Investment in farming is a risk, but there used to be a time when talking people into investing in farming was a lot scarier than what it is today.

With the crude nature of farming, coupled with the general lack of information about agro-businesses, people generally settle for other investment options regardless of whether they get better Return on Investment (ROI) compared to farming.

The truth, however, is that, although farming is a risky venture, it is highly lucrative. And for what it’s worth, credit will go to agro-crowdfunding players redefining the idea of investment in farming as we now know it.

Suggested Read: The rise of the internet farmers

Now, while sitting behind a desktop, from the comfort of your home, you can be involved in farming just as much. And on a closer look, it appears the new trend may not stop anytime soon.

So if you’re thinking of investing in them, here's what you should know about the online platforms that enable agro-crowdfunding in Nigeria.

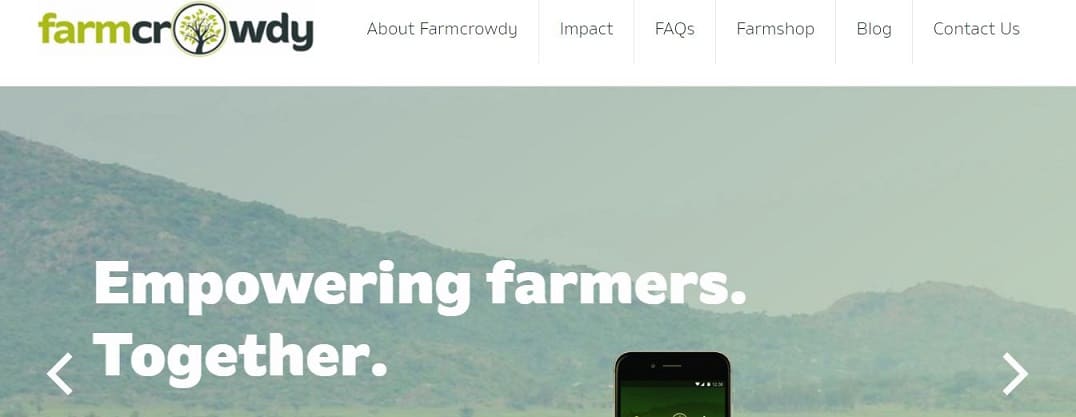

Farmcrowdy

- Website: Farmcrowdy.com

- Owner of farmland: Farmers

- ROI for investors: 6% - 25% (flat rate)

- Product listing: Maize, poultry farm, cassava, soybeans and rice.

- Predetermined cost of farmland: Yes

- Range cost of farm products: ₦90,000 - ₦284,000

- Period of cycle: 5 to 12 months, depending on the farm you select

- Risk mitigation policies:

- Insurance cover for initial sponsorship capital; does not cover the return after harvest.

Side note: Farmcrowdy has really attractive rates, except that they have been subject to fluctuations in recent times. Maize, for instance, was typically around 10% before taking a little spike. It’s unclear if the fluctuations are a result of scaling up the platform. But the big question is can they sustain it?

Be the smartest in the room

Give it a try, you can unsubscribe anytime. Privacy Policy.

