The weeks leading to Nigeria's lockdown which started on March 30 could be described as frantic and laden with uncertainty. Businesses, schools, and churches were closing and no one knew what would happen to the economy.

Several stock markets across the globe saw the market capitalisations and share prices of their biggest companies fall as investors tried to shore up disposable income by selling their shares. Similar actions took place in the cryptocurrency market.

Those with cash to spare swooped in for company shares which had fallen below their normal prices.

Tosin Osibodu, CEO of stock trading platform, Chaka.ng, reveals that trades of local and foreign stocks increased by 90% in February, March, and April, while a 70% increase occurred in May.

Though Nigeria’s stock market has been steadily recovering since the lockdown, there’s not been much activity for tech companies on the bourse. By contrast, tech companies like Amazon, Google, Netflix, and Zoom have influenced the gradual recovery of the US stock market.

Techpoint Africa grouped Nigerian ICT companies into two -- Flatliners and the Active -- based on how they fared, on the Nigeria Stock Exchange, during the lockdown.

Flatliners

If you had invested ₦30,000 ($77) -- Nigeria’s minimum wage -- in any of these stocks on March 30, 2020, you would have gained nothing, and it could be likened to saving the money in the bank without any charges.

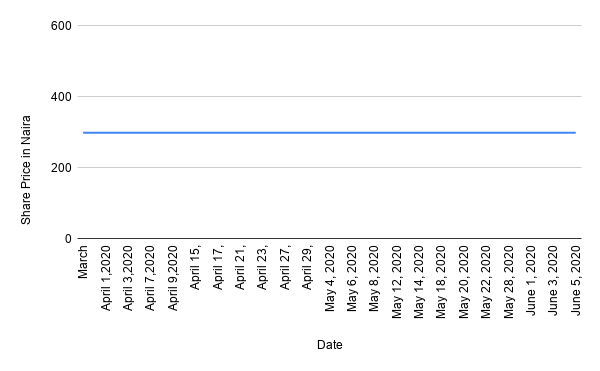

Airtel Africa

Profile: Airtel Africa is a provider of telecommunications and mobile money services, with a presence in 14 countries in Africa, primarily in East Africa and Central and West Africa.

- Date of listing: July 9, 2019

- Trading name: 'AIRTELAFRI'

- Share price: ₦2.54 ($0.0066) (static)

- Market cap: ₦1.123 trillion ($2.89 billion)

Throughout the lockdown, Airtel’s share price remained static at ₦298.9 and a market capitalisation of ₦1.123 trillion ($2.89 billion). Not even the announcement of its yearly and quarterly revenue on May 13 could cause a stir in stock market investments.

Be the smartest in the room

Give it a try, you can unsubscribe anytime. Privacy Policy.

Airtel listed on Nigeria’s exchange with subdued publicity on July 9, 2019. Trading as AIRTELAFRI, it had an initial public offering (IPO) price of ₦363 ($1 as at 2019) and after just a day’s trading, closed at ₦399.30 ($1.10), 10% higher than its opening price.

Airtel listed on Nigeria’s exchange with subdued publicity on July 9, 2019. Trading as AIRTELAFRI, it had an initial public offering (IPO) price of ₦363 ($1 as at 2019) and after just a day’s trading, closed at ₦399.30 ($1.10), 10% higher than its opening price.

Since the IPO, its share price has rarely fluctuated and because it has one of the largest market caps on the bourse, any fluctuations could cause a ripple effect on the entire stock market.

Despite the lack of movement in share prices, this might be favourable to long-term investors as it has a dividend yield of 3.82%.

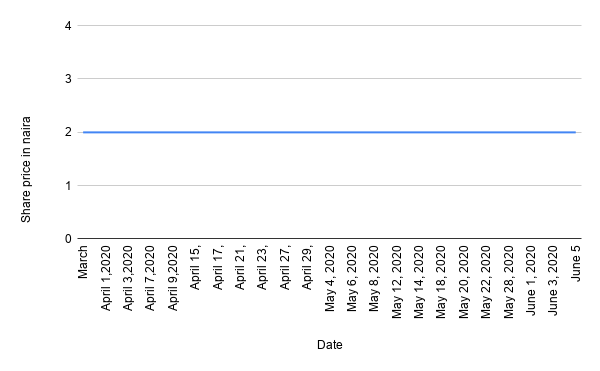

CWG PLC

- Profile: CWG PLC is currently a provider of ICT and cloud services solutions services across West, Central, and Eastern Africa.

