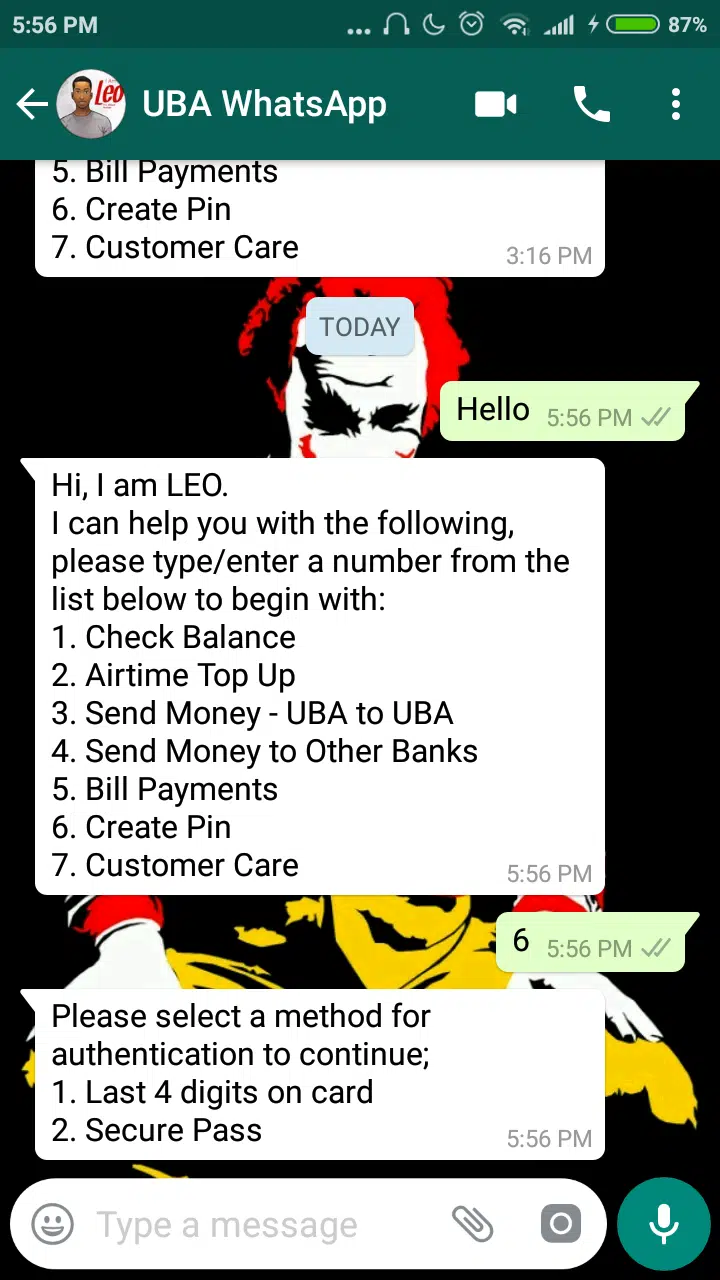

Imagine you are chatting with your tailor on WhatsApp. After sending them a picture of the beautiful style you saw on Instagram earlier in the day, you discuss the cost of achieving the look and request for their account number.

To send the money, instead of going through a USSD menu or opening your bank’s app (if you even have that installed), you simply find your bank as a contact on WhatsApp and proceed to begin the process of transferring the money. You complete your transaction in less than three minutes without leaving the messaging app.

This and other basic services within your favourite instant messaging app is what WhatsApp Banking promises. Leveraging on WhatsApp Business and Chat Banking, some Nigerian banks now offer access to financial services via WhatsApp.

Suggested Read: How the new WhatsApp Business app will work for small businesses

WhatsApp Banking is an extension of Chat Banking already available on Facebook and since the instant messaging app is the most used among Africans, it gives banks a wider reach compared to Facebook Messenger.