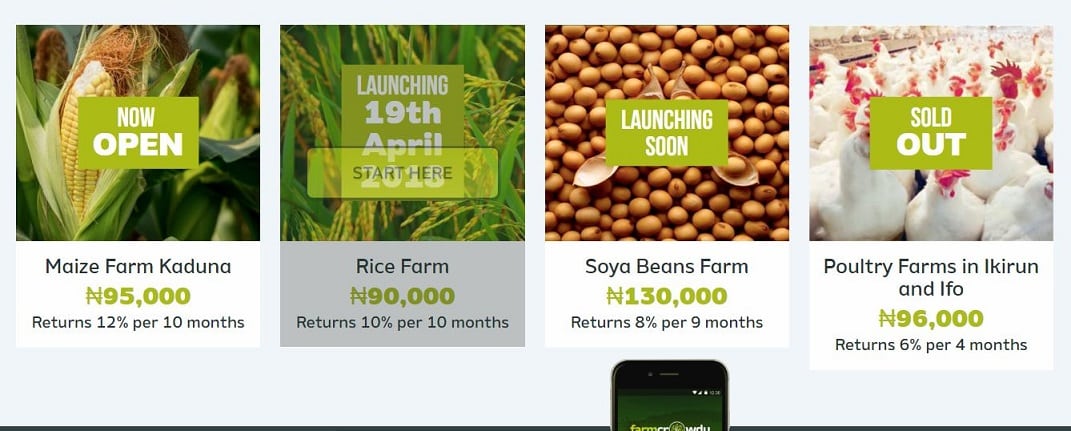

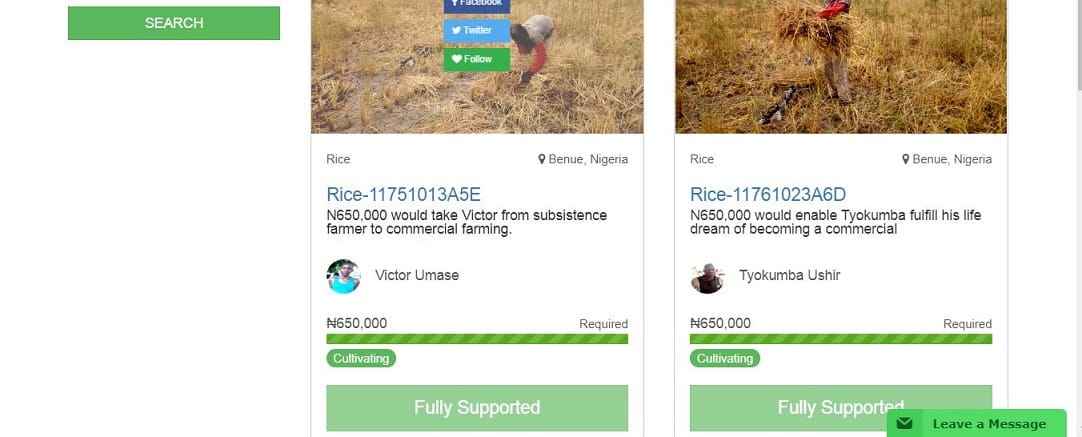

Growsel

- Website: Growsel.com

- Owner of farmland: Farmers

- ROI for investors: 5 - 20% (flat rate)

- Predetermined cost of farmland: No

- Product listing: Ginger, maize, potato, tomato, cassava, soybeans and rice.

- Range cost of farm products: No predetermined cost.

- Period of cycle: Fixed between 4 to 7 months.

- Risk mitigation policies:

- Insurance cover, which is usually a minimum of 3% and a maximum of 20% depending on the kind of farm.

- Partnership with Research institutes like IITA and OCP Africa for quality inputs like seeds and fertilisers.

- Hedging the market by partnering with off-takers who are able to offtake high-value crops even before harvest.

- Real-time and up to a week advance weather updates available for farmers.

Side note: Farm produce on Growsel do not come with a predetermined cost. Instead, farmers declare the cost for input they require at every point in time, and willing investors provide a minimum of 10% on the capital till full amount (for the input) is raised.

All things being equal, every farm is usually benched mark at 100% minimum ROI. Generally, short-term farms have around 5 -10% ROI while long-term farms have a maximum of 20% ROI.

