- Following the directive of the Central Bank of Nigeria on promoting financial system stability through the Know Your Customer (KYC) procedure for customers, PalmPay has introduced a new security update.

- This update requires all new users to include their Bank Verification Number (BVN) and National Identification Number (NIN) before creating a wallet.

- According to Chika Nwosu, Managing Director of PalmPay, this measure will reduce fraudulent activities and provide a safe banking environment. It will also reduce the number of impersonation incidents because users will have to move on to the face recognition process once they link to their NIN or BVN.

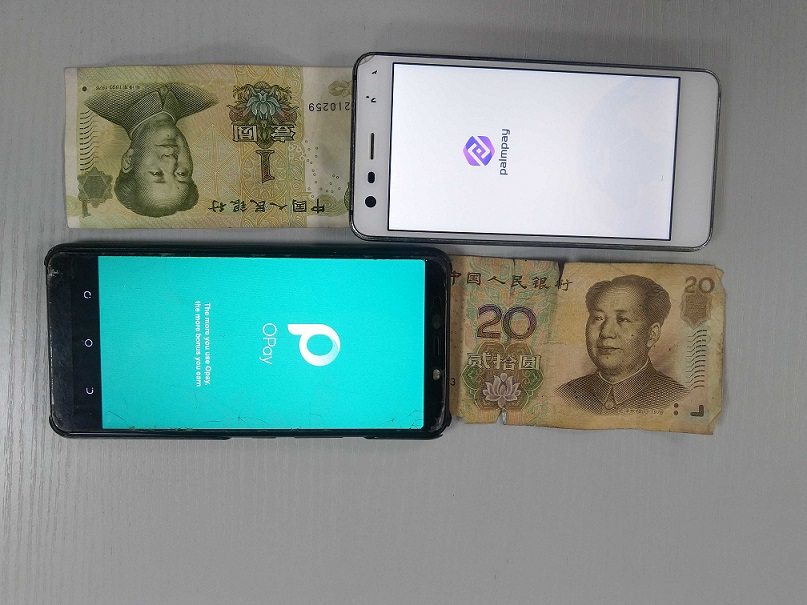

Last week, Techpoint Africa reported how fraudsters exploit OPay and PalmPay loopholes to hijack identities — a case study of a woman whose phone was stolen and identity was hijacked to syphon over ₦100,000 using an account created with her full legal name.

Meanwhile, this reporter attempted to create a PalmPay account using a new SIM, per the latest development by the fintech company. This reporter tried to transfer to the newly created account without adding the BVN or NIN, but it did not exist.

After adding the BVN, the new account could only receive money on a Tier 1 basis because additional upgrading required NIN verification.

Previously, a user could open a PalmPay account under any name without verification, allowing the user to conduct up to ₦50,000 transactions. However, this new update enables new users to only make transactions after being verified.

Similarly, OPay recently reacted to the issue of account impersonation and weak KYC. The fintech company said it implemented bank account verification in its onboarding process to help users authenticate their BVN conveniently in cases of forgotten BVN. However, the company maintained that it had taken down the feature.

According to OPay, “Generally, KYC verification can be done directly (NIBSS or NIMC portal) or indirectly (bank account verification). We introduced bank account verification to help users authenticate BVN more conveniently (for example, when a user forgets their BVN).

“For biometric validation, our system will verify the face of the user with that on the BVN database, or double-check with the user’s real name. This is combined with an OTP process which then certifies the authenticity of the user. This is more so, consistent with the CBN’s latest guidelines mandating BVN/NIN verification for Tier 1 users.”

The company also clarified that it has removed the Bank Account Verification feature, introducing only BVN and NIN as verification tools on the app.

In a circular issued on December 1, 2023, the Central Bank of Nigeria (CBN) announced that bank accounts that are not linked to a BVN or NIN by April 2024 will be frozen.

Don't miss out on Africa's financial revolution

Give it a try, you can unsubscribe anytime. Privacy Policy.

The apex bank also mandated that all Tier 1, 2, and 3 accounts be linked to a NIN or BVN.