The first of its kind was launched in July 2018 by Absa in South Africa and barely one month after, five Nigerian banks — United Bank for Africa (UBA), Guaranty Trust Bank (GTBank), First Bank of Nigeria (FBN), Access Bank and Zenith Bank — followed suit.

At the moment, only UBA and Access Bank customers can use WhatsApp Banking. GTbank is still currently testing the service while First Bank is yet to unveil its WhatsApp number.

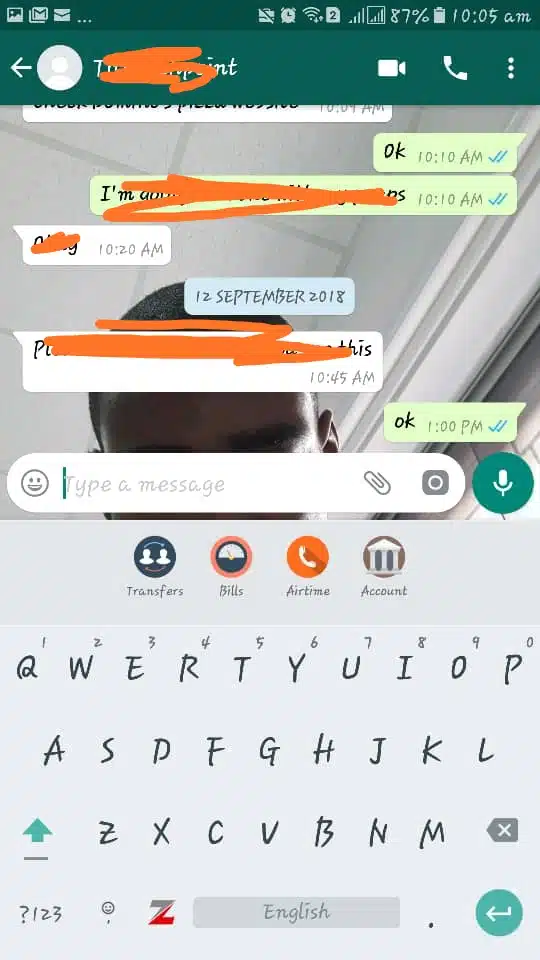

In the case of Zenith Bank, it is called Qwerty Banking. Users can conduct banking transactions within any mobile messaging application by simply enabling the Zenith Bank keyboard interface on the bank’s app.

