The Nigeria Inter-Bank Settlement System (NIBSS) has released its industry fraud report for Q3 2020. As presented by various financial institutions, the report captures major talking points around fraud volume, fraud techniques, fraud sources, and affected demographics among others.

According to data from the Nigerian Communications Commission (NCC), Nigeria gained at least 2.5 million Internet subscribers during the lockdown of April 2020.

Reports from eCommerce heavyweights, Jumia, and big tech giant, Google, suggested an increase in online activities during the lockdown period.

There were some side-effects though, as NIBSS reports that fraudulent activities increased during this period. Fraudsters attempted attacks 46,126 times, and they were successful on 41,979 occasions, 91% of the time.

Consequently, Nigerian financial services companies lost ₦5.2 billion to fraud between January and September 2020.

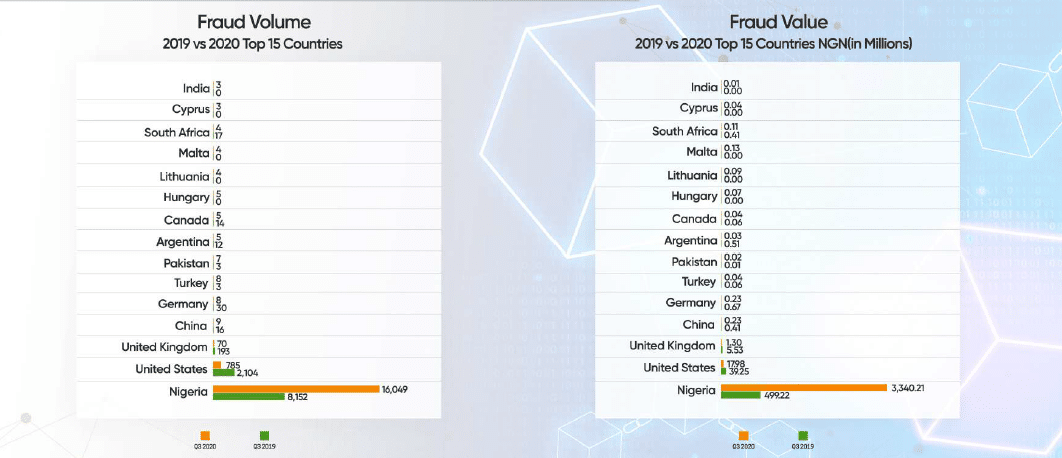

The bulk of this loss occurred between July and September 2020, when companies lost up to ₦3.36 billion. This was a 510% increase from the ₦550 million lost to fraudsters in the same period in 2019.

For the nine-month period, fraud attempts increased by 186% from 16,128 in 2019 to 46,126 as mentioned earlier.

The challenge of fraud is not peculiar to Nigeria alone, as several other countries faced similar challenges in 2020. But in Q3 2020, Nigeria appeared to be the worst hit by a wide margin.

Most popular fraud channels

Fraud attempts via mobile channels increased by 330%, while web and POS fraud increased by 173% and 215% YoY respectively.

These numbers are in keeping with the notion that Internet penetration, mobile phone usage, and agency banking activities are all increasing.

The NIBSS expects this trend to continue as more people come online and become more dependent on electronic transactions for their day-to-day activities.

According to the financial consortium, criminals will always use disruption to cause disruption’. As more innovative platforms arise, it advises that potential points of vulnerability are proactively engaged to boost confidence in digital financial services. –

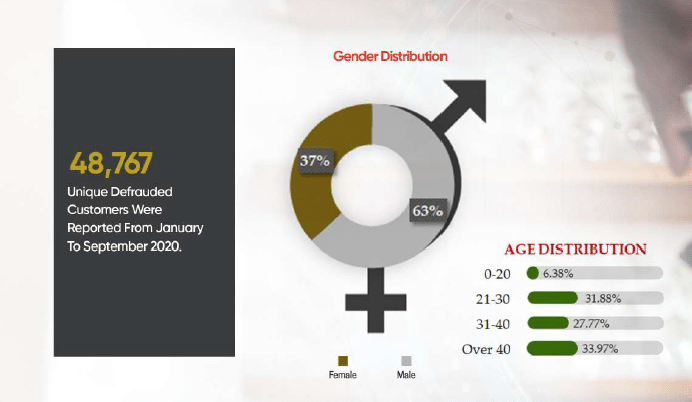

Who are the most affected?

NIBSS reports that criminals defrauded a total of 48,767 unique financial subscribers. Of this number, people over 40-years of age fell prey to fraudsters the most, with 33.97% accounting for the total number of defrauded persons.

Interestingly, people ranged 21 – 30 were the second most defrauded at 31%. Those aged 31 – 40 account for 27%, while people below 20 were the least defrauded with 6%.

How hackers are succeeding

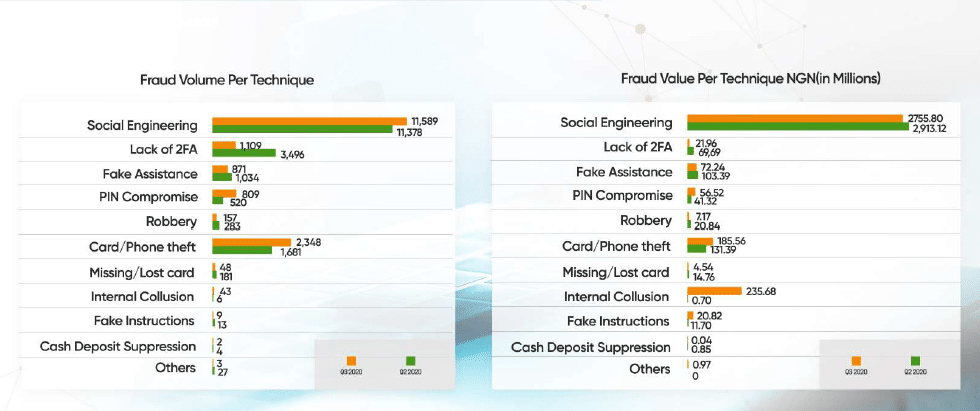

With so many people being defrauded, the NIBSS identified social engineering, no 2-factor authentication, PIN compromise, internal collusion, card/phone theft, fake assistance, and several others as the major methods for fraudulent activities in 2020.

Of these methods, social engineering remains the most common, accounting for 56% of the total fraud that occurred between January and September 2020. Despite campaigns from different banks, it appears people are being manipulated to give out confidential information.

Though NIBSS advocates for more innovation to prevent fraud, it might be very tough to develop an innovation that tackles social engineering, while still ensuring fast and seamless financial transactions.

Indeed companies like Voyance launched Sigma, and Cadnetworks launched the Blacklist to help tackle fraud in the fintech space, but that innovation barely stops social engineering.

As pointed out in this piece, humans will always be the weakest link in the most sophisticated firewalls and advanced technologies, and there’s a need for companies to engage in more customer and employee education.

NIBSS asserts that fraudsters are also leveraging the recent surge in POS usage through agency banking.

Here, the POS agent initiates a transaction of ₦20k and gives the customer to enter the pin, the customer reinitiates the transaction, inputs a lesser amount like ₦10k, enters the pin, and gives back the machine to the unsuspecting agent.

The result? The customer leaves with ₦20k cash but the agent only gets 10k and would be none the wiser if the receipt is not checked. The NIBSS advises agents to check the debit receipts before parting with cash.

As the digital space continues to grow, watch out for some of the most exciting financial innovation in 2021.

Featured Image by Bermix Studio on Unsplash