- Trading name: 'CWG'

- Share price: ₦2.54 ($0.0066) (static)

- Market cap: ₦6.413 billion ($16.5 million)

Computer Warehouse Group (CWG) PLC, trading as CWG, has had a static share price of ₦2.54 ($0.0066) and a market cap of ₦6.413 billion ($16.5 million) for the past year, and the pandemic-induced lockdown did nothing to change the company’s share price.

CWG listed in 2013, boosting the NSE's market cap by about ₦14 billion ($36.12 billion). However, the company’s fortunes have been shaky since then.

CWG listed in 2013, boosting the NSE's market cap by about ₦14 billion ($36.12 billion). However, the company’s fortunes have been shaky since then.

In 2019, CWG posted profits after tax of ₦72 million ($185,806), a marked improvement from 2018 and 2017 when it recorded losses after tax of ₦97.9 million ($252,645) and ₦151.9 million ($392,000) respectively.

CWG last reported that it paid out a 2 kobo dividend per share, but the NSE states the company is currently trading below listing standards.

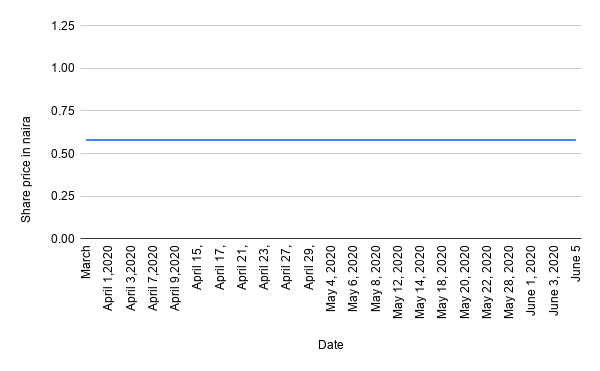

eTranzact

- Profile: eTranzact is an electronic payment processor and provider of software development services in Nigeria.

- Date of listing: August 7, 2009

- Trading name: 'ETRAN'

- Share price: ₦2.61 ($0.0067) (static)

- Market cap: ₦10.96 billion ($28.28 million)

Electronic payments processor, eTranzact, trading as ETRAN, also had a static share price of ₦2.61 and a market cap of ₦10.96 billion ($28.28 million) throughout the lockdown and even until the market closed on Friday, June 5, 2020.

In 2015, eTranzact recorded profits of ₦168 million (433,548), but fortunes have since changed for the self-acclaimed premier payments processor in Nigeria. In 2017, it recorded a ₦6 million (15,483) loss after tax, but it recovered in 2018 and 2019 respectively.

In 2015, eTranzact recorded profits of ₦168 million (433,548), but fortunes have since changed for the self-acclaimed premier payments processor in Nigeria. In 2017, it recorded a ₦6 million (15,483) loss after tax, but it recovered in 2018 and 2019 respectively.

The company’s CEO also denies cases of an ₦11 billion ($28.38 million) fraud that hit the company in 2018.

NCR

- Profile: NCR provides financial-oriented self-service technologies, such as ATMs, kiosks (financial and retail), mobile branches, video teller machines and recyclers

- Date of listing: May 30, 1979

- Trading name: 'NCR'

- Share price: ₦2 ($0.0052) (static)

- Market cap: ₦216 million ($28.28 million)

NCR listed on the NSE on May 30, 1979, making it one of the oldest tech companies on the stock market. Its share price fell to ₦2 on March 20, 2020, and remained unchanged throughout the lockdown until the market closed on Friday, June 5.

At the beginning of the year, NCR had a share price of ₦4.5 but it has kept losing its value.

