- Yellow Card, an African-focused stablecoin exchange, has partnered with Coinbase, a cryptocurrency exchange in the United States, to provide easy access to USDC and digital assets in 20 African countries.

- Coinbase users in these countries will buy USDC directly from the Coinbase Wallet app. Also, wallet users will send USDC without fees on social media platforms such as WhatsApp, iMessage, Telegram, and email starting in February.

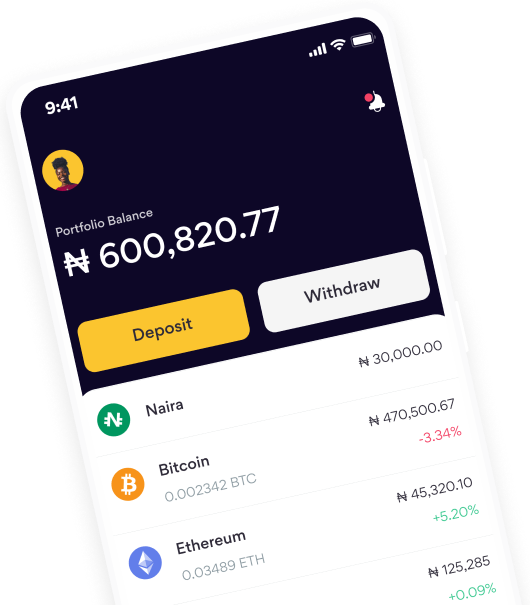

- This move allows Coinbase wallet users in Africa to make payments in their local currency via local bank transfers and mobile money. Per Yellow Card, the integration would provide a more streamlined and enhanced customer experience and a hassle-free KYC.

Following the partnership, the new Yellow Card Widget, a payment API that allows businesses to provide their African users with local currency payment options, has been integrated into the Coinbase wallet.

This integration would enable Coinbase wallet users to use payment methods available in over 20 African countries.

On the other hand, the partnership allows Yellow Card customers to send and receive USDC via Coinbase’s Layer 2 solution, Base. The Base chain, launched in August 2023, is an Ethereum Layer 2 solution that is said to provide faster transaction speeds and lower fees. This means that USDC transfers will become significantly more affordable.

Chris Maurice (CEO) and Justin Poiroux (CTO) founded Yellow Card in Nigeria in 2019. The platform claims to be one of Africa’s largest stablecoin on/off ramps, with users from 20 countries, including South Africa, Tanzania, Uganda, and Nigeria, accounting for approximately 52% of Africa’s population.

According to Maurice, the partnership will enable more Africans to “participate in the future of finance.”

Circle, a global technology firm, issues the USDC stablecoin, backed by the US dollar. It ranks seventh overall in the cryptocurrency market by market capitalisation and is the second-largest stablecoin, according to Coinmarketcap.

Yellow Cars raised a $40 million Series B in late 2022 to continue expanding in the African market despite the economic downturn. At the same time, the company secured a virtual asset provider license in Botswana.