One of the things we often don’t realize is that problem solvers also have problems.

A prime example is Cardtonic, a leading B2C fintech platform that has spent years providing solutions to major financial issues in Nigeria. It enables Nigerians to make global payments with reliable virtual dollar cards and makes gift cards spendable.

However, despite being a problem solver, the company also has its own share of deeper problems, which include struggling to find a reliable card for large payments.

Cardtonic spends thousands of dollars on tools, SaaS subscriptions, and running ads; however, making payments is often unnecessarily stressful. Most bank cards are difficult to fund, have unpredictable limits, and often fail when you need to make urgent payments.

After several years of facing the same problem that many other businesses in Nigeria and Ghana also face, Cardtonic decided to step in and create Pil, a B2B spend management platform that allows businesses or marketers with heavy expenses to make payments with ease.

How Pil is Redefining Spend Management for Businesses

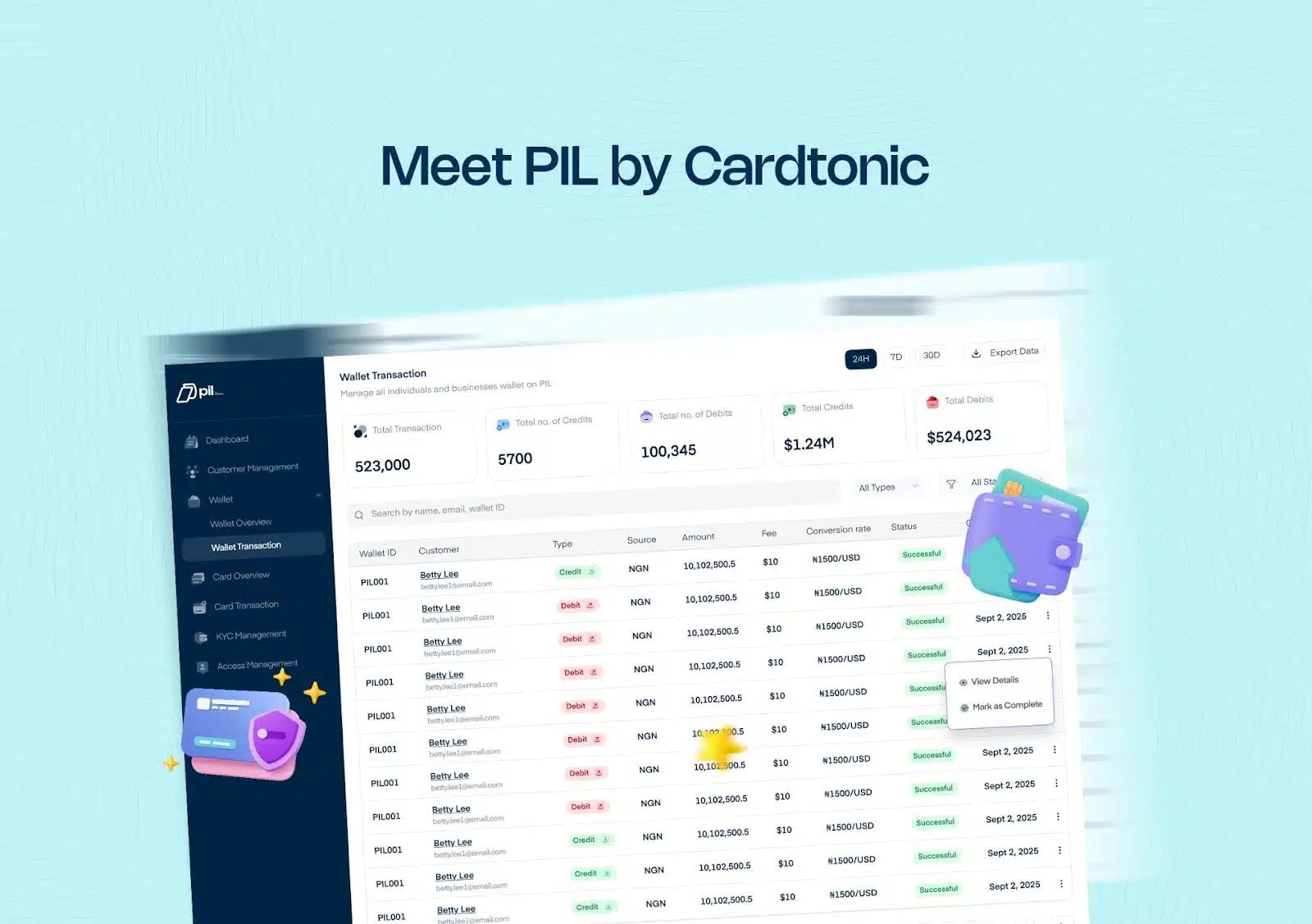

Pil by Cardtonic is a B2B virtual dollar card spend management platform designed for businesses with heavy spending, allowing them to make global payments with ease and track all expenses from a centralized dashboard.

With Pil, businesses can create instant virtual dollar cards that can be funded with local currencies such as Naira and Cedis or stablecoins like USDC. They can also create multiple labeled cards per category, depending on the payments they want to make, e.g., creating an ad spend card to pay for ads only, with flexibility to allocate limits and track spending.

As a company that understands the struggles of making large payments firsthand, Pil is on its way to becoming a stable payment powerhouse that businesses of all sizes, startups, and marketing agencies can rely on. It is redefining how spend management works for businesses, giving them access to not just reliable cards that work anytime but also have predictable limits and offer visibility into payment records and patterns, with flexible payment controls.

The Cost of Building Pil

Cardtonic is a customer-facing company by default; however, this new product, Pil, is primarily a business-to-business model, which means both have different structures and patterns.

For example, retail-based virtual cards are used by individuals whose usage patterns are random, based on personal needs, and require no integration with external systems. Business-grade cards, on the other hand, are used by businesses with recurring expenses and often require extensive control for administration and integration with accounting software.

To ensure both products meet users’ needs without impeding each other’s growth, Cardtonic decided to build a new solution from the ground up rather than upgrading the existing ‘consumer tools’ under a separate legal entity. Therefore, Pil exists as a child company of Cardtonic.

Before building Pil, Cardtonic had been running solely based on founder capital and revenue, as there was no need to do so. However, a global-scale solution like Pil requires huge capital to grow and scale smoothly. Cardtonic decided to raise $2.1 million from investors who were also interested in the solution they were developing.

Looking Ahead

The foundation of Pil by Cardtonic is already solid, as it was built based on real business pain points rather than assumptions.

Cardtonic has also experienced the struggles of making large payments firsthand and understands what businesses need when they are looking for a reliable spend management platform. Therefore, the team is implementing firm infrastructure systems to ensure Pil becomes the go-to solution for every business that makes large payments and needs visibility into cash flows, rather than just adding noise to the already crowded fintech marketplace.

The product roadmap also includes advanced tools and features for businesses, such as integrating smart automated expense flows and accounting software tools such as Xero, creating physical cards, and an API that businesses can integrate into their systems.