At the beginning of the year, NCR had a share price of ₦4.5 but it has kept losing its value.

Encouragingly, according to NCR’s financial report, it paid out ₦3.4 ($0.0088) per share in dividends to investors in 2019, a marked improvement from ₦0.11 dividends paid in 2018.

Tripple Gee & Company PLC

- Profile: Tripple Gee is a manufacturer of financial instruments, secure and commercial documents, labels and flexible packaging materials.

- MARKET: Main Board (NSE)

- Date of listing: April 2, 2013

- Trading name: 'TRIPPLEG'

- Share price: ₦0.58 ($0.0015) (static)

- Market cap: ₦283 million ($730,322).

Throughout the lockdown, TRIPPLEG’s shares stayed at ₦0.58, the same position it had maintained since January 2020, with a market cap of ₦283 million ($730,322).

Tripple Gee seems to be another stock for long-term investment since the company has a dividend yield of 8.62% and according to its last report, it paid out dividends of 5 kobo per share.

Tripple Gee seems to be another stock for long-term investment since the company has a dividend yield of 8.62% and according to its last report, it paid out dividends of 5 kobo per share.

Tripple Gee is a manufacturer of financial instruments, secure and commercial documents, labels, and flexible packaging materials. One of its core businesses, which includes the production cheques, has since taken a hit with the advent of e-banking.

Active

These companies saw their stocks fluctuate during the lockdown. If you had invested in these companies, the value of your investment might have increased or decreased during the lockdown.

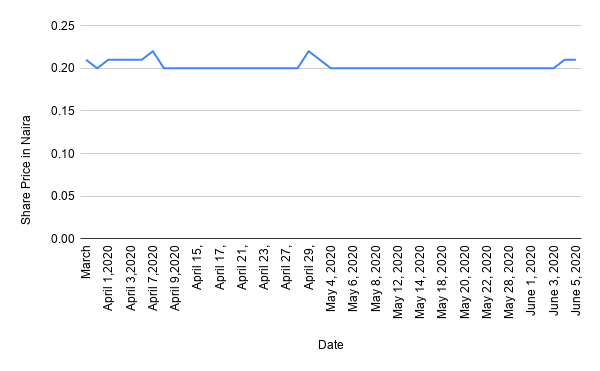

Courteville Business Solutions PLC

- Profile: Courteville started as a provider of financial and advisory services but pivoted to developing and deploying tech-related products.

- Market: Main Board (NSE)

- Date of listing: April 2009

- Trading name: 'COURTVILLE'

- Share price: ₦0.21 (High), ₦0.20 (Low)

- Market cap: ₦745.9 million ($1.92 million).

If you had bought Courteville stocks on March 30 and decided to cash out yesterday June 5, you would have gained nothing.

Courteville's stocks began the lockdown at ₦0.21 before dropping to ₦0.2 the next day and remaining there until June 4 when it went back to ₦0.21 where it stayed until the market closed on Friday. For the past year, the company’s stocks have not gone higher than ₦0.27.

In 2018, the company registered profits after tax of ₦78.4 million ($202,322), up 112% from ₦36.9 million ($95,225) in 2017.

In 2018, the company registered profits after tax of ₦78.4 million ($202,322), up 112% from ₦36.9 million ($95,225) in 2017.

Courteville Business Solutions PLC listed on the NSE in April 2009, with shareholders’ funds in excess of ₦7.75 billion ($20 million).

Omatek PLC

- Profile: Omatek PLC deals in manufacturing, distribution, selling and servicing of computer equipment and also providing engineering services.

