- Yellow Card has obtained a Crypto Asset Service Provider (CASP) licence in South Africa, enhancing its service offerings.

- This move allows Yellow Card to offer its cryptocurrency services within South Africa’s regulated financial framework, underscoring its commitment to compliance and growth across the continent.

- This came after it partnered with Coinbase and Block to expand access to digital assets and cross-border payments.

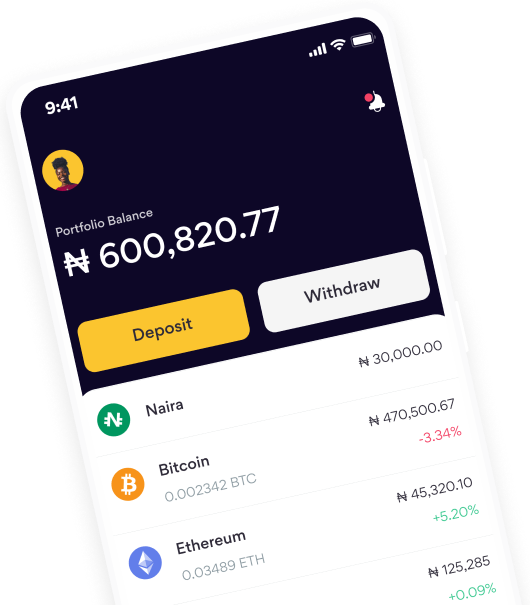

Founded in Nigeria in 2019, Yellow Card has rapidly expanded its footprint, now operating in 20 African countries and facilitating more than $3 billion in transactions. The company positions itself as the largest and first licensed stablecoin on-ramp/off-ramp in Africa. It provides businesses with secure and cost-effective methods to buy and sell stablecoins like USDT, USDC, and PYUSD via local currencies and its Payments API.

In October 2024, Yellow Card raised $33 million in a Series C funding round to fuel its growth, develop new products, strengthen its team, and lead engagement with regulators across the continent. This funding underscores the company’s dedication to expanding its services while adhering to regulatory standards.

In January 2024, Yellow Card partnered with Coinbase, a U.S.-based cryptocurrency exchange, to provide easy access to USDC and digital assets in 20 African countries. This collaboration allows Coinbase wallet users in Africa to make payments in their local currency via local bank transfers and mobile money, offering a more streamlined and enhanced customer experience.

Additionally, in 2023, Yellow Card partnered with Block, the U.S. fintech company behind Cash App and Square, to facilitate cross-border payments between 16 African countries, including Nigeria, Ghana, and South Africa. This partnership aims to enhance financial inclusion and provide more accessible financial services across the continent.

Securing the CASP licence in South Africa is a pivotal step for Yellow Card, as it navigates the complex regulatory landscapes of African countries. This achievement solidifies its presence in one of Africa’s largest economies and sets a precedent for other fintech companies aiming to expand within regulated environments.

As Yellow Card continues to grow, its focus on regulatory compliance and strategic partnerships positions it as a key player in Africa’s evolving fintech landscape, driving cryptocurrency adoption and financial inclusion across the continent.