- Yellow Card has secured a $33 million Series C funding round to enhance operations and drive expansion.

- Blockchain Capital led the funding round with participation from Polychain Capital, Third Prime Ventures, Castle Island Ventures, Block, Inc., Galaxy Ventures, Blockchain Coinvestors, Hutt Capital, and Winklevoss Capital.

- With this latest round, the startup’s total funding has reached $88 million. Previously, it announced a $15 million Series A in 2021 and raised $40 million in a Series B round in 2023.

The fintech company stated that the newly secured fund will be used to fund growth and expansion, specifically by improving Yellow Card’s API and widget products, which serve as gateways for international businesses (including Coinbase and Block) to enter African markets and for Pan-African companies to easily make international payments and manage their treasury using stablecoins.

Yellow Card confirmed it is developing innovative new products for the continent, strengthening its team and systems, and continuing to lead engagement with regulators across the continent.

In January 2024, Yellow Card partnered with Coinbase, a cryptocurrency exchange in the United States, to provide easy access to USDC and digital assets in 20 African countries.

The move allows Coinbase wallet users in Africa to make payments in their local currency via local bank transfers and mobile money. The integration also provides a more streamlined and enhanced customer experience and a hassle-free KYC.

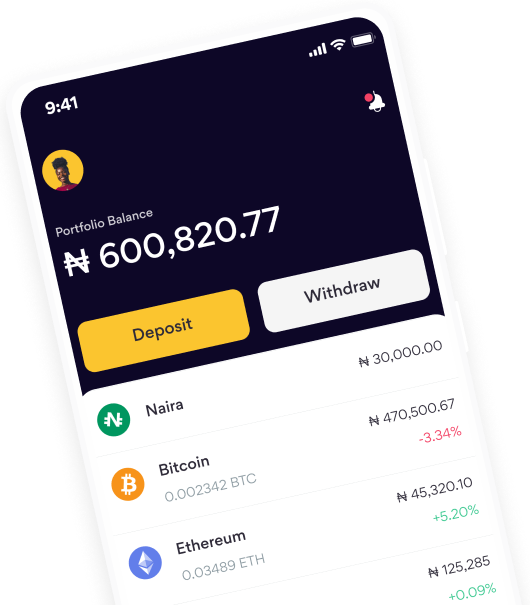

Yellow Card, founded in Nigeria in 2019, is a fintech company that operates in 20 countries and facilitates more than $3 billion in transactions across the continent. It claims to be the largest and first licenced Stablecoin on-ramp/off-ramp in Africa, offering businesses of all sizes with secure and cost-effective methods to buy and sell USDT, USDC, and PYUSD via their local currency directly and through our Payments API.

In 2022, the company reportedly became the first cryptocurrency company in Africa to be granted a Virtual Asset Service Provider licence to operate in Botswana.

In 2023, the fintech partnered with Block, the US fintech company behind the Cash App and Square, facilitating cross-border payments between 16 African countries, including Nigeria, Ghana, and South Africa.

As Yellow Card eyes growth with the new development, many similar startups have faced major challenges. Paxful, a US-based crypto exchange with a large presence in Africa, has shut down operations, while Mara has rebranded to Jara following financial difficulties.

This development also comes at a time when African countries, including South Africa and Nigeria, are making moves to regulate the crypto sector.