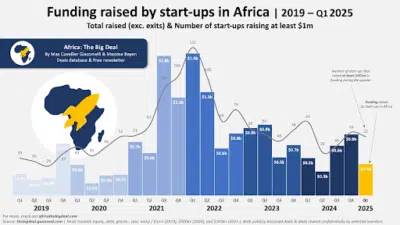

It’s been a month since the numbers came in: African startups pulled in $460 million in Q1 2025 from deals worth $100,000 and above (excluding exits). That’s only a 5% dip from Q1 2024’s $486 million.

If you stop at the surface, you’ll miss what’s really happening beneath the charts. The trend is revealing a change in investors’ appetites.

In this article, we break down the top startup funding destinations in Africa, drawing from Q1 2025’s performance and offering a forward-looking playbook for founders.

TL:DR; key takeaways from this article

- As usual, Kenya, Nigeria, South Africa, and Egypt are the top funding destinations. However, emerging players like Togo, Rwanda, and Ghana are also getting attention.

- There’s now increased visibility of local African funds and diaspora-backed VCs.

- Many startups that secured funding in 2025 so far have one thing in common: clear, measurable traction.

- There may be more funding opportunities in the coming months, but the first few weeks of Q2 have been quite disappointing.

- The message is clear: New African founders must explore local markets and sharpen their business models to thrive in this leaner period.

Top startup funding destinations breakdown for Q1 2025

| Key Point | Details | What It Means for You |

|---|---|---|

| Funding Volume | African startups raised $460 M in Q1 2025, a 5% dip from $486 M in Q1 2024 | You must show clear, measurable traction to attract steady investment |

| Top Destinations | Kenya, Nigeria, South Africa and Egypt captured 83% of funding | You should focus on building a strong local presence before expanding |

| Sector Distribution | Fintech led with 46%, energy followed at 18%, logistics at 10% | You can tap into high-growth areas or find niche problems in other sectors |

| Founder Gender Gap | Female-led teams received just over 2% of total funding | You should strengthen mentorship and network support for underrepresented founders |

| Emerging Markets | Togo (led by a $30 M Series B), Rwanda, Ghana and Senegal showed early promise | You can explore these growing ecosystems with less competition |

| Investor Appetite Shift | No megadeals over $10 M; mid-sized rounds dominated | You should tailor your pitch to secure realistic, mid-sized rounds |

| Q2 Outlook | Slow start in April; rising interest in climate tech, health tech and AI | You should prepare for stricter regulation and consider debt options as working-capital solutions |

| Recommended Actions | Deepen local market penetration, refine your model, build traction metrics | You must focus on solid execution and local proof points before chasing large rounds |

A total of 52 startups raised at least $1 million in Q1 2025, according to Africa: The Big Deal, a platform tracking investments across Africa’s startups.

This aligns closely with the average number of million-dollar deals seen in 2023 and 2024, showing consistency in deal flow despite lower total investment.

In the first quarter of 2025, approximately 83% of startup funding was secured by companies based in the “Big Four” countries: Kenya, Nigeria, South Africa, and Egypt.

Each of the first three nations attracted around $100 million, accounting for 24%, 24%, and 22% of the overall investment.

Egypt followed with $61 million (14%), while Togo shocked many by cracking the top five, almost entirely due to Gozem’s $30m Series B.

What sector got the most funding?

As usual, fintech firms dominated the funding landscape, securing 46% of the total raised, including major rounds like $53 million for LemFi and $38 million for Naked.

The reason for this is quite clear. Among other market-influenced reasons, mobile phones plus daily money problems allow for quick user growth of these startups.

Meanwhile, the energy sector came next with 18%, followed by logistics and transportation at 10%.

Female-led startups’ numbers don’t look good

Funding distribution remained heavily skewed toward male-led ventures.

Solo male founders and all-male founding teams captured 79% (11% and 67%, respectively), while startups with gender-diverse founding teams received 20%.

Female-led startups, however, received just over 2% of the total funding (about $10 million). The largest round in this category was a $6.2 million grant awarded to South Africa’s African Biologics, a biotech firm.

Excluding grants, the share of capital raised by companies with female CEOs drops dramatically to just 0.7%.

Emerging players

There’s not much to say about Ghana, Rwanda, and Senegal other than that they continue to show early promise.

We can draw insights from previous years. In 2023, Rwanda and Senegal shared the eighth position, each securing $44 million in startup funding.

These nations may not be the top performers, but they have actively pursued policies to promote innovation and entrepreneurship..

