If you frequently run PPC, then you’re likely aware that your next competitive move should be data-driven. Adthena has been greatly useful for this, but different tools excel at different parts of the PPC lifecycle, such as keyword spying, auction context, creative intelligence, audience signals, or media buys. But.. What are they?

In this article, you’ll learn:

- Which 7 tools are the most capable Adthena alternatives in 2025?

- What each tool is best at (auction context, creative tracking, audience signals, keyword intel).

- Clear pricing signals and which budgets they are suited for.

- A decision guide so you can pick the right tool for agencies, in-house teams, or performance marketers.

The 7 best Adthena alternatives for competitive PPC intelligence to try in 2025

- SEMrush

- Similarweb

- Google Ads Auction Insights (native in Google Ads)

- TapClicks

- SpyFu

- Quantcast

- Adbeat

An overview of the 7 best Adthena alternatives for competitive PPC intelligence to try in 2025

| Platform | Type | Pricing (2025) | Best for | Standout capability |

| SEMrush | SaaS all-in-one | Pro: $117.33/mo (annual) or $139/moGuru: $208.33/mo (annual) or $249/moBusiness: $416.66/mo (annual) or $499/mo | Full marketing teams | Keyword + ad copy + competitive PPC history |

| Similarweb | SaaS traffic & competitive | Competitive Intelligence: $125/mo (annual) or $199/moCI & SEO: $335/mo (annual) or $399/moCI, SEO & Ads: $540/mo (annual) or $649/mo | Market-level competitor landscape | Traffic sources + intent signals |

| Google Ads Auction Insights | Native in Google Ads | Free inside Google Ads | Immediate auction context | Direct auction overlap and impression share data. |

| TapClicks | PPC & keyword intel | Plans from $99/mo | Fast competitor PPC/landing-page checks | Ad and landing page galleries, KEI |

| SpyFu | Competitor PPC & keywords | From $39/mo (offers vary). | Keyword history & competitor lists | Deep historical PPC and organic keyword history |

| Quantcast | Audience & programmatic insights | Custom pricing (sales quoted). | Audience planning and programmatic | Behavioral audience segments and planning |

| Adbeat | Ad intelligence (display/native) | From $249/mo (Standard). | Display / native ad competitors | Publisher placement and creative trends |

How we chose these alternatives

To make our choices tightly relevant, we set out the questions below to guide our pickings:

- Auction context: Can the tool tell you who’s bidding in the same auctions and how often?

- Creative intelligence: Are ad creatives, landing pages, and publishers visible and exportable?

- Keyword and historical depth: Does it show historical CPC, impression trends, and ad copy evolution?

- Audience and media signals: Does it provide audience segments or placement-level insight?

- Pricing clarity: Is entry pricing visible so you can budget experiments?

Without further ado, let’s discuss the 7 Adthena alternatives.

1) SEMrush — best for combined keyword + ad copy + competitive history

Why SEMrush is a strong Adthena alternative for PPC

SEMrush combines keyword research, ad-copy tracking, and competitor PPC history in a single platform. If you want to move from knowing “who’s visible” to “what keywords and ad copy drove visibility over the past year,” SEMrush gives you a fast path. The platform surfaces competitors’ top-paid keywords, displays landing pages tied to ads, and stores historical positions, allowing you to see how rivals respond to seasonal demand. For many teams, this single-pane approach replaces the need to stitch together separate tools.

Pricing (2025)

- Pro Plan – For beginners and individual projects

- Monthly: $139/month

- Annual: $117.33/month (billed annually)

- Guru Plan – For small businesses

- Monthly: $249/month

- Annual: $208.33/month (billed annually)

- Business Plan – For agencies and mid-market companies

- Monthly: $499/month

- Annual: $416.66/month (billed annually)

- SEMrush Add-ons

- Additional Users: Starting at $45/month

- Lead Generation: $90/month

- Base Report: $10/month

- Pro Report: $20/month

Pros

- Rich keyword and ad copy history across search engines.

- Built-in workflows for keyword gap analysis, CPC trends, and ad testing planning.

- Integrates organic and paid data so your teams don’t work in silos.

Cons

- Pricing and limits can increase rapidly once you require large-scale tracking or API access.

- Not as focused on publisher-level display buys; display intelligence is present but lighter than Adbeat.

2) Similarweb — best for market-level competitive signals and audience intent

Why Similarweb is a strong Adthena alternative for PPC

Similarweb is less about per-ad creative and more about the overall competitive landscape. It tells you where competitor traffic comes from, which channels fuel it (organic, paid, referral), and high-level intent shifts you can use to reprioritize keywords and display buys. If your brief is “which competitors are growing paid investment and through which channels,” Similarweb gives a quick, visual answer and complements auction-level tools with market signals.

