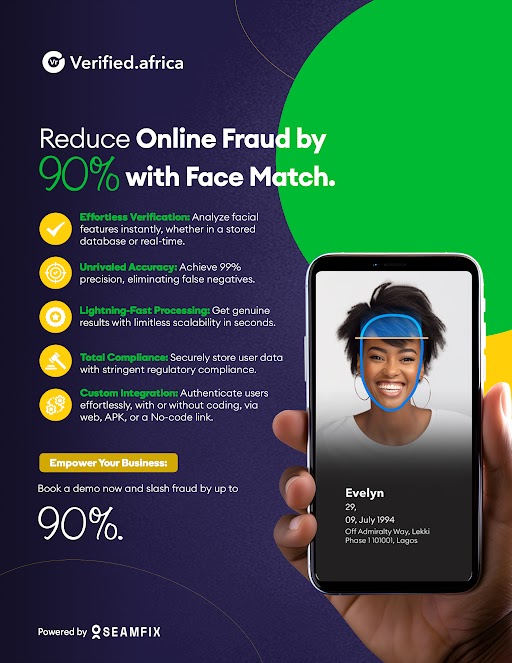

Verified.africa, a market leader in biometric identity verification, is empowering businesses across Africa to seize growth opportunities by seamlessly integrating Face Match technology into their Know Your Customer (KYC) processes.

The African internet economy is on track to reach $180 billion by 2025, presenting immense potential for startups and established companies. However, establishing trust is crucial for sustained growth, particularly when engaging with investors and customers.

Biometric identity verification addresses this challenge by providing a swift, secure, and reliable method to verify individuals' identities. Face Match, in particular, is transforming KYC checks, enabling businesses to confirm identities in seconds across any platform.

Emmanuel Adeyemo, Product Manager at Verified.africa, highlights the significance of trust in fostering growth: “Scaling trust from one individual to millions is the key to unlocking unlimited growth potential. Face Match is critical in boosting identity verification, offering businesses a swift and secure means to onboard customers and eradicate fraudulent activities."

Understanding How Face Match Works for KYC

Face Match facilitates real-time identity verification by comparing facial images from diverse sources, such as ID documents, live camera captures, governmental databases, or proprietary archives. This comparison involves extracting key facial landmarks and calculating a similarity score, ensuring up to 90% accuracy in confirming identities.

For instance, Union Bank, a prominent African commercial bank, leverages Face Match by cross-referencing customer-provided pictures with images stored in the NIBSS (Nigeria Inter-Bank Settlement System) database when opening digital bank accounts. Through API integration with Verified.africa, Union Bank achieves precise BVN facial matching, swiftly and securely onboarding thousands of customers.

Face Match caters to multiple use cases, including sim registration for telecoms, Fintech mobile onboarding, bank account opening, and guest check-ins for hospitality services. Emmanuel Adeyemo highlights accessibility: "Our goal was to make Face Match easily adaptable across platforms. We offer various integration options—APIs and SDKs for custom integrations or a no-code solution for swift implementation.”

Emmanuel Adeyemo emphasises, “Our technology complies with industry regulations, providing faster biometric identification with up to 90% accuracy globally.” Face Match seamlessly combines with document verification across five African countries—Ghana, Kenya, South Africa, Uganda, and Nigeria—offering a comprehensive user experience.

To explore how the Face Match solution can optimise your onboarding workflow, simply book a demo here or visit their website for more information.

About Verified.africa

Verified.africa is a leading KYC startup offering cutting-edge identity verification solutions. Our mission is to simplify and ensure compliance in KYC processes for companies of all sizes, making identity verification simple, accessible, and secure.