Nigeria is reeling from the effect of the SIM registration ban, as mobile subscribers have dropped drastically in just four months.

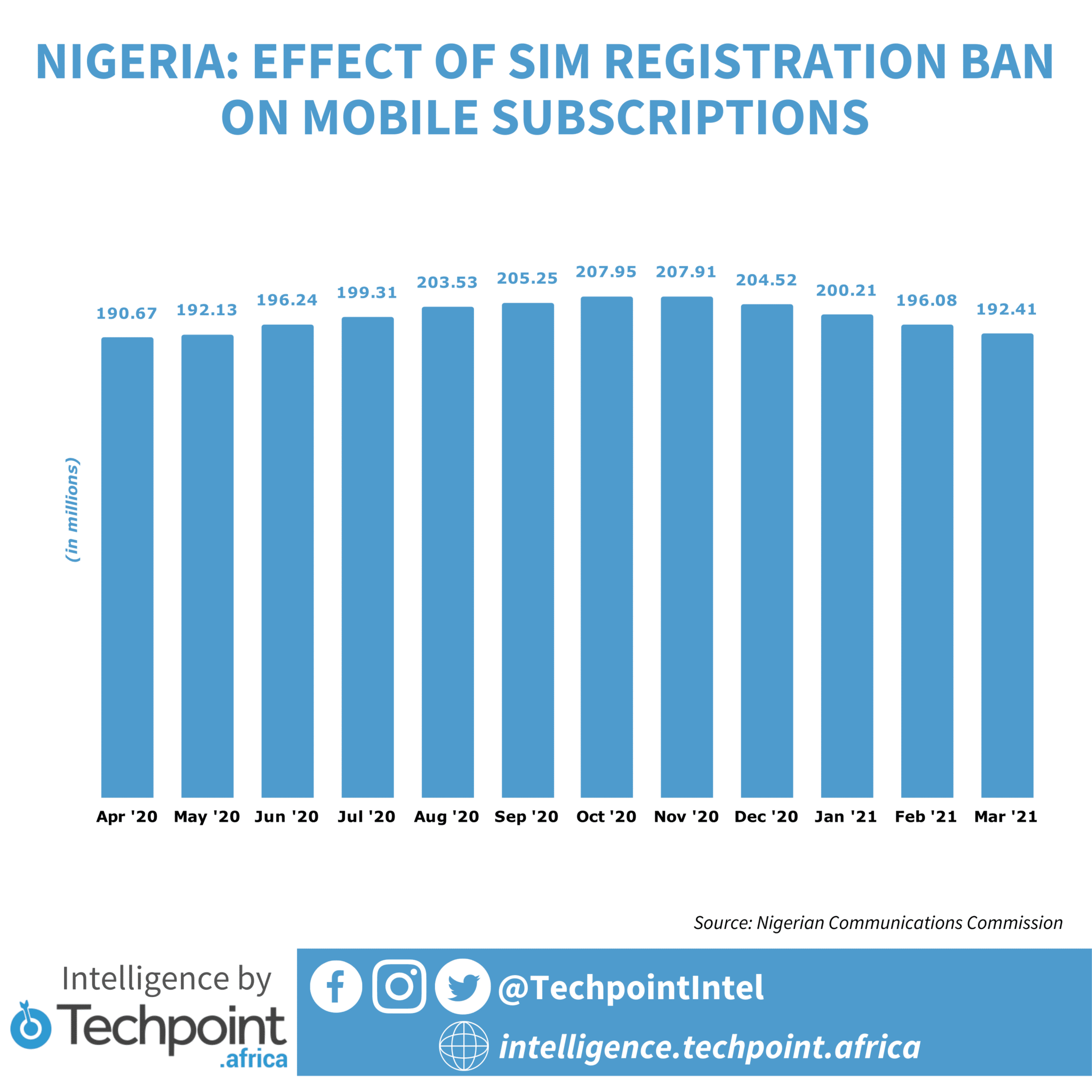

Pooling data from the Nigerian Communications Commission (NCC), Intelligence by Techpoint reveals that Nigeria lost 15.5 million subscribers between December 2020 and March 2021.

In 2020, Nigeria had 190 million mobile subscribers, but that number hit 192 million in March 2021.

In December 2020, the Nigerian government banned the sale and registration of new SIM cards and introduced a December 30 deadline for people to link their National Identity Number (NIN) with their SIM cards.

In retrospect, it is not clear if the government considered the risks of COVID-19, as that move coincided with a sharp increase in positive cases in the following months.

MTN and Airtel’s financial reports for Q4 2020 and Q1 2021 revealed that this policy would also hurt telecom companies. Both companies registered a reduction in subscriber numbers during the period in question.

The NCC’s data all but confirms these numbers.

In November 2020, Nigeria had up to 207.9 mobile subscribers, but the country has witnessed a downward spiral since then, leading to the loss of over 15 million subscribers.

Compared to previous years, this could be considered an abysmal showing.

By comparison, Nigeria gained 15.7 million subscribers between March 2019 and March 2020. From March 2018 to 2019, subscribers grew by a whopping 23 million.

The NCC’s subscriber numbers could perhaps be termed inflated, considering the data doesn’t account for people holding multiple SIMs in different devices.

Consequently, the actual number of mobile subscribers is much lower than what the NCC’s records show. Though the regulator had plans to regularise the data in the past, nothing much came of them until the NIN order.

The subscriber decline in such a short time continues to raise questions about the size of Nigeria’s addressable Internet market, as most of the lost subscribers are Internet users.

Per the NCC, Nigeria lost 9.2 million Internet subscribers between December 2020 and March 2021.

While the data wars of 2019 and 2020 were particularly thrilling to observe, Nigerian telecom companies were on a losing streak in the three months between December 2020 and March 2021.

MTN was the hardest hit, with 3.8 million Internet subscribers lost. For context, MTN lost 4.8 million subscribers in total. This means about 70% of them were Internet subscribers.

Historically a formidable competitor to MTN in the data market, Airtel lost about 3.5 million Internet users. This is about 67% of the subscribers it lost in total.

Glo fared way better than the first two, losing 1.3 million Internet subscribers, about 68% of the total mobile users it lost.

SIM ban or not, 9mobile has struggled with the loss of its subscribers in recent years. However, it lost the least number of Internet subscribers at a respectable 701k.

However, this number gets weird considering that it lost just 132k mobile subscribers. This would mean about 569 9mobile subscribers went offline during this period.

The loss of Internet subscribers by Nigerian telcos is also telling considering that, due to the pandemic, more people needed to be online to attend to their businesses, jobs, or education, but the SIM ban period might have been a stumbling block.

Thankfully, the ban has been lifted even though the NIN registrations continue.