Pricing (2025)

- Competitive Intelligence – Best for researchers & analysts

- Monthly: $199/month

- Annual: $125/month (billed annually)

- Competitive Intel & SEO (Most Popular) – Best for marketers & SEO managers

- Monthly: $399/mo

- Annual: $335/mo (billed annually)

- Competitive Intel, SEO & Ads – Best for performance marketers

- Monthly: $649/month

- Annual: $540/month (billed annually)

Pros

- Best-in-class channel mix and traffic-source views.

- Useful for competitive benchmarking and sizing ad opportunities.

- Fast surface-level signals that guide deeper PPC probes.

Cons

- Not optimized for ad creative history or per-placement creative archives.

- Enterprise tiers are pricey for small teams.

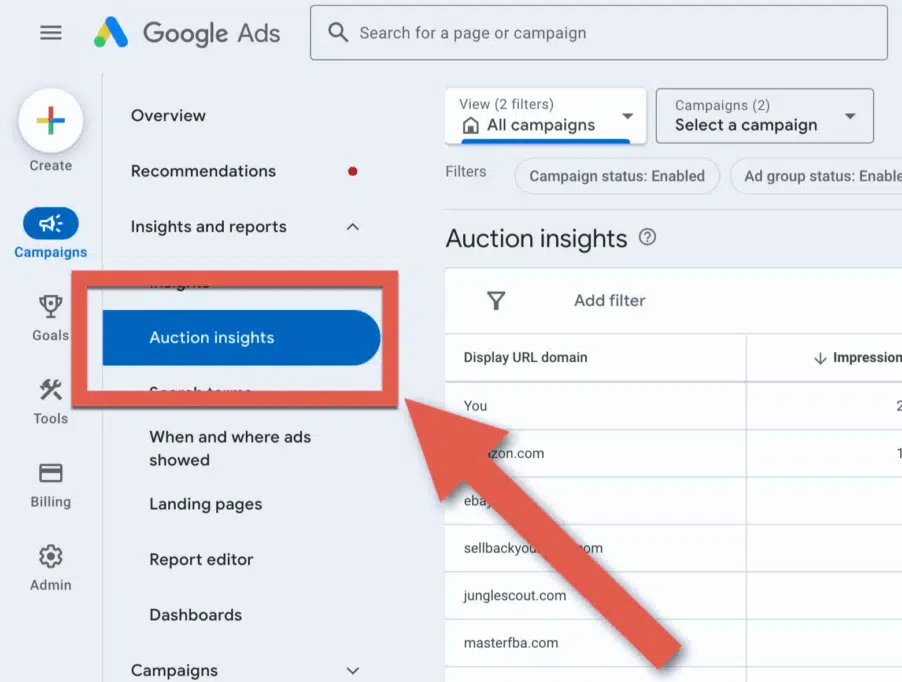

3) Google Ads Auction Insights — best for immediate auction overlap and share

Why Auction Insights is a must-use complement to Adthena

Google’s Auction Insights is the single most accurate source for what you’d call “who I see in the same auctions right now” because it draws from Google’s auction data. It reports impression share, overlap rate, outranking share, and top-of-page rates for Search, Shopping, and Performance Max. Use it to validate competitor lists from other tools and to prioritize bids and negative keywords. Since the data is native to your account, it serves as the authoritative source for auction overlap.

Pricing

- Free inside Google Ads — available at campaign, ad group, or keyword levels without added cost.

Pros

- Ground-truth auction overlap and impression share.

- No extra cost and immediate availability.

- Works for Search, Shopping, and Performance Max auctions.

Cons

- Limited historical depth compared with paid competitors.

- No creative archive or publisher placement data.

- Only shows auctions you participate in — proper but not omnicompetitor visibility.

4) TapClicks — best for quick, affordable PPC/landing-page monitoring

Why TapClicks is a practical Adthena alternative

TapClicks provides a clear and concise view of competitor paid keywords, along with landing page screenshots and ad galleries. If you want to see which landing pages competitors tie to their ads and capture ad copy at scale without a heavy contract, TapClicks is a pragmatic and cost-effective solution. It’s convenient for small agencies and in-house teams that want an affordable day-to-day PPC spy tool.

Pricing (2025)

- Tiered plans start at $99.00.

Pros

- Clear ad and landing-page galleries for fast competitive checks.

- Affordable entry-level plans for small teams.

- The Keyword Effectiveness Index helps prioritize terms.

Cons

- A smaller dataset and limited coverage in some international markets.

- Less sophisticated audience or programmatic insights.

