Fintech

Top stories

Zimbabwe has launched its gold-backed digital currency. It has also announced how the currency will be valued and distributed. We explain how a gold-backed currency works, and how Zimbabwe plans to use it to control inflation.

Low transaction limits drove the adoption of virtual dollar cards. Now chargeback fraud and declined transactions threaten their continued usage.

Zenith Bank’s primary data centre experienced a fire outbreak on Wednesday morning. Here is how that could affect its customers.

Chipper Cash’s Nigerian users will now be charged ₦500 for declined transactions caused by insufficient funds. Here’s why the startup is doing that.

Nigerian fintech startup, Nomba, has raised $30 million in a round led by Base 10 Partners as it eyes pan-African expansion.

AI is the new kid on the block and startups are scrambling to get in on the act. In this article, Nigerian fintech experts share their thoughts on how fintech startups can leverage artificial in their operations.

Babatunde Akin-Moses, Mayowa Adeosun and Onyinye Okonji conceived the idea for Sycamore while studying for an MBA. With more than 50,000 users served since its inception, it now has its sights set on offering more financial services.

Takaful, an Islamic insurance principle, ensures users receive a portion of their premiums if they make no claims. Car insurance startup, ETAP hopes to increase the number of insured cars in Nigeria with ETAP Takaful.

Funding for fintech startups in Nigeria has fallen in Q1 2023 but there are still reasons for startup founders to be excited about the future of the sector. Read on to discover some of these reasons.

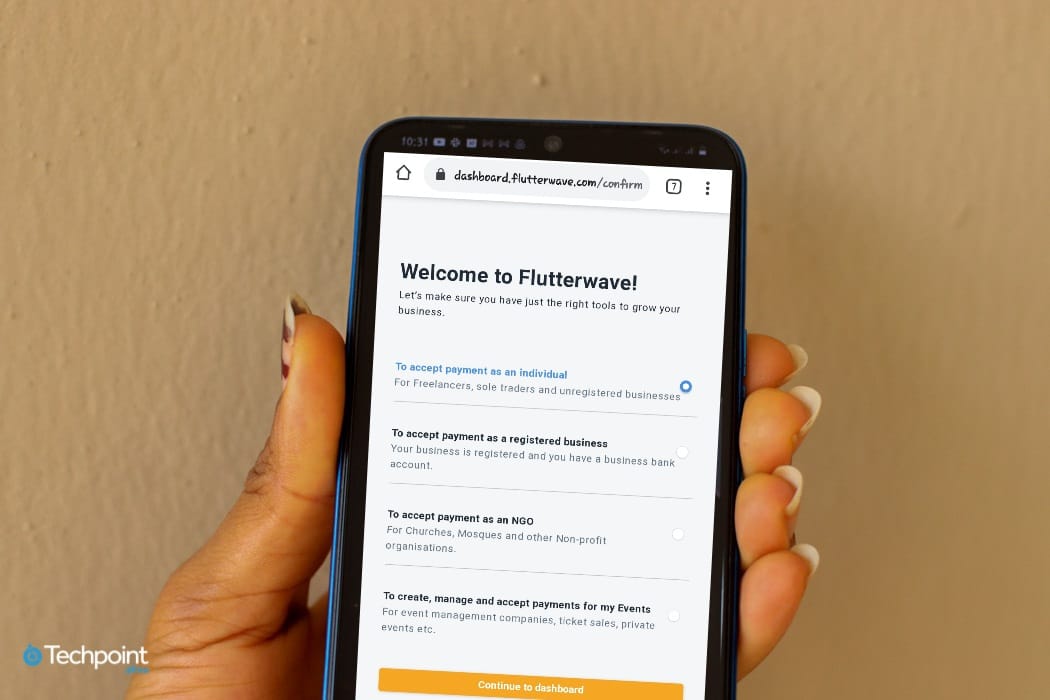

Beneficiaries of the ₦2.9 billion ($6.3 million) Flutterwave breach reported in March have confirmed they were detained by the police. Beneficiaries of another set of ₦250 million($543,088) and ₦200 million ($434,470) transactions were also reportedly detained by the Police. Flutterwave insists that there was no breach.

