me question if it’s worth the effort.

That said, the best way to know if Cryptohopper fits your trading style is to try it yourself. They offer a 3-day free trial, so give it a go and see if it works for you. Have you used a crypto trading bot before? Drop your thoughts in the comments! Also, subscribe for more deep dives into automated trading tools.