Like many things, money has an order. And in South Africa, there are names besides this order.

These South Africans didn’t just make the list with vague background stories, but for their evidentiary possession in various industries like retail, food processing and manufacturing, digital banking, mining, tech, pharmaceuticals, and entertainment.

In this list, we focus on the top 20 billionaires and multimillionaires with verified financial power. Each person you’ll meet below has built, inherited, and significantly grown a structure that contributes to South Africa’s economic statistics in 2025. Their stories reveal how capital grows in South Africa, who controls it, what drives it, and how they continue multiplying it in uncertain economic times.

Here are the top 20 richest South Africans in 2025, and how they made their money.

1. Johann Rupert

Net Worth (Jan–June 2025): $13.8–$17 billion

Leading Company: Richemont (Luxury Goods), Remgro (Investments)

Johann Rupert leads Richemont, a company known worldwide for luxury brands such as Cartier and Montblanc. His wealth comes mainly from this group and Remgro, an investment holding company with diverse interests. Rupert studied economics but left university early to gain practical experience abroad in finance. When he returned to South Africa, he focused on reshaping the family’s investments toward high-end luxury goods, which have proven highly successful. Despite economic ups and downs and currency changes, Richemont’s brands have maintained strong sales, especially in Asia and Europe.

Richemont reported a 7% increase in revenue in the first quarter, driven by strong demand for watches and jewelry in 2025. This growth helped stabilize Rupert’s wealth amid global economic uncertainties. His leadership style is known for careful planning, patience, and avoiding risky moves. Rupert has faced criticism for focusing on luxury goods, which some see as disconnected from South Africa’s broader social challenges.

However, he quietly supports several philanthropic projects, including education and conservation. He prefers to keep a low profile and rarely appears in the media, focusing instead on the long-term health of his companies.

2. Nicky Oppenheimer

Net Worth (Jan–June 2025): $9.5–$12.3 billion

Leading Company: De Beers (Diamonds, formerly), Tana Africa Capital (Investments)

Nicky Oppenheimer is known for his role in the diamond industry. He once led De Beers, the company controlling a large share of the global diamond market. After completing his studies at Oxford, he worked in the family’s diamond operations and helped guide the company through significant changes. De Beers faced challenges such as losing its monopoly and addressing concerns about conflict diamonds. Oppenheimer helped establish the Kimberley Process, which certifies diamonds to ensure they are ethically sourced.

Since selling the family’s stake in De Beers in 2012, Oppenheimer has focused on investments across Africa through Tana Africa Capital, including mining, agriculture, and private equity. In early 2025, Tana Africa Capital announced a new partnership to develop sustainable agriculture projects in Zambia to improve food security and create jobs.

Oppenheimer is also involved in conservation efforts and supports education initiatives. His approach combines respect for tradition with adapting to new ethical and environmental standards. He is considered a steady and thoughtful figure in South African business.

3. Ivan Glasenberg

Net Worth (Jan–June 2025): $9.3–$9.8billion

Leading Company: Glencore (Commodities Trading & Mining)

Ivan Glasenberg is associated with Glencore, a company that trades and mines commodities like metals, minerals, and energy products. Starting as a coal trader, Glasenberg helped expand Glencore into one of the world’s largest commodity firms. The company’s operations are global, making its performance sensitive to economic cycles and demand for raw materials.

In 2025, Glencore announced plans to increase investments in renewable energy projects, aiming to reduce its carbon footprint while maintaining profitability. This shift reflects growing pressure from governments and investors to address environmental concerns. Glasenberg stepped down as CEO in 2021 but remains a major shareholder, benefiting from the company’s ongoing success.

Although he has been criticized for his environmental and labor practices, Glasenberg remains a key player in global markets. He is known for focusing on efficiency and managing risks carefully.

4. Clive Calder

Net Worth (Jan–June 2025): $5.7–$6.9 billion

Leading Company: Zomba Group, Jive Records (Music Industry)

Clive Calder’s fortune was built on music, but his path was anything but typical. Born in Johannesburg, Calder started his first record company in 1971, eventually co-founding Zomba Group and Jive Records. Moving to London, he expanded his reach, signing acts like NSYNC, Britney Spears, and the Backstreet Boys.

Calder’s big payday came in 2002 when he sold Zomba to Bertelsmann for $2.74 billion. Since then, he’s invested in games and philanthropy and lives in the Cayman Islands. Calder’s business style is quiet but effective, letting the music and the numbers speak for themselves.

