Earlier in the year, Zinox Group acquired Konga but the value of the acquisition wasn’t made known to the public.

Some quarters quoted the sale to be worth $10 million, which is disappointing for an eCommerce company that was once valued at $383 million by Naspers.

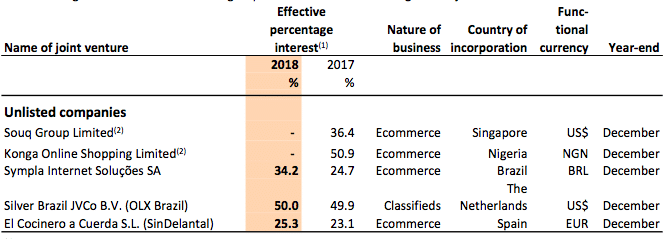

Kinnevik and Naspers are the major investors in Konga, with the latter having a 50.9% stake in the company as at December 2016.

Suggested Read: Konga acquisition: It seems Kinnevik and Naspers lost a combined 93% return on investment

There’s no mention of Konga in Kinnevik’s H1 2018 financial report despite disposing off its stake in the eCommerce company.

For Naspers however, its financial statement for the financial year ended March 31, 2018 states a ‘$38 million loss on disposal’ of Konga. And coincidentally, Konga was valued at almost the same figure after raising about $27 million in 2013.

The financial statement reads in part:

“During February 2018 the group disposed of its investment in its joint venture Konga Online Shopping Limited. A loss on disposal of US$38m, representing the reclassification of the group’s foreign currency translation reserve from other comprehensive income to the income statement, has been recognised in “(Losses)/gains on acquisitions and disposals.”

On disposal of an asset, the loss/gain is the difference between the amount received and the book value of the asset at the time of the sale. When the amount received is greater than the asset’s book value, the difference is referred to as a gain and vice versa.

The reported loss on disposal doesn’t in any way reveal how much Naspers got from the sales of their 50.9% stake. But extrapolating from Naspers’ valuation of Konga as at 2015, the ecommerce company couldn’t have been sold for less than $230 million.

In 2015, Naspers invested $41 million in Konga, putting the valuation of the company at $383 million. That implies that Naspers’ 50.9% stake in Konga was worth $194.947 million in 2015.

Afterwards, in 2016, Naspers recorded an impairment loss of $53 million on its investment in Konga.

Investopedia defines impairment loss as the decrease in an asset’s net carrying value that exceeds the future undisclosed cash flow it should generate. Since impairment is a reduction in the value of an asset, this put Naspers’ stake to be worth around $141.947 million as at 2016.

In 2017, Naspers put an additional $13.5 million in Konga. With no other impairment loss reported between then and now, we can safely assume that the South African media group’s 50.9% stake couldn’t have been less than $155.447 million as at the time of sale in 2018.

Based on this valuation, Naspers should have gotten more than $117.447 million from the sale of Konga, seeing as it recorded only $38 million loss on disposal from April 2017 to March 2018 (a month after the sale was announced).

This means that the Zinox Group couldn’t have paid less than $230.746 million to acquire Konga. This seems more like a reasonable price to pay, even for an out-of-favour $383 million-company, as opposed to the circulated $10 million value.