Hello there!

Today I’m discussing:

- Mono’s Series A

- Digital gender gap

- Airtel Money’s spend now and pay later service

Editor’s Note: In the Techpoint Digest for yesterday, October 10, 2021, we stated that “only 10% of West African startups with a female co-founder have raised $1 million.” which was somewhat misleading.

A more accurate statement would be, “only 10% of West African startups with a female co-founder raised over $1 million between 2010 and 2019”, as it clearly states the timeframe for funding activities in Women-led startups. You can check out this piece for more.

Mono announces $15m Series A to speed up growth in Africa

What happened? On Monday, October 11, 2021, African fintech startup, Mono, announced a $15m Series A. This round follows a $2 million seed raised in May.

American investment firm Tiger Global led this round, with participation from SBI Investment, Target Global and General Catalyst, all first-time investors in Mono. Returning investors include Ingressive Capital, Entree Capital, Golden Palm Investment Corporation (GPIC), Lateral Capital, and Acuity VC.

What’s up with Mono? Mono is a fintech API that serves as a source for financial data. They aggregate data like income, account statements, real-time balance, customer spending patterns, and historical transactions into a single API for financial firms and third-party developers.

Hold on a bit: A month after the startup launched, it raised a $500k pre-seed in September 2020, then a $2m seed in May 2021. This amounts to $17.5 million in funding disclosed so far. If funds raised in investment rounds connotes traction, then Mono seems to be growing. Although, in most cases, traction reflects more in user-base growth and revenue.

Per TechCrunch, Mono’s CEO Abdulhamid Hassan, former Product Manager at Paystack , shared that not only has Mono partnered with 270 businesses and developers in processing over 200 million financial data transactions, they have also seen a 45x year-on-year growth in connecting bank accounts and a 10x revenue increase since their pre-seed in May.

Coupled with a recent expansion to Ghana and a planned foray into Kenya, South Africa, and Egypt, Hassan says that most of Mono’s moves are primarily based on customers’ requests, as they have built a reputation amongst customers. With this funding, they’re looking to develop solutions for non-tech and traditional industries and establish a footprint in five African countries by next year.

This article provides some much-needed context on Mono and the growing sub-sector it’s playing in: Why API-led fintech startups are becoming a big deal in Nigeria

Countries lose $1 trillion from the digital gender gap in over a decade

Surprise, surprise? Issues like gender imbalance in education, unequal pay, and the exclusion of women in economic activities and innovative processes seem to be over-flogged discussions, and by now, you’d expect a rapid change in policies to address these gaps. Sadly that is not the case.

Bye-bye money: On Monday, October 11, 2021, the World Wide Web Foundation and Alliance for Affordable Internet(A4AI) released a report on the Economic Consequences of the Digital Gender Gap, and it was found that lower-middle-income countries have lost an estimated $1 trillion in GDP due to digital gender gap in over a decade.

What is the digital gender gap? It is the aspect of the digital divide — the division of people into the connected and unconnected and disparity in access to technology — that exists as a result of gender differences. The report shows that globally, women are disproportionately excluded from the Internet, with 52% of men likely to be online than women.

But why does it exist? This gap exists for both intentional and unintended reasons, which include inequalities in education and digital skills, social norms that discourage women and girls from being online, privacy, safety, and security.

From the 32 countries surveyed, one-third of women were connected to the Internet, translating into a $24 billion loss in tax revenue annually. To dig up these figures, the report reviewed 70% of the collective GDPs of these countries and paired it with existing data from the International Telecommunications Union (ITU). You can find the full report here.

Going forward: In a constantly evolving world, the need for digital inclusion is crucial, and we cannot build solid walls for the future if one part is left out. Early introduction and access to technology and digital innovation will make a world of difference.

Tanzanian Airtel Money users get extra spending power

Airtel Money users in Tanzania can now spend and pay later

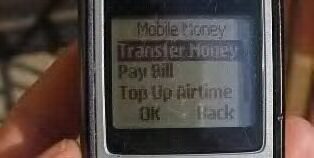

What’s the news? On Monday, October 11, 2021, mobile money provider, Airtel Money, announced that via a partnership with I&M Bank, Tanzania, it had launched Kamilisha, a digital lending service that allows users to access overdrafts. Based on terms and conditions, of course.

With Kamilisha, customers with no funds in their wallet can buy airtime and data bundles, carry out person-to-person (P2P) transfers, make water and electricity bill payments to Dar es Salaam’s Water and Sewerage Authority (DAWASA), and The Tanzania Electric Supply Company Limited (TANESCO), and pay back later.

How it works: To access this service, users can dial the code *150*60#, select 0, click on fund my wallet, and activate Kamilisha for transactions by pressing 1. The technology behind this service is powered by YABX, an African-focused fintech startup that offers credit facilities.

Fun fact. Kamilisha is a Swahili word that means “complete.”

In case you missed it on Techpoint Africa

- A journey through the lives of four women doing big things in African tech. Read.

What I’m reading/watching

- Early Work. Read.

- Lisa Bentley: “Belief Trumps Talent Every Time.” Read.

- Your elusive creative genius. Watch.

Opportunities

- Mono is hiring a Technical Product Specialist. Apply here.

- Attend the Product-Led Growth (PLG) guide founders’ meet and greet hosted by Netcore. See details here.

- Altschool by TalentQL has launched. Earn a Diploma in Software Engineering. Join the waitlist.

Have a beautiful day!