Fintech

Top stories

Nigerian fintech Abeg has changed its name to Pocket while getting an approval in principle to run a mobile money service. What does this all mean for the startup?

In January 2022, the Nigerian Postal Service launched its agency banking platform and biometric debit cards as it looks to drive financial inclusion. We took a look at what that really means for you.

As competition heats up in the African fintech industry, Oluwatobi Boshoro, CEO of Infinitetiks, believes that the greatest threat will come from businesses that can add financial services to their core services.

From a global giant’s arrival to a fintech battle royale, we take a peek behind the curtain of the fintech predictions by one of Nigeria’s foremost minds in the fintech space

It’s the age of fintech in Nigeria, and as the year concludes, we look back on some trends in the fintech space, and the predictions made for 2021.

Nigerian mobility giant, @GIGMobility, has launched a payment features on its app. @chigo_nwokoma examines what this means for the company’s super app ambitions.

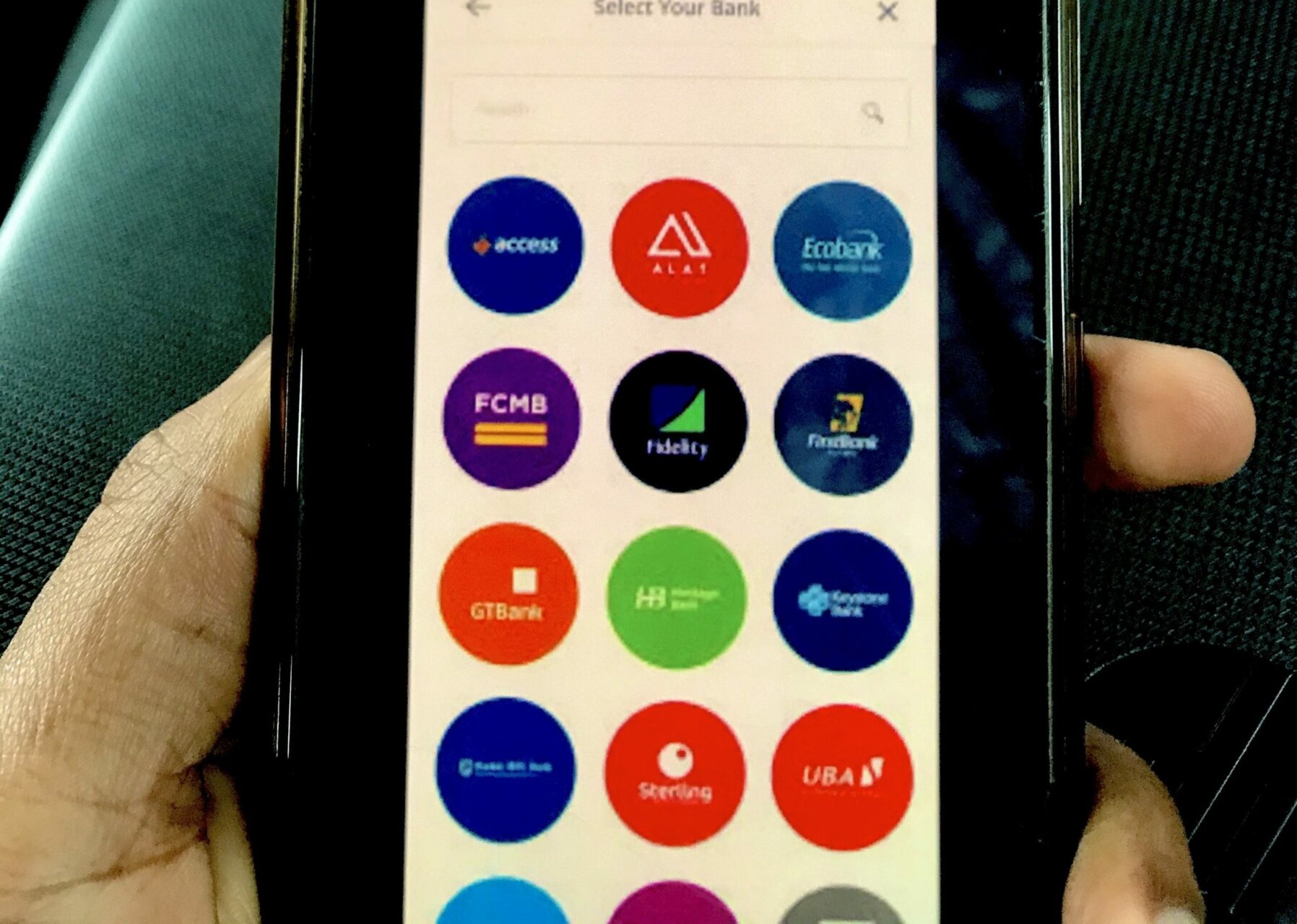

From recurring payment structures to plug and play APIs, the African fintech industry has evolved. But what does the next frontier look like for the sector? We talked to Abdul Hassan (@ijbkid) and @dejiolowe to get their opinions.

