Peer-to-peer (P2P) crypto trading is a simple idea on paper. Instead of buying or selling cryptocurrency directly from a platform, users trade with one another, while the platform provides escrow, basic dispute resolution, and a marketplace to find counterparties.

In Nigeria, P2P did not just grow organically. It was pushed into the mainstream.

In early 2021, the Central Bank of Nigeria instructed banks and financial institutions to stop facilitating cryptocurrency-related transactions. While the move was widely described as a “crypto ban,” it did not criminalise crypto ownership or trading.

What it effectively did was cut off the most straightforward on-ramps and off-ramps: bank transfers to and from crypto exchanges.

For everyday users, the implication was immediate. You could still hold crypto, but turning it into naira or buying it with naira became a problem.

This was when the P2P feature — which was usually done on WhatsApp and Telegram — took shape on exchanges. Binance, which is a dominant exchange in the country, rolled out the feature and allowed Nigerians to trade directly with one another using bank transfers.

Other global platforms followed. If exchanges could no longer touch fiat rails directly, users would.

The model worked. P2P is now one of the most popular ways to on-ramps and off-ramps, which is probably why Nigeria is consistently ranked among the world’s largest P2P crypto markets, with platforms like Bybit, Bitget, and others processing thousands of trades daily.

But while P2P solved an access problem, it quietly introduced a new problem, which is uncertainty.

Victoria Fakiya – Senior Writer

Techpoint Digest

Stop struggling to find your tech career path

Discover in-demand tech skills and build a standout portfolio in this FREE 5-day email course

As adoption grew, so did stories of delayed payments, short-changed transfers, fake alerts, and traders disappearing mid-transaction. These experiences surfaced sporadically on social media and WhatsApp groups, often dismissed as edge cases or user error.

Until recently, no one had attempted to document what P2P trading in Nigeria actually feels like at scale.

Documenting the P2P problems in Nigeria

For the first time, a crypto platform called Breet decided to document what the experience is like using P2P platforms.

Called The State of P2P in Nigeria 2025, the company conducted a research with over one hundred live P2P trades across five major platforms, including Bybit, Bitget, Gate.io, BingX, and Noones. In parallel, it analysed more than 20,000 tweets posted between 2022 and 2025 to understand how Nigerians talk about P2P when things go wrong.

According to the research, P2P works, but not consistently. While some trades were completed in as little as one minute, others dragged on for more than an hour. Across all platforms tested, payout times ranged from three minutes to eighty-six minutes, with outcomes determined almost entirely by the individual trader involved, not the platform itself.

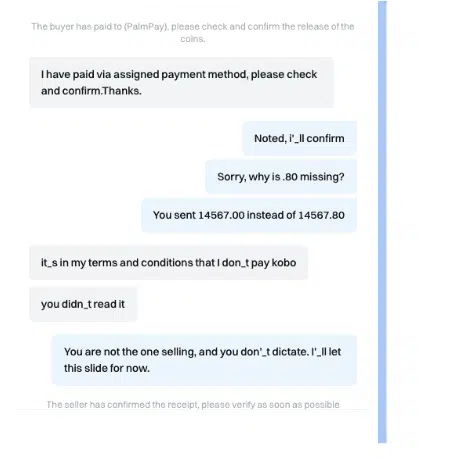

Accuracy was an even bigger issue. Breet found that roughly thirty-one percent of all P2P trades analysed had some form of payout discrepancy.

In plain terms, users received less than what was displayed.

Sometimes it was missing kobo. In other cases, traders deducted as high as a hundred naira, often without prior agreement. Platforms rarely flagged or corrected these differences automatically.

