Businesses have struggled to deal with the pandemic which has caused changes in consumer behaviour. Airtel Africa benefited from the shift online, but declines in voice revenues and other economic forces have dealt significant blows to what was otherwise a strong showing.

Airtel Africa, a subsidiary of India’s Bharti Airtel, has a presence in over 14 countries and a 111.5 million subscriber base in the continent, making it one of the biggest telecommunications providers in Africa.

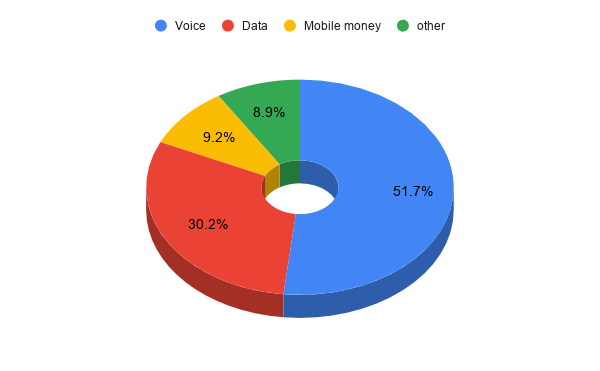

According to Airtel’s Q2 2020 report, its Internet data users increased by 4.5% (1.6 million users) from 35.4 million in March 2020 to 37 million in June 2020. This led to a 5.5% data revenue growth from $253 million to $267 million within the same period.

On the other hand, voice revenue dipped 11% from $510 million in March to $453 million in June 2020. Mobile money also dipped 2.4% from $83 million to $81 million.

However, voice remains the cash cow for Airtel Africa and the slight growth it witnessed in data was not enough to offset the dip in voice revenue.

In its previous report, Airtel stated that it was noticing a dip in voice usage and expected growth in data usage. During this period, it invested in 562 towers to support this expected growth.

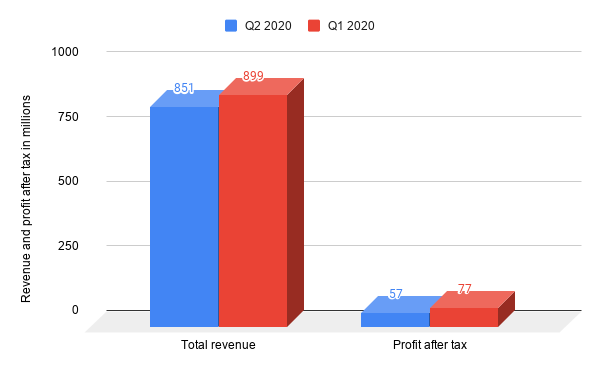

Though there seems to be an increase, Airtel performance in Q1 2020 was better than in Q2 2020. This was despite projections that changing consumer habits during the lockdown would drive data revenue.

By comparison, between January and March 2020, Airtel gained 2.6 million data subscribers, a million more than Q2 2020. However, subscribers used up 279 petabytes (279 billion megabytes) worth of data in Q2, much higher than Q1’s 219 petabytes.

Airtel users consumed an average of 2.6 gigabytes per user, up 500 megabytes from 2.1 gigabytes the preceding quarter. The average revenue per user remained unchanged at $2.5 per user.

Consequently, the telco’s revenue dropped by $48 million (5.3%) from $899 million in March to $851 million in June. Profits after tax also fell 28% from $77 million to $57 million within the same period.

Considerable dips in major markets

Considerable dips in major markets

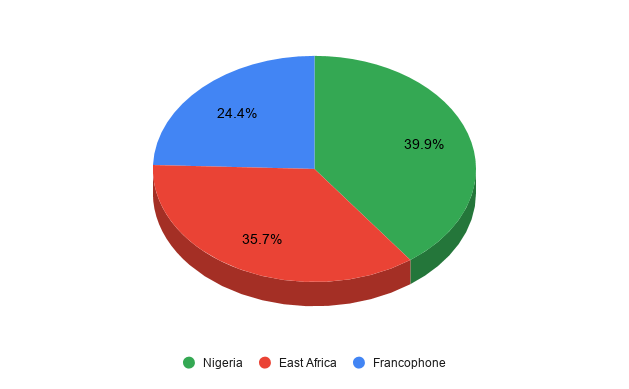

Across its major markets, Airtel only recorded slight growths in customer base and data revenues. Voice and mobile money revenues fell or remained unchanged despite the growth in its customer base.

