Total venture funding for African startups in 2020 so far has passed the $500m mark. This is according to Maxime Bayen, company builder at GreenTec Capital, a German but African-focused investment firm.

Bayen carries out surveys on investments secured by African startups. However, most of his reports only contain deals of $1 million or more.

In the first quarter of 2020, Bayen reported that 35 African startups had raised over $340 million.

So far in 2020, 3️⃣5️⃣ #startups in #Africa have raised $1M+, totalling $340M. A few stats:

📊This is 33% YoY vs 2019

📊Top 3 countries: 🇿🇦(10 deals) 🇳🇬(8) 🇪🇬(6)

📊Only 4/35 have a woman co-founder, only 1 woman CEO>> All details on these deals: https://t.co/QJkUpGYwsC pic.twitter.com/nnuQX9t0co

— Maxime Bayen (@MaxBayen) April 1, 2020

Comparing this to the Bayen's survey of Q1 deals from last year, African startups raised $112m more this year ($256m last year, $368m in 2020). This represented an uptick of about 43%.

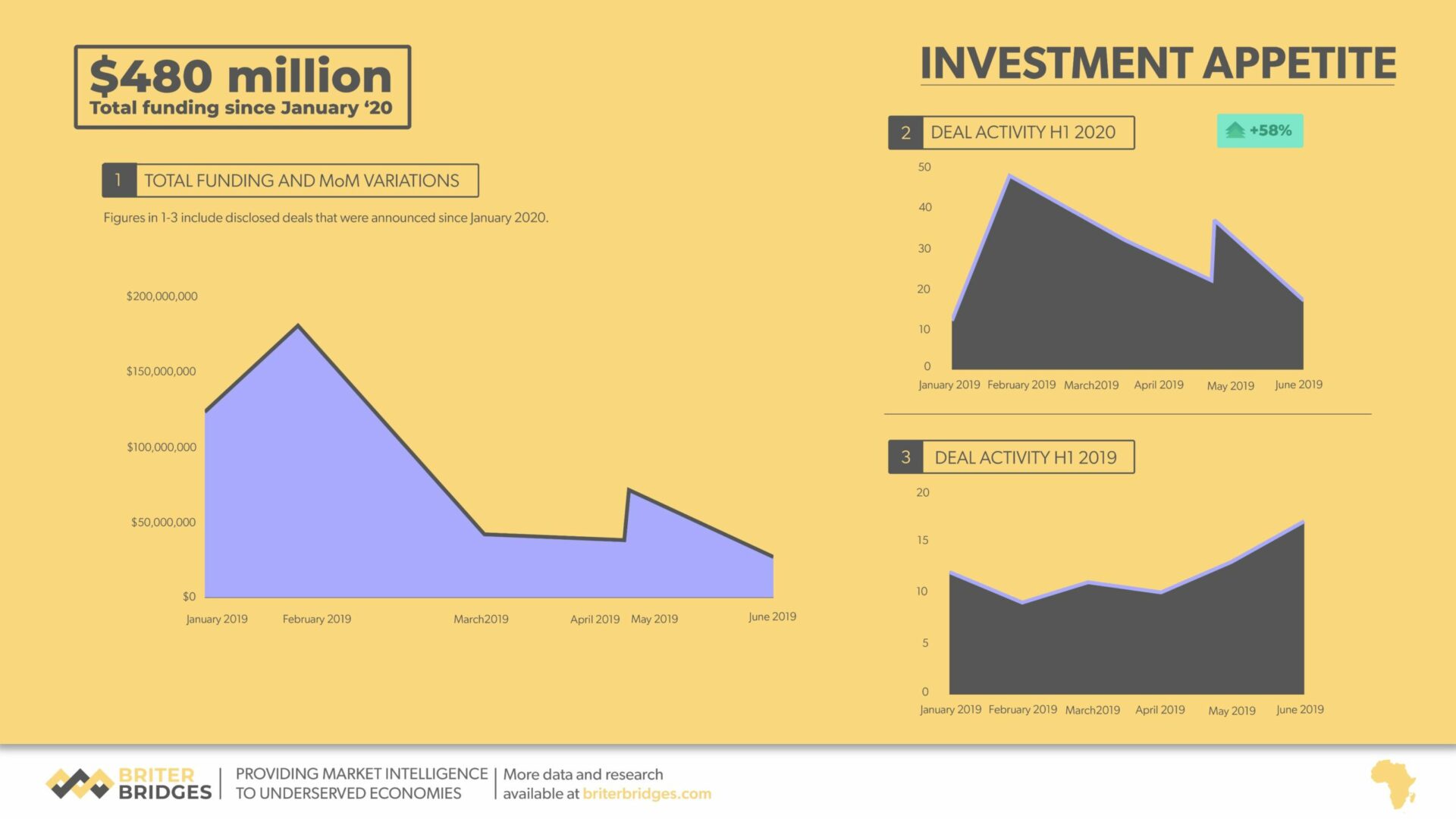

Similarly, Briter Bridges, a tech ecosystem data intelligence consultancy, reported figures akin to Bayen's. For the first quarter of 2020, Briter Bridges reported that African startups raised approximately $350m. This is significantly higher than $300m, the amount reported by the consultancy in Q1 2019.

Also, the top four countries included South Africa with $112m; Nigeria, $74m; Kenya, $62m; and Egypt, $51m. These countries also received the lion share of Africa's funding in 2019.

The major disclosed deals from 2020's first quarter included large fintech investments from South Africa's Jumo and Nigeria's Flutterwave as they both raised $55m and $35m respectively.