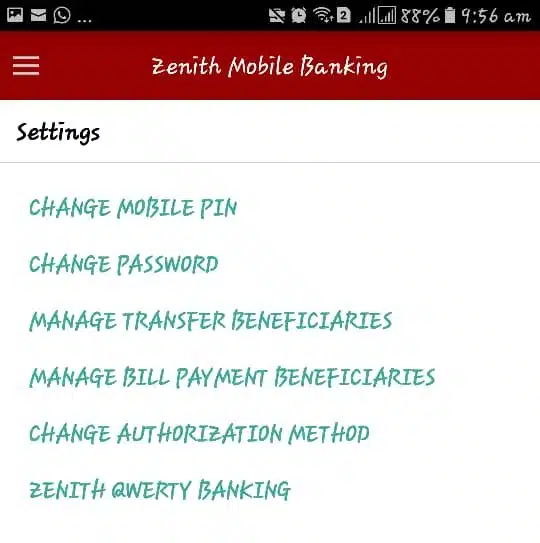

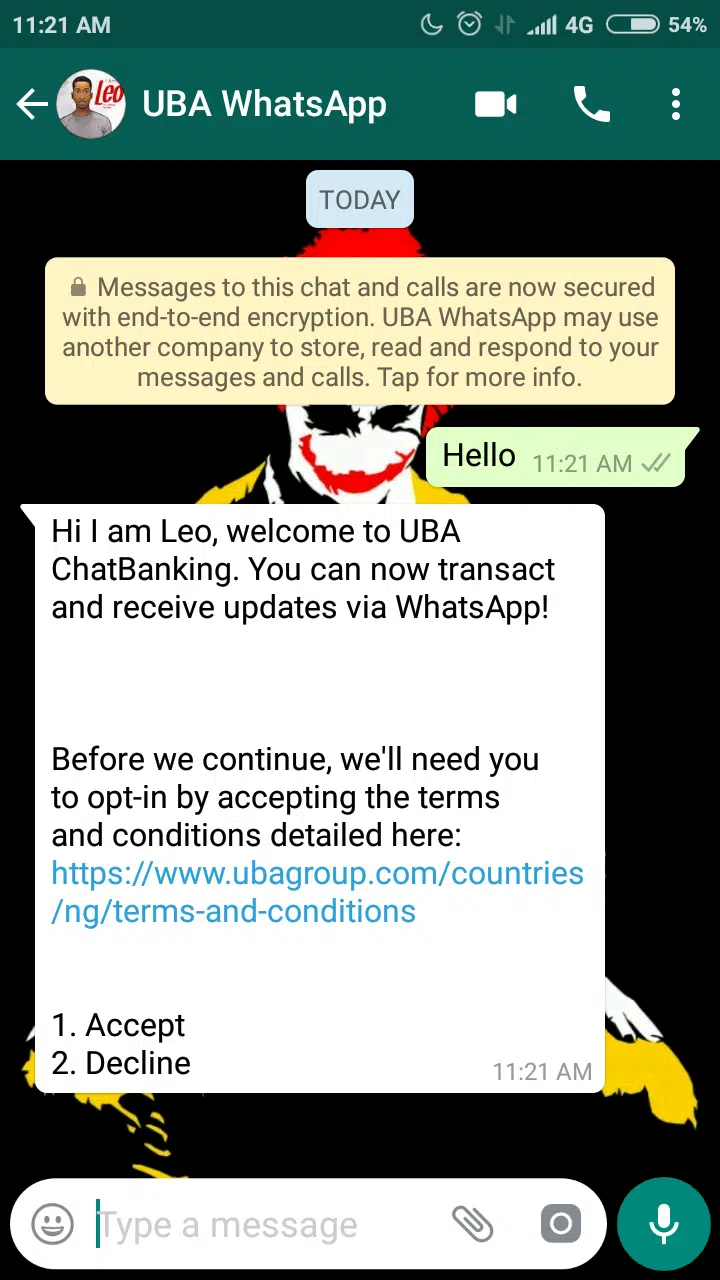

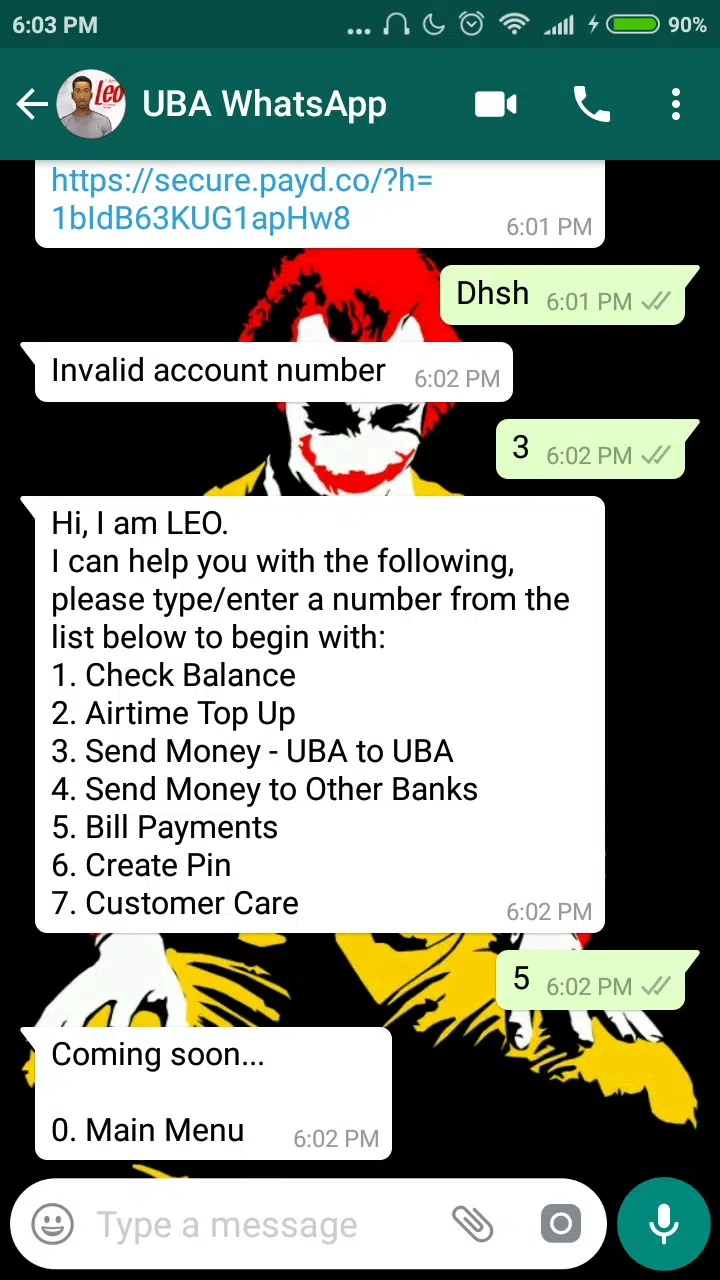

Using UBA on WhatsApp, you’ll be interacting with Leo, its Chat Banker

To initiate a conversation, you’ll simply need to send a “Hi” or “Hello” to the bank’s WhatsApp number.

Victoria Fakiya – Senior Writer

Techpoint Digest

Stop struggling to find your tech career path

Discover in-demand tech skills and build a standout portfolio in this FREE 5-day email course

Just like on other banking channels, you’ll be able to check your account balance, send money, buy airtime and pay bills.

To begin, you’ll need to create a PIN. You however cannot create a PIN if you do not have an ATM card or a token

The bill payment option is still unavailable at the moment

To enter sensitive information, you’ll be directed to secure web page on your browser