Not much is known about open banking despite the CBN approving regulations for the infrastructure. Here are some answers to questions about open banking operations in Nigeria.

Contrary to reports stating it could acquire Payday for $40 million, Moniepoint’s Head of Global Marketing has denied these reports stating that it’s investment in the startup was a strategic acquisition.

With $3 million in seed funding, Payday wants to help remote workers get paid faster, but could soon offer loans to users.

Payments startups dominate the fintech sector in Nigeria; Mayowa Kuyoro, Partner and Head of West Africa Financial Services at McKinsey & Company, shares her thoughts on potential areas for growth in the sector.

Founded in 2020, Nigerian fintech startup, SeerBit, builds payment solutions for businesses and individuals in Africa. With a presence in 12 countries, it hopes to become the payment option of choice for Africa.

African cross-border payments startup, Chipper Cash, is reportedly considering a sale. Since December 2022, the startup has laid off more than 100 employees as tech companies reel from the decline in venture capital funding.

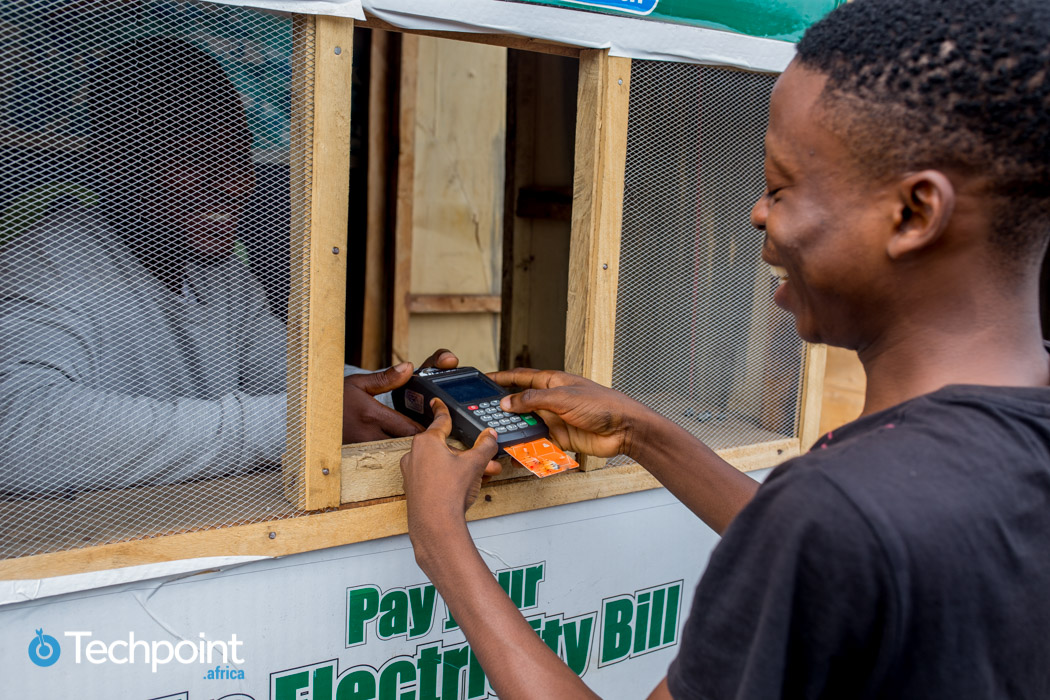

As cash shortages continue across Nigeria, small and medium-sized businesses are changing their processes and POS agents have not been left out.

In early February 2023, hackers transferred over ₦2.9 billion from Flutterwave accounts. While police investigations are ongoing, Flutterwave is seeking to freeze accounts where some of the money was transferred. A motion to freeze accounts in 27 financial institutions in Nigeria, including Access Bank, Kuda, Zenith Bank, and Opay, has been filed.

Depending on who you ask, the scarcity of cash in Nigeria is causing a lot of hardship. I experienced this hardship first-hand in an attempt to survive a day in Lagos without cash, and here’s how it went.