Why the big four dominate…again

Kenya, Nigeria, Egypt and South Africa remained the top investment destinations, each attracting roughly $100 million.

Many of the continent’s earliest and most successful tech startups, from Flutterwave to Twiga Foods and Paymob, were born in these markets.

Their success created an interesting loop: big exits attracted more investors, more investors funded more startups, and more startups created stronger ecosystems.

Admittedly, none of the Big Four countries has perfect regulatory conditions, but they’ve each made meaningful strides in creating startup-friendly environments.

For example, Nigeria’s SEC started regulating crowdfunding five years ago, Kenya developed sandbox frameworks, Egypt launched its digital economy strategy, and so on.

Meanwhile, Investors are human. And like most people, they lean toward the familiar.

As a result, even when promising opportunities arise in places like Zambia or Burkina Faso investors often pass not due to lack of potential, but due to lack of comfort.

Key trends observed in Q1 2025

Based on observation from January to the time of writing, one thing underscores African startups’ funding: fewer megadeals and more mid-sized rounds.

And this explains the overall 5% dip year-on-year.

1. No megadeals

No investments exceeding $10 million were recorded, indicating that while funding was still secured, it primarily consisted of smaller deals.

If you remember 2024, African startups cumulatively raised $2.2 billion, driven by two mega deals by Nigeria’s Moniepoint and South Africa’s Tyme Group.

Another possible explanation is the reduction of international aid. Many startups rely on international aid-backed initiatives.

So, entities like the United States decided to freeze and potentially eliminate funding from agencies such as the USAID, which had a ripple effect on the African startup landscape.

2. Rise of local and diaspora VCs

One of the most notable developments this quarter has been the increased visibility of local African funds and diaspora-backed Venture Capitalists (VCs).

This includes firms like Future Africa, LoftyInc, DFS Lab, and diaspora-led outfits based in the US, UK, and Europe.

It is a positive trend because it helps:

- Reduce Africa’s overreliance on foreign capital

- Democratise access to funding for first-time and underrepresented founders.

As venture partner at Uganda’s Benue Capital, Marge Ntambi, says, “True ecosystem ownership starts with local investment. While international capital can accelerate growth, it often lacks a deep understanding of local dynamics and on-the-ground realities.”

3. Increase in tech sector diversity (green tech, health tech, AI)

Almost half of the funding raised so far (46%) was raised by fintech startups, followed as usual by energy (18%) and logistics and transportation (10%).

While fintech still claims the largest slice, there’s growing investor appetite for green tech, health tech, AI-powered platforms, and deep tech startups solving local problems in unconventional ways.

- Green/climate tech saw a rise in funding, particularly for startups tackling energy access, waste reduction, and sustainable agriculture.

- Health tech gained attention, with digital health platforms, biotech ventures (like Afrigen Biologics), and insurance disruptors making headlines.

- AI applications in logistics, education, fraud detection, and language processing are becoming increasingly fundable, reflecting the global boom in generative and predictive AI.

Q2’s outlook

The signals from Q1 deals pose a difficult question: Are we on track for another billion-dollar year?

The activities in the first week of April were quite disappointing. Only one startup funding round was announced throughout the week: Ivory Coast’s Djamo, which raised $17 million.

- In the coming months, we expect heightened regulatory oversight in fintech and AI, reflecting growing trends in these sectors.

- At the same time, climate tech investments, especially in renewable energy and agri-tech, are poised for growth.

- The momentum for a stronger Q2 and beyond will likely hinge on larger deals entering the region, which could significantly shift the current trajectory.

However, Africa’s funding landscape appears to be moving more slowly.

Launch Africa’s head of investment, Uwem Uwemakpan, recently revealed in an interview, “In our experience, especially in high-growth sectors, what’s often needed isn’t equity but debt—working capital to keep the business running and growing.”

So, on the brighter side, this slowdown can allow founders to build with greater focus, investors to maintain discipline, and the ecosystem to solidify its core strengths.

If investment patterns stabilise and funding options expand, Q2 2025 could offer a more promising outlook for African entrepreneurs.

What founders should know or do

It would appear clearer than ever that investors are shifting focus from big visions to solid execution.

In Q1 2025, many startups that secured funding had one thing in common: clear, measurable traction.

Whether it’s growing revenue, active users, customer retention, or repeat sales, metrics are the story now. Founders should focus on deepening local market penetration and fine-tuning their business model in one country.

They can now use that as a springboard into culturally and economically adjacent markets.