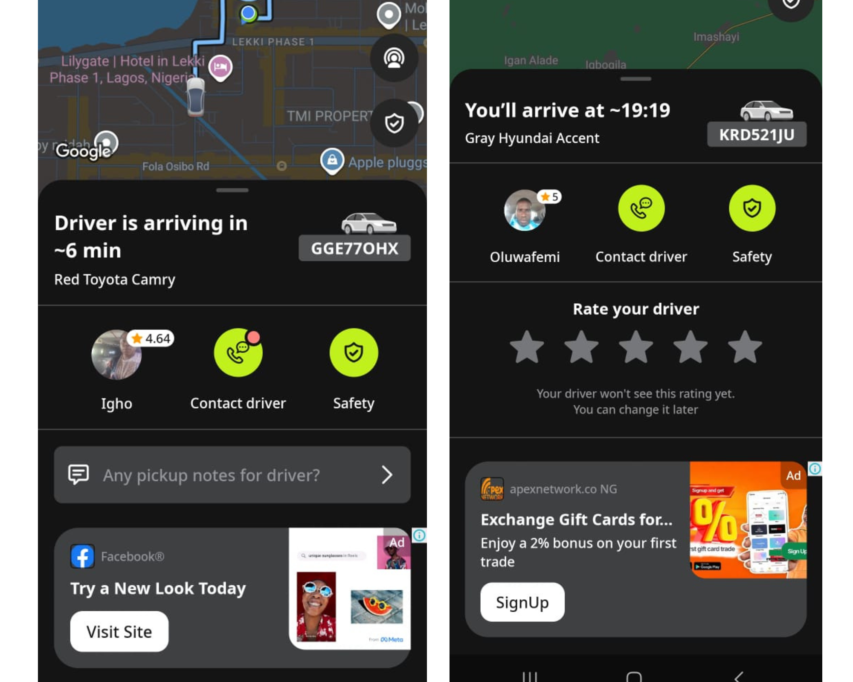

Ride-hailing platform inDrive quietly rolled out in-app advertising in Nigeria as part of a broader strategy to diversify revenue beyond ride-hailing and delivery services, Techpoint Africa can confirm. The feature, introduced in November 2025, is powered by Bookings.com and places ads within the app interface, notably during post-booking wait times and while passengers are en route.

The move comes as inDrive, like many mobility startups, seeks new revenue streams in markets where ride commissions alone are proving insufficient to sustain long-term growth. Advertising offers a high-margin, scalable source of income tied directly to app engagement.

The move mirrors broader industry trends in Nigeria’s gig economy, where local platforms are experimenting with alternate monetisation beyond ride-hailing fees. Fellow delivery and mobility players, including Chowdeck and Glovo, have also launched in-app advertising offerings over the past two years to capitalise on large audiences and frequent usage patterns.

The introduction of ads arrives amid mounting pressure on driver earnings in Nigeria. Transport unions recently raised alarms over double VAT deductions on trip fares following tax changes in 2026, with drivers reporting that overall deductions climbed from roughly 9.99% to about 12.5% per ride.

This amplifies ongoing tensions between inDrive and its driver community. In late 2025, the company rolled out a promotional policy in South Africa allowing drivers to retain 99% of their fares in some cities, capping the platform’s commission at just 1%. While framed as support for drivers, the initiative is widely seen as a response to unrest and competitive pressure rather than a permanent business model shift.

Nigeria has also seen drivers strike and protest in previous years over low-priced fares and safety concerns tied to ride-hailing operations.

inDrive’s signature peer-to-peer pricing, which lets riders and drivers negotiate fares directly, helped it gain traction in price-sensitive markets like Nigeria, where it ranks as one of the most downloaded ride-hailing apps globally. Yet as the company pushes toward a super-app strategy that includes grocery delivery and other services alongside advertising, it must balance new revenue ambitions with driver relations in a highly competitive mobility landscape.