Claims that the crypto Ponzi scheme, CryptoBridge Exchange (CBEX), stole ₦1.3 trillion ($822 million) from Nigerians have appeared to be unsubstantiated.

While many Nigerians have reported losses on social media, the total loss is estimated to be significantly less.

After tracking multiple wallets and smart contracts in connection with the crypto Ponzi scheme, Techpoint Africa estimates that at least $6.1 million has been deposited into the fake exchange.

What is CBEX?

According to the scheme’s website, it is a cryptocurrency exchange registered in the US. It claims to be certified by the US Department of Treasury’s Financial Crimes Enforcement Network (FinCEN).

Interestingly, the company is on the FinCEN’s list of registrants. However, FinCEN noted that the inclusion of a business on its registrant’s list does not prove the legitimacy of the business.

“The Registrant Search Web page, which is updated on a weekly basis, contains entities that have registered with FinCEN as a money services business pursuant to Bank Secrecy Act. Information contained on this site has been provided by the MSB registrant and reflects only what the registrant has provided to FinCEN,” the disclaimer noted.

FinCEN also said on its website that fraudsters have been attempting to steal money by claiming to be approved by it.

Besides its FinCEN registration document, the platform published more than three documents to prove its legitimacy, including one allegedly signed by the Secretary of State in Colorado, US.

With CBEX now confirmed as a Ponzi scheme, it can be inferred that the documents are mostly fake.

Victoria Fakiya – Senior Writer

Techpoint Digest

Stop struggling to find your tech career path

Discover in-demand tech skills and build a standout portfolio in this FREE 5-day email course

Why did people deposit money in CBEX, and why did it crash?

CBEX promised users a 100% return on investment within 30 days, accepting only dollar-denominated transactions and offering referral bonuses to incentivise user growth.

Its claims of leveraging artificial intelligence for trading lent it an air of credibility, attracting a substantial user base in a country eager for high-yield investment opportunities.

CBEX’s operations have come under intense scrutiny. In early April 2025, the platform restricted withdrawals, citing a “security breach” and promising a resolution by April 15.

However, there has been panic among users, with many reporting that their account balances had been reduced to zero and that they couldn’t contact customer support.

There are reports of aggrieved investors ransacking the exchange’s office in Ibadan, Oyo State, Nigeria.

How much did Nigerians lose to CBEX?

While the total loss cannot be ascertained at this time, Techpoint Africa estimates a loss of $6.1 million based on deposits tracked to wallets and smart contracts connected with CBEX.

It should also be noted that there is no way to confirm if these deposits were made by only Nigerians.

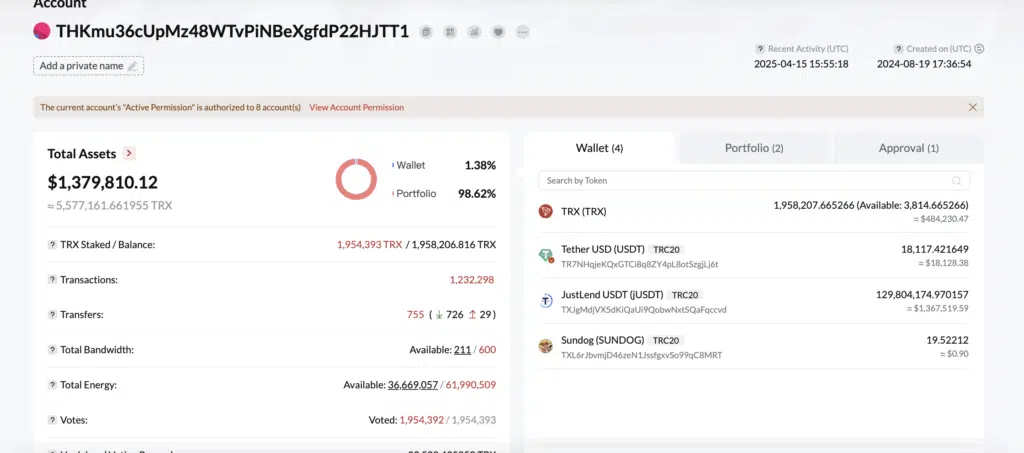

The USDT deposited into a user’s primary wallet was moved to another wallet with $1.37 million worth of assets.

Further analysis shows that the wallet was created on August 8, 2024. As of the time of publication, it had $484,805 in Tron tokens (TRX), $18,000 in USDT, and $1.36 million in JustLend USDT, a decentralised autonomous lending organisation.