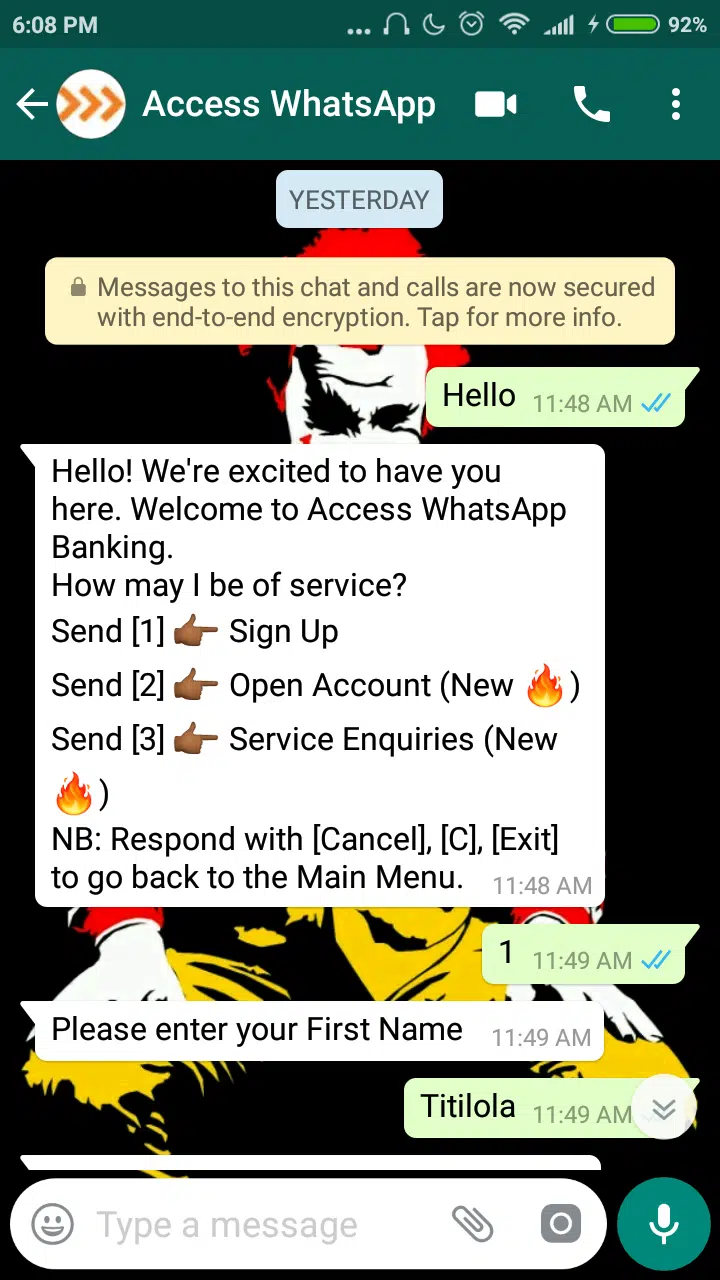

Using Access Bank on WhatsApp is very similar

Using Access Bank on WhatsApp is very similar

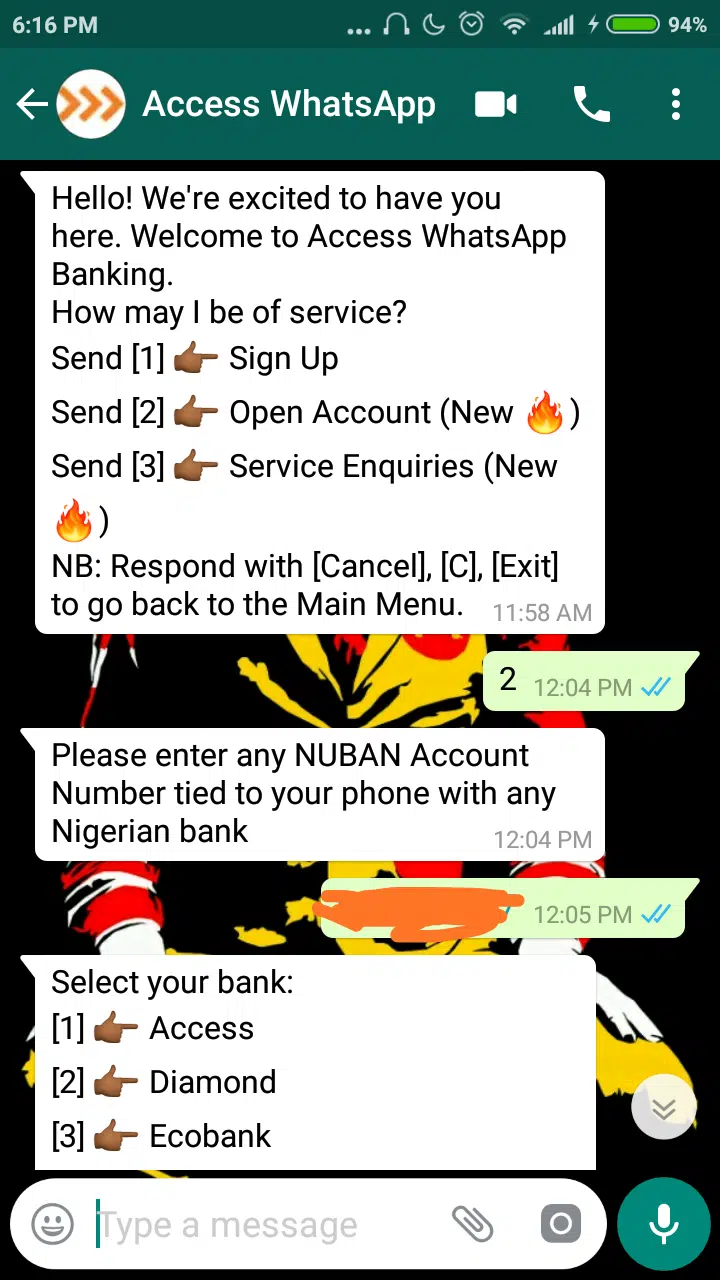