Given the widespread support that has accompanied the Central Bank of Nigeria’s decision to grant MTN and Airtel approvals in principle to operate payment service banks, we examine its potential impact on financial inclusion in Nigeria.

“Naira’s digitisation via the eNaira: Beyond financial inclusion” by Aderemi Fagbemi and Oluchi Mgbenwelu for @TopeAdebayoLLP (Techpoint Africa Publishing Partner)

Citing alleged illegal forex market dealings and cryptocurrency trading, Nigeria’s Central Bank has reportedly frozen the accounts of Nigerian investment-tech companies, Chaka, Bamboo, Risevest, and Trove. What happens to investor funds? The startups?

JumiaPay, the fintech startup of the @Jumia_Group marketplace, has partnered with @NBE1898 in offering new digital payment services.

@cenbank has slated October 1, 2021, to launch its digital currency pilot that will run on a private Blockchain network giving it total control of the currency. While this ensures security, how does it plan to address issues of transparency?

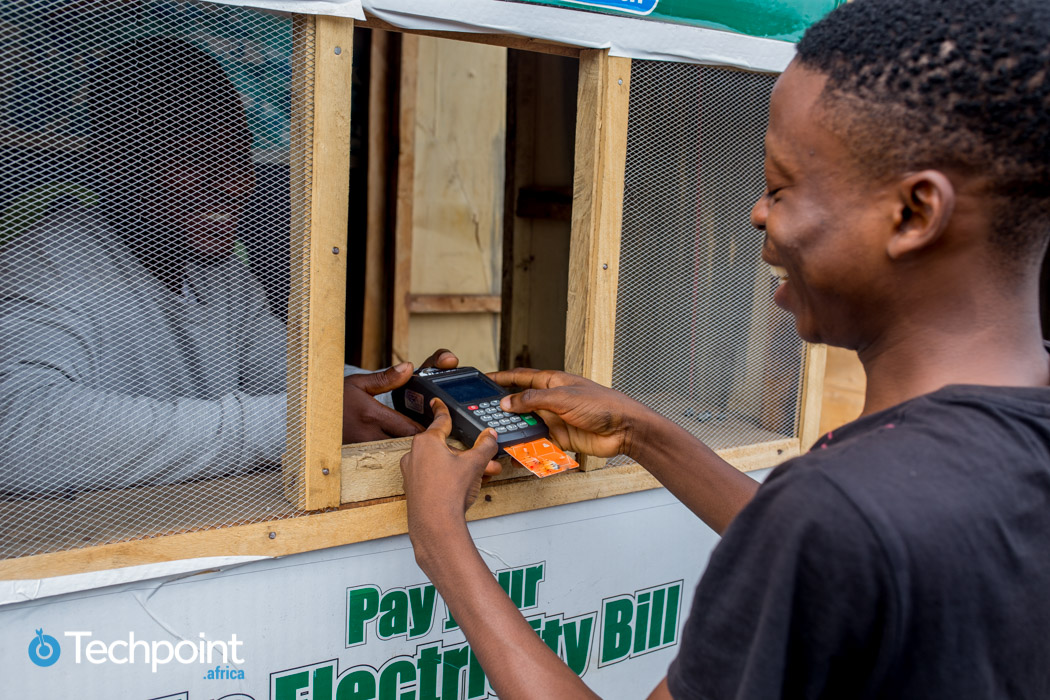

Point of Sale (PoS) services are now prevalent in Nigeria, with an increasing drive for financial inclusion. @nifemeah finds out how to run a PoS business in Nigeria and shares how agents navigate the market to make a profit.

After a $1.5m seed funding in 2017 and $6.9m Series A in 2018 Nigerian lending platform, @lidyadotco, now boasts $16.45m in total funding since its launch.

Nigerian wealth-tech startup, Cowrywise, has secured SEC’s fund management licence. With plans to capture 10 million investors by 2025, it is launching a public API to digitise Nigeria’s investment operations.

Six months after a restricting court order and two months after an industry-wide warning, Nigeria’s SEC has issued its first fintech licence to investment-tech startup Chaka. What does this mean for the broader industry?

With a reported $5.9 billion worth of transactions, Nigerian fintech, TeamApt has almost doubled its numbers for the entire 2020 in just two months in 2021. What’s next? A challenging foray into digital banking and a Francophone Africa expansion

From Q3 2021, Nigerian fintechs without defined regulations must undergo incubation before operating

.@SECNigeria has issued a new framework mandating fintechs operating in regulatory grey areas to undergo an incubation program. This will begin in Q3 2021 and could affect lending, investment, and API fintechs.

Nigeria’s banking regulator’s latest licensing requirements have been met with several reactions in the last 72 hours. We look at what this means for fintechs and whether the reactions are warranted

With $3 million funding from a sole investor, MFS Africa, Maviane wants to extend its reach across Central Africa. But could this be a ploy by MFS Africa to slowly dominate fintech on the continent?