- Market: Main Board (NSE)

- Date of listing: 2008*

- Trading name: 'OMATEK'

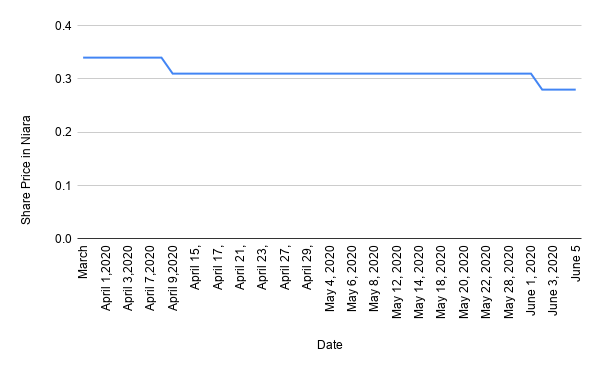

- Share price: ₦0.34 (High), ₦0.28 (Low)

- Market cap: ₦2.94 billion ($7.58 million).

Investing ₦30,000 ($77.4) in Omatek stocks would have led to a loss of ₦5,294 ($13.66) as of Friday, June 5.

Omatek stocks started March 30 at ₦0.34, and the price dropped twice during the period under review on April 9 (₦0.31) and June 2 (₦0.28).

The company had a relatively torrid 2017 when it lost its founder and a court subsequently ordered the shutdown of its factory as a penalty for defaulting on a billion naira loan it took from Nigeria’s Bank of Industry.

The company had a relatively torrid 2017 when it lost its founder and a court subsequently ordered the shutdown of its factory as a penalty for defaulting on a billion naira loan it took from Nigeria’s Bank of Industry.

The company made a net loss of ₦1.15 billion ($2.96 million) and ₦1.38 billion in 2018 and 2017 respectively.

Chams PLC

- Profile: Chams PLC is a leading provider of smart card technologies, payment collections and identity management systems.

- Market: Main Board (NSE)

- Date of listing: September 8, 2008

- Trading name: 'CHAMS'

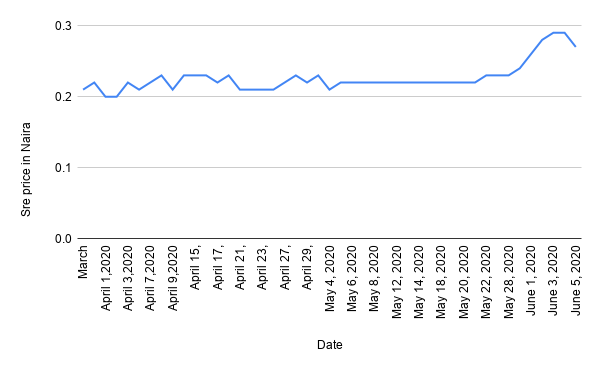

- Share price: ₦0.29 (High), ₦0.21 (Low)

- Market cap: ₦4.69 billion ($12.1 million).

If you had invested ₦30,000 ($77) in Chams' stock when the lockdown began, you would have gained roughly ₦6,800 ($17.5 million) when the market closed yesterday, June 5. But your heart would have probably been in your mouth if you were monitoring it.

The company went public on the NSE in 2008. On March 30, 2020, Chams' share price dropped from ₦0.23 to ₦0.22. It fell to ₦0.21 before the week ended.

The company went public on the NSE in 2008. On March 30, 2020, Chams' share price dropped from ₦0.23 to ₦0.22. It fell to ₦0.21 before the week ended.

Throughout April, Chams' share price fluctuated between ₦0.21 and ₦0.23, hitting ₦0.23 when Nigeria extended the lockdown on April 14. When the federal government eased the lockdown on May 4, stocks dipped to ₦0.21 but went back up to ₦0.22 the following day.

The easing of the lockdown seemed to stop the fluctuations of Chams' stock as it stayed steady for 16 days until May 22. Investor confidence seemed to be restored in the stock market during this period, and at the beginning of June, stocks went up to ₦0.26 per share.

During the past week, stocks went as high as ₦0.29 but fell to ₦0.27 at the close of the market on June 5.

The company’s financial fortunes took a turn for the better in 2018 when it recorded a ₦380 million ($980,865) profit after tax, a 130% increase from a loss of ₦1.27 billion ($3.2 million) in 2017. The company paid out dividends of ₦0.03 per share and had a dividend yield of 11.11%.

MTN Nigeria

- Profile: MTN is Nigeria's largest provider of telecommunications services.