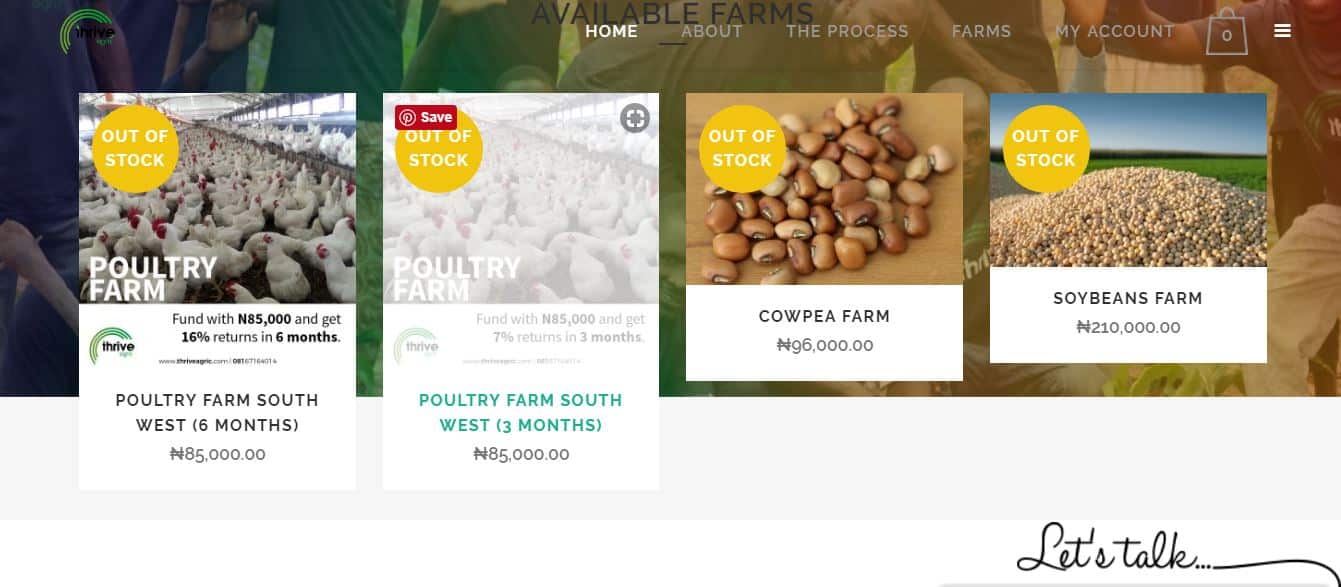

Thrive Agric

- Website: Thriveagric.com

- Owner of farmland: Farmers

- ROI for investors: 6 - 25% (depending on the type of produce)

- Predetermined cost of farmland: Yes

- Product listing: Poultry farm, maize, groundnut, sorghum, cassava, cowpea, soybeans and rice.

- Range cost of farm products: ₦80,000 - ₦260,000

- Period of cycle: Fixed between 3 to 6 months.

- Risk mitigation policies:

- Insurance cover to the tune of full capital invested, but not profit.

- Deployment of an app for extension workers

- Co-operative schemes for farmers

- Forward agreement with off-takers and partnership with IITA and NAERLS for improved seed.

Sidenote: Thrive Agric is listing cassava for the first time in the current planting season. Noteworthy is the short tenure of their farms (except cassava), perhaps it could be more of a strategic decision to get the most of price fluctuations.

eFarms Nigeria

- Website: efarms.com.ng

- Owner of farmland: Farmers

- ROI for investors: 15 - 35% (flat rate)

- Product listing: Maize, poultry farm, cassava, pineapple farm, catfish farm, snailery and soybeans.

- Predetermined cost of farmland: Yes

- Range cost of farm products: Undisclosed

- Period of cycle: Unknown.

- Risk mitigation policies:

- A training academy for farmers.

- Capital back for investors, in the event of crop failure or any other mishaps

Side note: For a relatively unknown prospect, eFarms does appear to offer the most attractive rates. It's hard to say for sure how their farms are doing investment-wise, considering that all of the farms are currently closed (as at the time of curating the post).

It is also important to clarify that the capital back insurance applies over a mutually agreed period and only covers investor capital.

Conclusion

Investment through agro-crowdfunding platforms is still a relatively new concept. These platforms are obviously attempting to boost investor confidence through various risk mitigation policies. But even at that, there tends to be volatility from price fluctuations and other unforeseen market factors.

Whatever platform one decides to invest with, the watchword should generally be on managing expectations less it becomes another pyramid scheme.