Additionally, Egyptian healthcare startup, Vezeeta, raised $40m and ride-hailing startup, Swvl, raised $20m.

Join over 3,000 founders and investors

Give it a try, you can unsubscribe anytime. Privacy Policy.

Second-quarter of 2020

If the colossal deals of Interswitch and OPay are included, the last quarter of 2019 saw African startups and companies complete deals worth almost $580m.

Without the pair (Interswitch secured $200m from Visa while OPay raised $120m), other African companies bagged at least $260m in Q4 2019. Going into 2020, there was optimism in the African tech ecosystem that the continent could better its record of $2 billion raised as reported by Partech Africa.

Back-to-back raises from Flutterwave and Jumo in January and February seemed to put the continent on track. However, since the coronavirus pandemic found its way into the continent accompanied by its resulting lockdowns, the free-flowing investments have reduced.

Since March, most African businesses, including startups, have struggled. Investors too are not exempt as it has become increasingly difficult to fund startups due to the global recession.

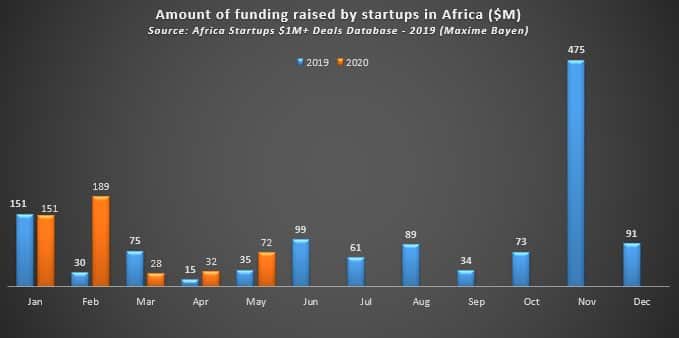

This is evident in Bayen's report. We gathered that African startups raised $151m and $189m in January and February but these figures dropped by 85% to $28m in March.

Investment increased to $32m in April and $72m in May before another drop to about $45m in June. In total, we can deduce from Bayen’s report that funding for the second quarter was approximately $150m, less than half of what was raised in Q1 2020.

Briter Bridges' deals database has a similar presumption. From it, we gathered that in Q2 2020, 68 African startups raised a total of $143.5m, a 60% drop from its Q1 report of $350m.

Coinciding with the rise in the need for healthcare solutions to help curb the spread of the coronavirus, two of Africa's highest funded startups during this period are in healthtech.

In April, Nigerian biotech startup, 54gene raised $15m and in May, Ghanaian healthtech startup, mPharma raised $17m.

Also, Nigeria’s Helium Health secured a $10m funding.

Other large-round raises came from Pan-African fintech startup, Chipper Cash ($13.8m) and Tunisian agritech startup, nextProtein ($11.2m).

Funding in the continent might fall below projections

In April, tech ecosystem accelerator, AfricArena, reported that venture capital in the continent would reduce by as much as 40%.

An excerpt from the report reads:

“Whilst until early 2020 the trend seemed to be relatively clear in terms of the growth of investment in the continent’s tech ecosystem, the COVID-19 crisis has put a high level of uncertainty and poses many challenges."

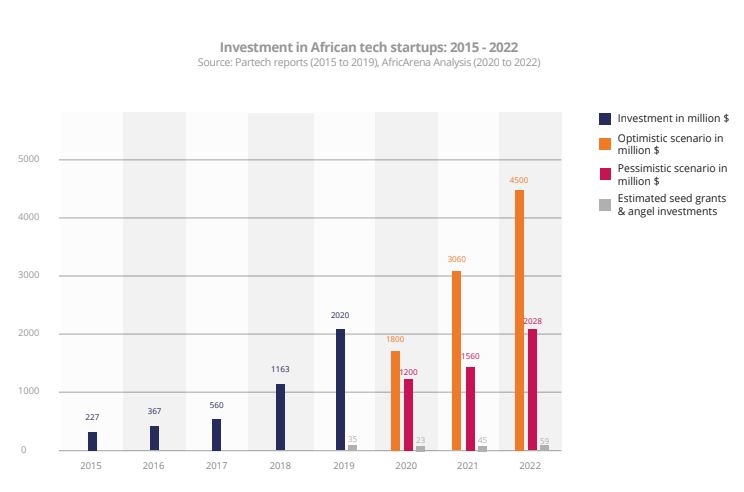

Using data from Bayen's Q1 2020 report and Partech Africa's 2019 report, AfricArena presented two scenarios.

First, an optimistic view that expects African deals to reach $1.8b throughout the year. And a pessimistic one where African startups will go on to raise $1.2b in 2020.

[auto-iframe link=https://techpoint.africa/2020/05/06/african-venture-capital-to-drop-by-40-at-the-end-of-the-year/embed tag=first]

The accelerator attributed this anticipated sharp fall in the second and third quarters to VCs refinancing deals on their portfolios.

“In spite of valuation metrics likely down by a 20 to 30% factor, new deals will be limited until the broad economy restarts.”

But the world's economy is showing signs of recuperation. Buoyed by this, VC investment in Africa might recover in the third quarter going into the rest of the year.

However, with the increasing number of coronavirus cases, there's still cause for concern. If the world's economy relapses, the funding activities of Q3 and Q4 might be identical to the first half of 2020. Should that happen, African VC funding might fall $200m and $800m short of the pessimistic and optimistic view painted by AfricArena.

Featured Image: majjed2008 Flickr via Compfight cc