- Market: Premium Board (NSE)

- Date of listing: May 16, 2019

- Trading name: 'MTNN'

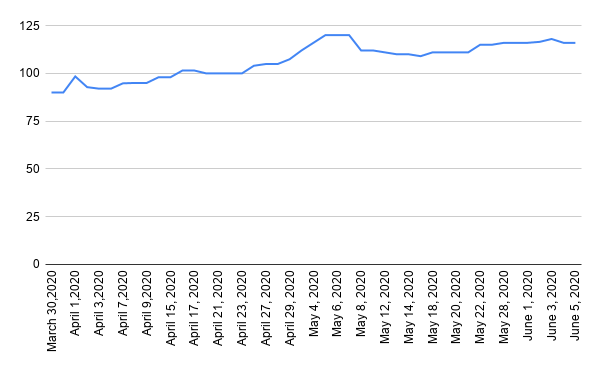

- Share price: ₦120 (High), ₦116 (Low)

- Market cap: ₦2.36 trillion ($6.08 billion).

Buying ₦30,000 ($77) worth of MTN stocks on March 30, would have given you an ₦8,666 ($22.36) gain as at Friday, June 5.

As part of a fine settlement plan with the country, MTN Nigeria became the first telecom company to list on the NSE in May 2019. In just a few months, it briefly overtook Dangote to become the most valuable company on the NSE.

As part of a fine settlement plan with the country, MTN Nigeria became the first telecom company to list on the NSE in May 2019. In just a few months, it briefly overtook Dangote to become the most valuable company on the NSE.

In just six months on the NSE, it gained a ₦698 billion ($1.8 billion) valuation, but stocks later fell as the year came to an end. MTN’s shares started the year at ₦109 ($0.28) and shares went as high as ₦128 ($0.33) in January but began to plummet the following month.

When the lockdown began, MTN stocks had fallen to its IPO price of ₦90 ($0.23). As a popular stock, investors likely sold a lot of their shares in panic which sent its stocks crashing down.

Throughout the month of April, MTN made a slow and gradual recovery with regular fluctuations. The company’s shares went up to ₦116 ($0.33) when Nigeria eased its lockdown in May and hit ₦120 ($0.31) when it announced huge profits in its Q1 2020 financial report.

MTN stocks fell back to ₦116 ($0.30) on Friday, June 5, and it remains the only tech company on the country’s premium board.

Worthy mention

Jumia

- Profile: Jumia, tagged the Amazon of Africa, is the largest eCommerce platform on the continent

- Market: New York Stock Exchange

- Date of listing: April 12, 2019

- Trading name: 'JMIA'

- Share price: $6.77 (High), $3.2 (Low)

- Market cap: $258.56 million (₦100.19 billion)

If you had bought ₦30,000 ($77.42) worth of Jumia stock on March 30, your stocks would have more than doubled to ₦63,476 ($163.81) and you'd have gained ₦33,476 ($86.37).

Though Jumia’s status as an African company is debatable, its major market is in Africa, and its listing on the New York Stock Exchange (NYSE) was a big moment for the African startup ecosystem.

Starting March 30 at ₦1,420 ($3.2), Jumia stocks have since more than doubled to $6.7 (₦2596) as of June 5. During the announcement of its Q1 2020 report where it recorded slightly reduced losses, the company’s stock value stopped rising, but it has since recovered.

Starting March 30 at ₦1,420 ($3.2), Jumia stocks have since more than doubled to $6.7 (₦2596) as of June 5. During the announcement of its Q1 2020 report where it recorded slightly reduced losses, the company’s stock value stopped rising, but it has since recovered.

In conclusion

According to Osibodu of Chaka, several Nigerians are expressing interest in both foreign and Nigerian markets, but MTN Nigeria seems to be the major Nigerian tech company attracting investor attention.

The pandemic has halted plans for Interswitch, Africa’s fintech unicorn, to list on the NSE, and it might be another high profile boost for tech companies and the entire bourse.

Featured image: S Remeika on Flickr (cc)