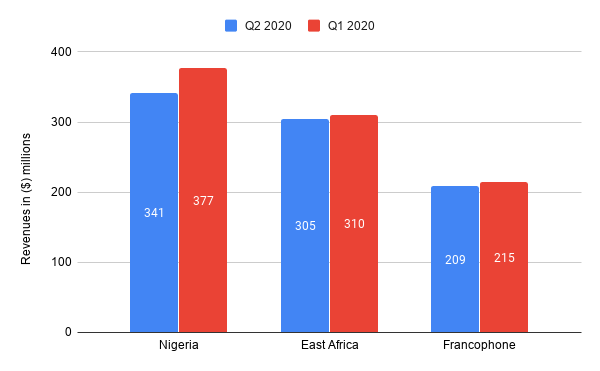

In Nigeria, Airtel’s biggest market, the telco gained just 600,000 data subscribers in Q2 2020, much lower than 1.5 million in Q1 2020. Airtel’s voice revenue fell by $37 million, and it could only gain $2 million in data revenue in response.

These numbers are not surprising. According to data from the Nigerian Communications Commission (NCC), Nigeria gained 2.5 million Internet subscribers during the lockdown, but Airtel only gained a fraction (9.6%), far behind Glo (69.1%) and MTN (29.1%).

In East Africa, Airtel gained 700,000 Internet users, much higher than the 200,000 recorded in Q1 2020. The telecom giants recorded data revenues of $4 million, but its voice revenues fell by $10 million. Strangely, QoQ mobile money revenues remained unchanged at $58 million.

The pandemic only hit Eastern Africa in mid-March 2020, and Airtel appears to have had much better showings in terms of data usage in Q2 2020 than in Q1 2020.

For francophone Africa, the story is similar. Data revenues increased by $6 million while voice revenues fell by $10 million, and mobile money by $2 million in Q2 2020. Airtel’s francophone subscriber base remained unchanged, and its data subscribers increased by just 200,000.

Airtel’s mobile money transactions increased 12.5% in value from $8.2 billion in Q1 2020 to $9 billion in the next quarter. But the higher value did not seem to increase its mobile money revenue across its active markets in francophone and Eastern Africa.

Internet is cheap, but barely affordable

From Airtel’s report and our previous research, it appears that global trends during the pandemic have not gone as expected in Africa. The economies of lower-income countries have been strained and in Nigeria, this probably led to a $10 billion drop in online transactions.

Airtel and several other telcos and even governments have been investing in Internet infrastructure to facilitate the surge in Internet usage. Globally, the prices of data have continued to fall, but for Africa, it does not seem affordable.

With the effects of devaluation and inflation hitting hard in a country like Nigeria, the actual cost of accessing the Internet has been on the increase for the past five years. It is, therefore, not surprising that there are fewer active Internet users than expected.

Airtel’s slow growth in data usage and dips in voice revenues seems to be the result of the current economic landscape across its major markets.

Investor reactions: A tale of two markets

Upon announcing its financial results on July 15, 2020, Airtel’s stocks went up from ₦328.7 to ₦340 per share on the Nigerian Stock Exchange (NSE). However, prices went down from £63.6 to £61.5 on the London Stock Exchange (LSE).

Airtel is dual-listed on the LSE and NSE but their activities have differed widely. While the LSE has witnessed active trades, Airtel mostly flatlines for months with occasional downward or upward movements on the Nigerian market.

On June 26, 2020, NSE staff reported that a single trade by a foreign investor pushed Airtel’s stock from ₦298.9 to ₦328.7 per share. A move that saved the entire market from ending that week with a loss.

With its latest earnings call, the telecom giants placed basic earnings per share at 1 cent, slightly lower than 1.5 cents recorded the previous quarter.

Airtel’s resilient showings through the economic challenges of the lockdown seemed to have increased investor confidence in Nigeria, but UK traders did not seem to share the same confidence.

Airtel Africa closed trading for Wednesday, July 29, 2020, at ₦348 per share and a market cap of ₦1.3 trillion on the NSE and £55.3 with a £2.07 billion market cap on the LSE.