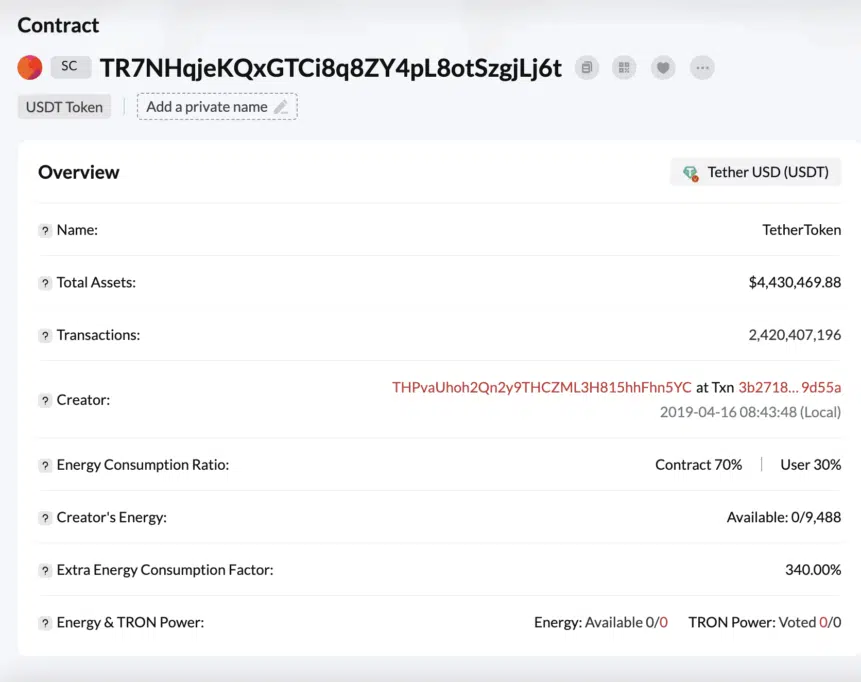

Another wallet where a user deposited $200 was tracked to a smart contract — TR7NHqjeKQxGTCi8q8ZY4pL8otSzgjLj6t — with $4.4 million in total assets.

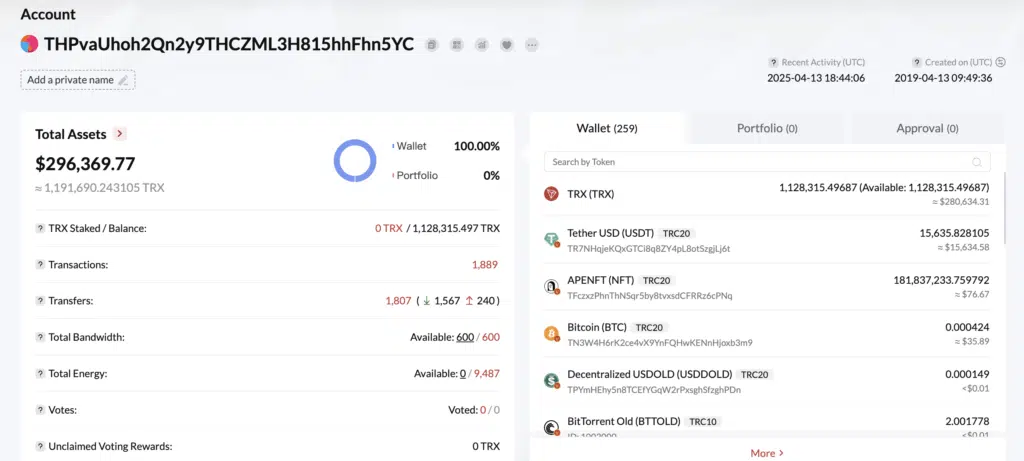

Interestingly, this smart contract was created in April 2019, and the creator of the smart contract has a total of $294,626 in their wallet. The last transaction on the wallet was three days ago.

At the time of publication, the smart contract address was still receiving deposits ranging from $1 to $7,000.

SEC declares CBEX illegal

The Securities and Exchange Commission (SEC) has issued a stern warning against unregistered digital trading platforms, following concerns over the operations of (CBEX).

During a virtual engagement with fintech stakeholders on Monday, April 14, 2025, the Investment and Securities Act (ISA) 2025, SEC Director General, Emomotimi Agama, emphasised that any platform not registered with the Commission is operating illegally. He stated, “If it is not registered, it is illegal.”

The ISA 2025, recently signed into law, grants the SEC enhanced powers to regulate digital asset platforms, including the authority to prosecute operators of unregistered platforms and Ponzi schemes.

Under the new law, such operators face up to ten years in prison and fines up to ₦40 million.

Agama also cautioned celebrities and influencers against promoting unregistered platforms, noting that endorsing such schemes could have legal consequences.

He warned that promoting meme coins or projects that harm the public would not be tolerated.

*This is a developing story