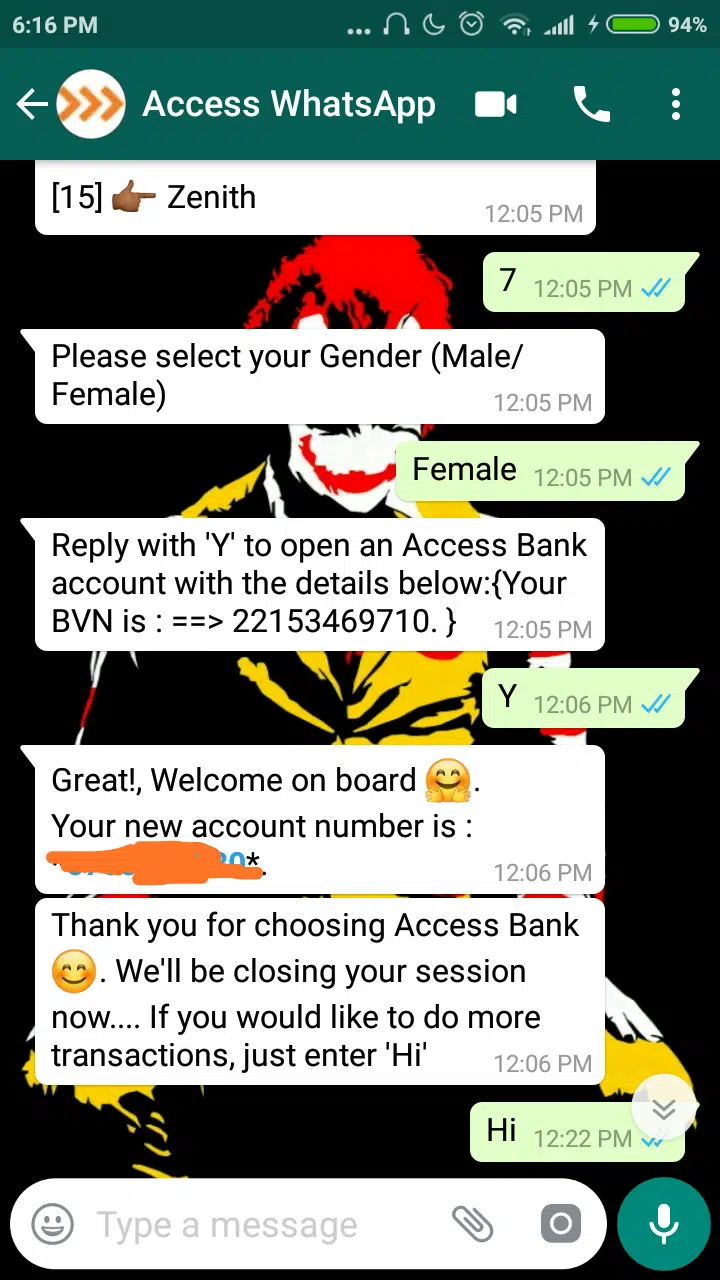

You initiate a conversation by sending “Hi” or “Hello” to the bank’s WhatsApp number. You start by signing up as an existing customer or opening a new account.

