Fintech

Top stories

As the financial services space evolves, more concepts are being embraced. One of them is Banking as a Service. Although not entirely new, it is gaining popularity as technology advances and customer preferences change.

Businesses in Africa struggle to access credit, but Moni, a fintech startup, uses social capital to provide loans for them.

Nigerian fintech startup, Flutterwave, can now process payments in Egypt after receiving a payment services provider and payment facilitator licence.

The CBN wants Nigerians to go cashless, but neither Nigeria nor Nigerians are ready for a truly cashless economy.

Seven months after a Kenyan court froze $3.3 million in Flutterwave’s accounts due to money laundering and card fraud allegations, which Flutterwave denied, the Kenyan government has cleared the company of these allegations.

The CBN claims a domestic card scheme will drive financial inclusion in NIgeria, but that couldn’t be farther from the truth.

Buy now, pay later (BNPL) startups enable customers to spread payments over a specific period but with rising inflation and lower income levels, could there be an alternative for such startups in Nigeria?

Nigerian fintech startup, Fincra, receives payment service solution provider licence (PSSP) from CBN

The Central Bank of Nigeria has granted Fincra a payment service solution provider license to process payments in the country.

Keeping up with what seems to be a yearly tradition, we brought in Adedeji Olowe, CEO of Lendsqr and Open Banking Nigeria trustee to look back at Nigeria’s fintech space in 2022 and cast our gaze into the new year

With many Nigerian banks restricting or suspending card transactions on international platforms, these virtual dollar cards will help you.

From January 31, 2023, personal loan apps in Nigeria and Kenya must submit extra documentation as Google moves to protect users on the Play Store.

As venture capital funding drops globally, funding to African fintech startups has fallen by 58% in Q3 2022, with early-stage deals constituting 90%.

Fintech startups worldwide are providing services to under-represented groups, but is there a potential for women-focused fintech startups in Africa?

This week’s EverydayPeople features Abdulroheem Abdulrauf, a Nigerian importer of luxury bags and luggages. And he had some interesting things to say about foreign exchange and how he pays for goods.

Payment switching companies enable quick and seamless online payments, and Obi Emetarom, CEO of Appzone, explains how it works and the benefits of obtaining a licence for it.

Bamboo has launched in Ghana to offer Ghanaians the opportunity to invest in global companies.

Amid the ongoing forex scarcity, First Bank of Nigeria’s customers will be unable to pay for international transactions using their naira cards.

Following news of its impending IPO plans, Flutterwave has received a switching and processing license from the Central Bank of Nigeria.

With over $2 billion raised in 2021, Africa’s fintech sector is the biggest recipient of startup funding on the continent, but how can that translate to profitability?

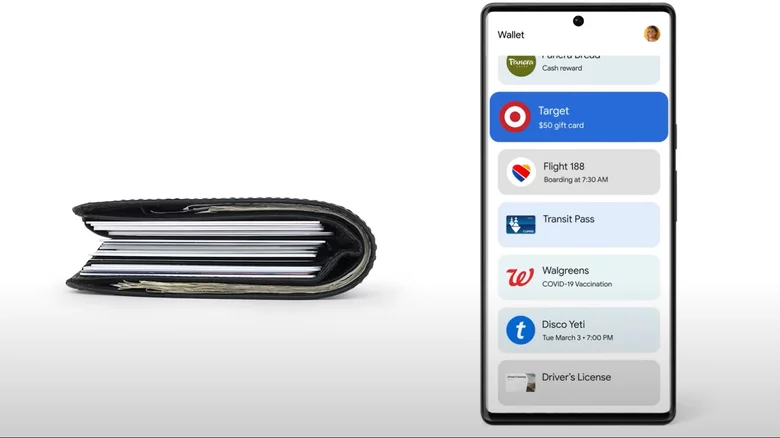

Google’s mobile payment system, Google Wallet, has been launched in South Africa, making it the first African country where the Wallet is available.