5) SpyFu — best for deep historical keyword and competitor lists

Why SpyFu is a focused Adthena alternative

SpyFu excels at surfacing long-term keyword history and compiling competitor lists based on historical rank and spend estimates. If your question is “which keywords has competitor X relied on for the last five years and how did their spend shift seasonally,” SpyFu’s historical depth is useful for trend analysis and strategy planning. It’s an economical research tool for keyword-led campaigns.

Pricing (2025)

- Plans range from roughly $39 to $79/month, depending on whether you opt for annual or monthly billing; higher tiers unlock additional weeks/months of tracking and exports.

Pros

- Excellent historical keyword archives and domain overviews.

- Lower entry price for long-tail and historical research.

- Helpful in understanding organic-paid overlaps.

Cons

- Creative archives and publisher placements are limited.

- Sampling and data estimates can vary by region.

6) Quantcast — best for audience modeling and programmatic planners

Why Quantcast is a good Adthena alternative for audience-first PPC

Quantcast focuses on audience insights, programmatic reach planning, and real-time behavioral segments. Suppose your PPC campaigns are tightly integrated with programmatic buys, or you need to build custom audience segments for lookalike targeting. In that case, Quantcast supplies first-party modeling and scaled audience estimates that many auction- or creative-first tools don’t provide. It’s beneficial for media teams building data-driven audiences.

Pricing

- Generally custom and enterprise-focused; contact Quantcast sales for quotes and integration options.

Pros

- Strong audience modeling and programmatic planning tools.

- Useful for growth campaigns that rely on precise segments.

- Suitable for publishers and programmatic buyers as well.

Cons

- Enterprise pricing and onboarding can be a barrier for small teams.

- Not meant for ad creative archives.

7) Adbeat — best for publishers, display placements, and creative trends

Why Adbeat is the clear Adthena complement for display and native ads

Adbeat specializes in display, native, and publisher-level intelligence. If your competitor mix is heavily weighted towards display, native, or affiliate channels, Adbeat surfaces publisher placements, creative rotations, and spend signals. This makes it easy to identify which publishers’ competitors they rely on and which creatives they A/B test across networks. For programmatic and display-heavy competitors, Adbeat fills the gap left by search-centric tools.

Pricing (2025)

Standard plans start at around $249/month; advanced plans cost $399, and enterprise tiers (custom priced) offer more direct buy and native network data. Trial/free basic views are available to preview data.

Pros

- Publisher and creative-level detail for display and native.

- Suitable for media planning and creative inspiration.

- Exports are useful for creative ops and asset libraries.

Cons

- Costly for teams that only need search-level insights.

- Limited direct keyword-level detail compared with SEM tools

Decision framework: how to know “Your Tool”

Let’s get right to the point. This is how you know you’re a fit among these 7 Adthena alternatives.

If you…

- …run search-first campaigns and need ad copy plus keyword history: start with SEMrush or SpyFu.

- …need market-level channel mix and competitive traffic signals: pick Similarweb.

- …want authoritative auction overlap for immediate bid decisions: use Google Ads Auction Insights inside your accounts.

- …need a cheap, fast landing page and ad galleries: test TapClicks.

- …want audience segments and programmatic planning: contact Quantcast for a tailored solution.

But, if your…

- …advertising budget focuses on banner ads and sponsored content (not search ads): prioritize Adbeat.

So,

Here’s the next step for you. Start with a free trial of one tool (SEMrush or Similarweb) and track 3-5 core competitors for 2-3 weeks. Focus on extracting one actionable insight that changes a bid, creative, or placement. If it delivers, go month-to-month to prove ROI to stakeholders. After 2-3 months of measurable wins, negotiate annual pricing for maximum savings.

FAQs on Adthena alternatives for competitive PPC intelligence

What Adthena alternative is best for agency PPC audits?

- Agencies often combine SEMrush (keyword/ad copy depth) with Adbeat (display intelligence) to ensure audits cover both search and cross-channel buys.

Which Adthena alternative gives the most accurate auction overlap?

- Google Ads Auction Insights is authoritative for auctions you participate in because it’s native to Google Ads and uses real auction data.

Is Similarweb a suitable alternative to Adthena for market research?

- Yes. Similarweb excels at traffic sources and channel mix, making it ideal when you need market- or category-level context rather than per-ad creative history.

Which tool is the most cost-effective to start with for PPC competitor tracking?

- SpyFu and TapClicks offer low-cost entry plans (often under $100/mo) for keyword and landing-page checks.

Which alternative helps plan programmatic audience buys like Adthena cannot?

- Quantcast focuses on audience segments and programmatic planning, making it a better choice for audience-first buys; expect enterprise pricing.

Can Adbeat replace Adthena for display and native creative intelligence?

- Yes, Adbeat is purpose-built for display/native intelligence and often exposes publisher placements and creative rotation patterns more comprehensively than search-first tools