On average, businesses make 40-50 vendor payments monthly. These payments, done by finance managers or accountants, are made manually through regular bank transfers, reconciliations are done manually, and vendor invoices are managed using spreadsheets.

Processing vendor payments manually can be extremely time-consuming, especially when there are new vendors to pay, from adding your new vendor as a beneficiary on your bank portal and then making the payment. Let’s not forget how easy it is to mess up while working with too many numbers. Calculations can go wrong, and you start over again to fix your mistakes, resulting in late or incorrect payments.

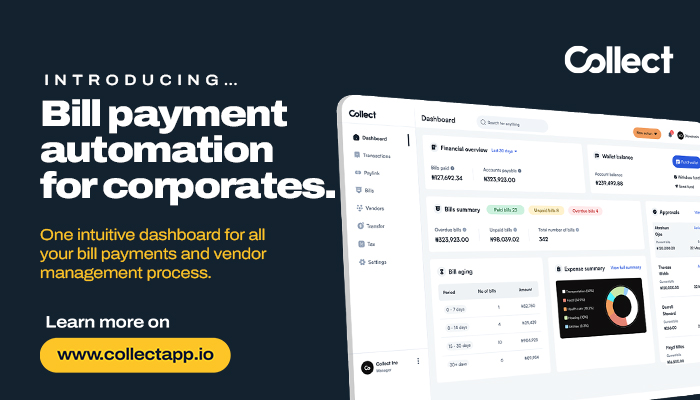

B2B payments startup, Collect has pivoted and unveiled a new product designed to help modern businesses automate payouts to vendors, suppliers and contractors globally.

Founded in 2021 by Abraham Ojes and Wale Martins, Collect started as a payment collection platform that enabled small and large businesses to accept payments seamlessly across diverse platforms.

With this pivot, Collect has launched an intuitive payment dashboard with features to help finance teams get real-time insights into their account payables, manage expenses, and pay their vendors and suppliers anywhere in the world.

By switching from a manual invoice processing system to Collect’s fully automated process, companies can track the progress of invoices, expedite approvals, and automate payouts, helping them to cut costs, save time, and reduce errors.

The smart and highly responsive dashboard replaces several spreadsheets, using optical character recognition (OCR) technology to read uploaded invoices, populate the details automatically and calculate/track withholding tax on bill payments. So, businesses can say goodbye to data-entry mishaps and stay compliant with tax regulators.

Without having to go through multiple platforms, businesses can also benefit from managing all their bill payment processes from a single platform, ensuring payments are made on time with timely automated reminders.

According to the team at Collect, this product will improve the vendor management and payment process within organizations, helping business owners and finance managers better manage their relationships with vendors, make cross-border payments seamlessly and pay bills more efficiently.