The news:

- Nigerian banks have reportedly commenced the payment of the debt they owed telecom companies, following the payment plan that was agreed upon in the last quarter of 2023.

- As of November 2023, Nigerian banks owed telecom firms ₦200 billion ($132 million) for using their Unstructured Supplementary Service Data (USSD) services.

- The payment, due largely to the direct involvement of Central Bank of Nigeria (CBN) Governor Olayemi Cardoso, is not going as fast as the telcos had hoped.

According to Gbenga Adebayo, President of the Association of Licenced Telecommunication Operators of Nigeria (ALTON), the bank has been slow to make payments, causing the debt to drag on for longer.

“The ₦200 billion, which consists of the principal sum and the interest is likely to rise if the payment continues to drag. We believe that our friends in the banks can do better than what they are doing,” he stated.

For six years, the debt has been a source of dispute between telcos and banks, requiring the intervention of CBN and the Nigerian Communications Commission.

Some people have claimed that snail-paced debt repayment is the banks’ way of getting back at the telcos for what they consider bad faith.

One bank CEO, who insisted on remaining anonymous so he could speak freely, explained, “There was no agreement between the banks and telcos about sharing USSD fees from the beginning. The banks only discovered the telcos were interested in the fees when they started to threaten to cut the service.”

During an investor call in 2021, Herbert Wigwe, the late CEO of Access Holdings — the parent company of Access Bank — clarified that “There is no such thing as an obligation due from banks to telcos.”

Till now, other bank executives have questioned how the telcos arrived at the debt figure, decrying the lack of transparency surrounding the billing process.

In 2023, Segun Agbaje, Group CEO of GTCO, submitted that the responsibility for collecting the debt should fall to telcos since the entire ₦6.98 fee per USSD transaction goes directly to them.

However, regulators insisted that banks collect and remit the fees to telcos, although it now seems like the banks are pushing back by dragging out the payments.

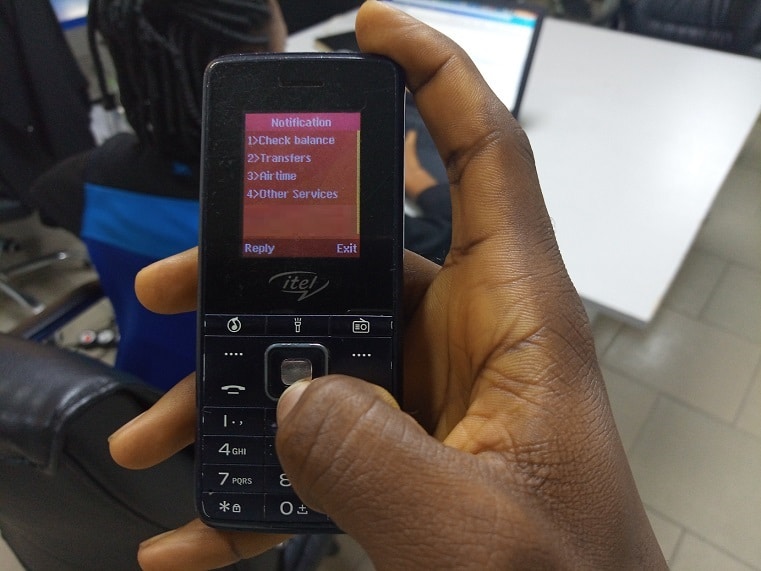

The USSD, originally designed by telecom companies to provide airtime and subscriptions to customers, quickly found widespread adoption in banking because, unlike mobile banking, customers don’t need the internet or smartphones to use USSD.

In May 2023, the NCC granted telcos in the country — MTN, Glo, Airtel, and 9mobile — the approval to disconnect banks from using USSDs. The debt that was ₦80 billion ($179.1 million) in USSD fees as of November 2022 rose to more than ₦120 billion ($261.36 million) by April 2023. Now, it’s ₦200 billion ($132 million). In March 2023, ALTON announced that banks and telco customers would begin performing bank transactions using a uniform code.