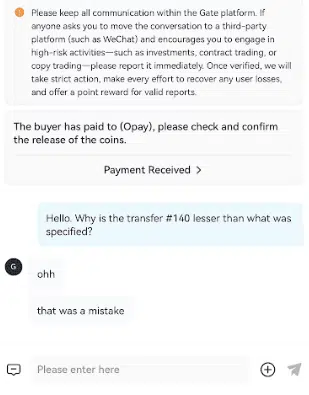

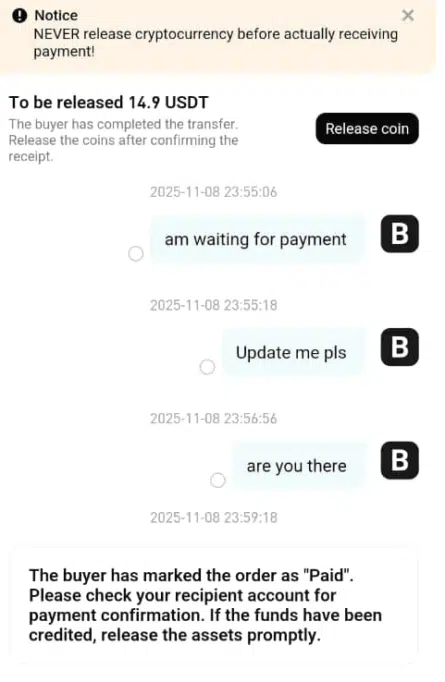

Fraud attempts were not rare either. Suspicious or manipulative behaviour appeared in about one in every six transactions. Common patterns included traders marking transactions as paid without sending funds, sending fake bank alerts, or attempting to move conversations off-platform to WhatsApp, where pressure tactics were easier to deploy.

The Twitter analysis reinforced these findings. Negative sentiment dominated the conversation, driven by anger, frustration, and fear.

The most common complaints centred on fake payment alerts, missing funds, delayed transfers, and unresponsive support. While positive experiences existed, they were largely drowned out by warnings and scam exposés.

These patterns are not unique to Breet’s research. People have been posting negative reviews about P2P platforms for a long time.

What Breet’s research does is quantify the risk associated with P2P and show how predictable it has become.

The main takeaway from the research is that P2P trading in Nigeria is trader-dependent, not system-controlled. When users match with reliable merchants, transactions are fast and smooth. When they do not, the system offers limited protection beyond escrow and slow dispute resolution.

This reality explains both why P2P remains dominant and why alternatives are beginning to attract attention.

How Breet is trying to remove the human risk from crypto off-ramps

From Breet’s research, the problem with P2P is that its success depends on people’s behaviour, and you can’t always count on people to behave properly.

Instead of connecting users to individual traders, Breet operates an automated crypto-to-cash off-ramp. Users send crypto to a designated wallet address, and the platform converts it to naira at a fixed rate before paying out directly to a bank account.

There is no chat window, no negotiation, no waiting for a merchant to come online, and no decision about whether to trust a completion rate.

In practice, this removes several of the pain points identified in P2P trading. Payout accuracy is guaranteed because rates and conversions are system-calculated, including kobo.

Scam vectors such as fake alerts or premature “mark as paid” actions disappear entirely because users are not dealing with other individuals. Transaction times are consistent, determined by system processing rather than human response.

Breet is not the only platform attempting to solve this problem. Other automated off-ramps and over-the-counter crypto services exist, both locally and internationally. Most offer similar promises around speed and predictability.

Where Breet stands out, however, is how explicitly its product design responds to the specific failures of Nigerian P2P trading: missing funds, negotiation pressure, emotional stress, and the uncertainty of receiving money from unknown sources.

The company’s research-driven approach also reflects a broader shift in Nigeria’s crypto ecosystem. As adoption matures, convenience and reliability are starting to compete with rate optimisation.

For a growing segment of users, especially first-timers and businesses, knowing exactly how much will arrive and when is becoming more important than squeezing out the last few naira from a volatile P2P rate.

However, this does not mean P2P is disappearing.

Why Nigerians still choose P2P

Despite the risks, P2P is still very popular in Nigeria. The reasons range from better rates, familiarity, and loyalty of crypto users in Nigeria.

P2P platforms continue to dominate because they combine P2P with deep liquidity and a large pool of active merchants. When dozens of traders compete to buy crypto, rates improve. For users who prioritise price above all else, this remains compelling.

However, while some people know their way around these platforms, beginners struggle with confusing interfaces, delayed payments, and dispute processes that offer little reassurance in the moment.

This is where platforms like Breet are gaining traction. By offering a system-controlled alternative, they appeal to users who value certainty over marginal rate advantages.

In the end, the future of crypto off-ramps in Nigeria may not belong to a single model, but to a spectrum of options that reflect how much uncertainty users are willing to live with.