Across Africa, continued interest in startups has significantly increased the amount of capital invested over the last five years.

Last year, the continent achieved a major milestone, with Partech Africa reporting that 234 African tech companies raised a total of $2.02 billion in 250 equity rounds. This signalled a 74% increase from $1.163 billion raised by 146 startups in 164 rounds in 2018.

This year, however, due to the pandemic, forecasts by AfricArena have it that the continent’s startup scene might not reach the same heights. However, African startups would likely cross the billion-dollar mark again.

Having established the growth in investments, it is worth noting that despite the uptick in indigenous investment entities, the continent still largely relies on foreign funds.

How does West Africa compare?

In the first and second quarters of 2020, Nigerian startups raised $55.37m and $28.35m, respectively. Of the total amount raised, local investors provided a meagre 1% and 5% in the two quarters, respectively.

Two years earlier, Techpoint Africa's Nigerian Startup Funding Report for Q2 2018 showed that 2% of the funds raised were from local investors.

This has been an occurrence since the startup ecosystem in Nigeria, and to a large extent, West Africa began to gain recognition by raising large investments.

Our recently-released West African Startup Decade report reveals that Millionaire West African Startups in the region raised over $1.8 billion in the last ten years.

'Millionaire West African Startups' being West African startups that have raised at least $1m cumulatively between 2010 and 2019 across six of the region's most active tech scenes: Benin, Côte d'Ivoire, Ghana, Nigeria, Senegal, and Togo.

Join over 3,000 founders and investors

Give it a try, you can unsubscribe anytime. Privacy Policy.

For the past 2 years, the @Techpointdotng intelligence team has been working on a report on West African startup activities for the last 10 years. This includes funds raised, investors, founders' background (education, gender, origin etc). https://t.co/DG88EVTFf9 pic.twitter.com/9ecDy8PlWn

— Adewale Yusuf (@AdewaleYusuf_) October 5, 2020

From our research, we found that despite the influx of foreign investments into West African startups, Nigerian investors outperformed investors from other countries in terms of the number of deals made. Well, except the US.

US-based investors like the popular seed-stage accelerator, Y Combinator, have proved vital in brewing high-growth startups in West Africa. Companies like Paystack, OMG Digital, and Oolu have gone through its programme and subsequently raised million-dollar rounds.

But it comes as a surprise that Nigerian investors were the second most active players. This group represented 13% of the more than 200 investors who participated in funding million-dollar West African startups. They also took part in 16% of the number of deals made within this period.

Some have even led million-dollar rounds. For instance, PiggyVest's $1.1 million raise in 2018 was led by LeadPath Nigeria, with Village Capital and Ventures Platform participating.

Confidence is rising among African investors

Kenya and South Africa, like Nigeria, are two African countries with the most funded startups. However, not only do they seem to attract investment, our report tells us that investors from these countries are quite active in the West African region.

For instance, CRE Venture Capital, an SA-based VC firm, invested in Nigerian-based fintech startup, Flutterwave. And Kenyan-based Novastar Ventures invested in Ghanaian healthtech startup, mPharma.

From our findings, one thing is evident: although West African startups are still majorly funded by foreign entities, more African venture capitalists (VCs), private equity funds (PEs), and angel investors have become increasingly confident of putting their money into West African early-stage startups.

To buttress this point, we carefully mapped out investment activities across these regions and highlighted the importance of various players in this insightful West African Startup Decade report.

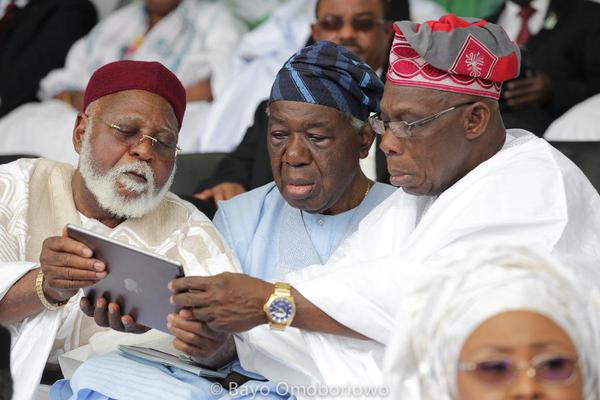

Featured image: Kola Aina (Founding Partner, Ventures Platform) [left]; Michael Seibel (CEO & Partner, Y Combinator) [right]. Source: Ventures Platform's Facebook.