Opening a new bank account takes less than three minutes

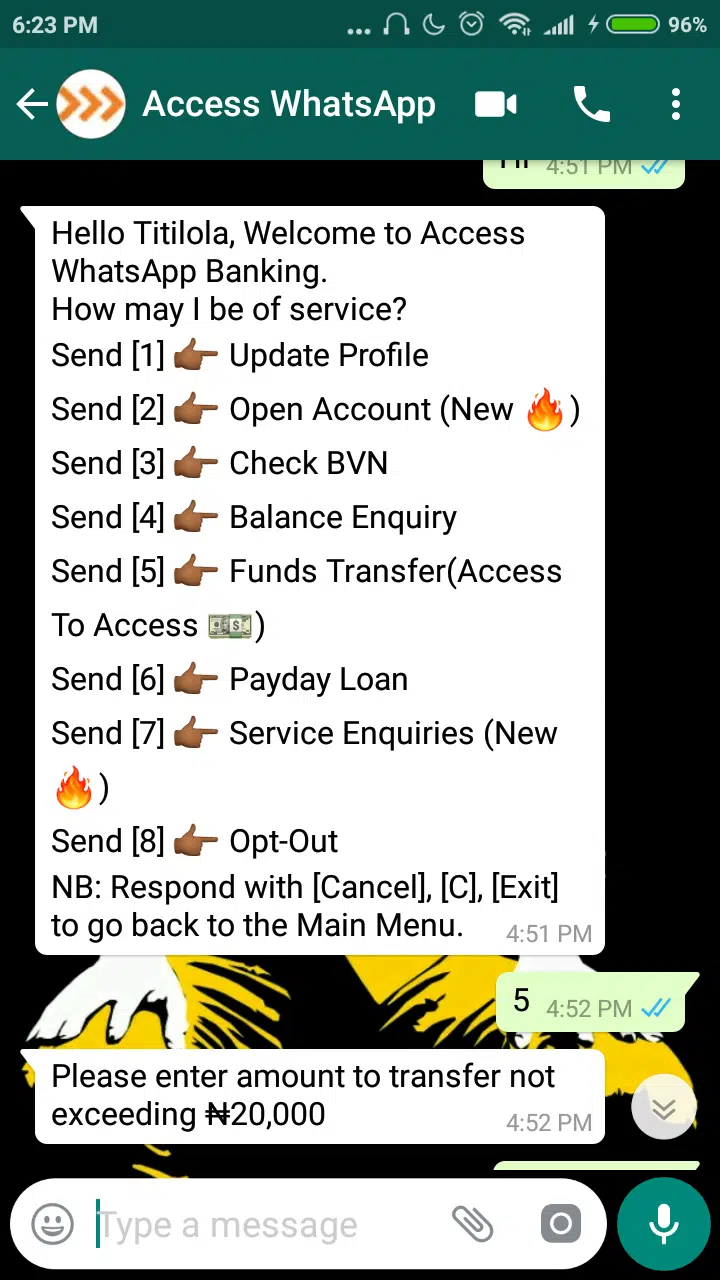

In addition to being able to open a new account, you can send money, check your account balance and Bank Verification Number (BVN) and resolve issues, among other things.

Unlike UBA that redirects to your web browser when you need to enter sensitive information, everything with Access WhatsApp Banking takes place within the messaging app.

You can only transfer a maximum of ₦20,000, exclusively to only Access Bank accounts

Zenith Qwerty Banking

To use Qwerty Banking, you’d first have to install or update the Zenith Bank mobile app.

To begin, activate the Zenith Qwerty Banking option in the app’s settings

WhatsApp and Chat Banking promise access to basic banking services and that’s exactly what you get. One worry however is security.

However, even though there are security measures already in place, anyone who has access to your phone could initiate a conversation with your bank and depending on the information they have, carry out transactions without your knowledge. Then again, the same can be said about other digital banking channels.

As the service is gradually improved and more Nigerian banks catch up with the trend, we may probably see more Nigerians favour this banking option over bank apps, online banking and maybe using USSD.

Using Access Bank on WhatsApp is very similar

Using Access Bank on WhatsApp is very similar