The music industry is notoriously fickle, but Calder’s knack for spotting talent and trends set him apart. He’s faced the ups and downs of changing technology and shifting tastes, but his legacy is secure as one of the most successful music moguls ever to come out of Africa.

5. Patrice Motsepe

Net Worth (Jan–June 2025): $3.2–$3.4 billion

Leading Company: African Rainbow Minerals (Mining), Tyme Group (Digital Banking)

Patrice Motsepe is a well-known figure in mining and finance.

Growing up in a family of entrepreneurs, Motsepe became South Africa’s first black billionaire. He studied law, became the first black partner at Bowman Gilfillan, and seized the opportunity presented by post-apartheid Black Economic Empowerment laws. He started with marginal gold mines at low prices and found them profitable, founding African Rainbow Minerals (ARM).

Motsepe’s empire now spans mining, finance, and digital banking, with Tyme Group becoming Africa’s ninth unicorn in 2025. He’s also the president of the Confederation of African Football, showing his influence beyond business. Motsepe’s challenges have included navigating South Africa’s political changes, labor unrest, and the volatile commodities market. He’s known for philanthropy, joining The Giving Pledge to donate half his wealth.

Motsepe’s work emphasizes creating opportunities for others and supporting economic growth in South Africa.

6. Koos Bekker

Net Worth (Jan–June 2025): $2.7–2.9 billion

Leading Company: Naspers (Media & Technology)

Koos Bekker is the architect behind Naspers’ transformation from a local media group to a global tech giant. After earning degrees in law and literature and an MBA from Columbia, Bekker co-founded Mnet, one of the first pay-TV services outside the US. He became CEO of Naspers in 1994, steering it into pay-TV and mobile networks (MTN) and, most notably, investing early in Tencent.

That single decision multiplied Naspers’ value many times over. Bekker’s leadership style is visionary but practical, always looking for new markets and technologies. He’s faced the challenge of adapting a traditional media company to the digital age, and his willingness to take risks paid off. Naspers’ growth under Bekker was explosive, and his story is a lesson in spotting opportunities and executing boldly.

Even after stepping down as CEO, Bekker’s impact on African business and global tech investment is profound.

7. Michiel Scholtz du Pré le Roux

Net Worth (Jan–June 2025): $1.1–$2.2 billion

Leading Company: Capitec Bank (Banking)

Michiel le Roux founded Capitec Bank in 2001, intending to offer South Africans simple, affordable banking services. Capitec’s focus on low fees, transparency, and easy access challenged established banks and attracted millions of customers.

In early 2025, Capitec reported a 15% increase in active digital banking users, reflecting the bank’s success in embracing technology. The bank is expanding its services to include more online loans and savings products, targeting underserved communities. Le Roux stepped down as CEO in 2013 but remains a significant shareholder and advisor.

Le Roux faced skepticism from traditional banks and regulators but persisted with his customer-centric model. Capitec’s growth changed the banking landscape in South Africa, proving that innovation and simplicity can disrupt established industries. His work continues to influence financial inclusion in the region.

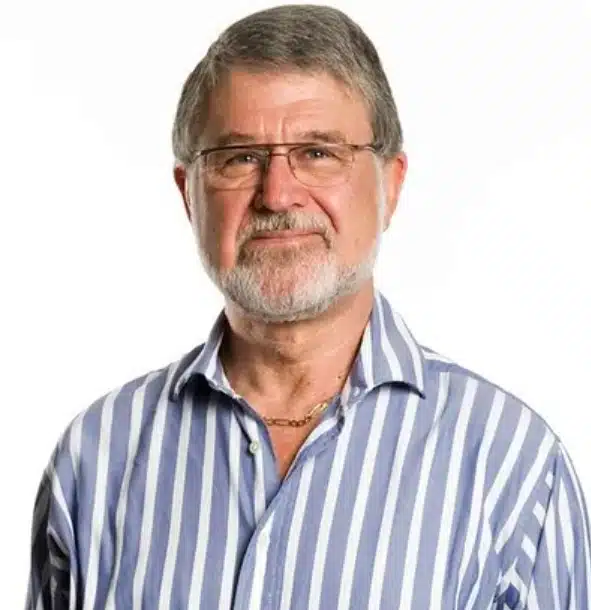

8. Jannie Mouton

Net Worth (Jan–June 2025): $1.6–$1.85 billion

Leading Company: PSG Group (Investments)

Jannie Mouton founded PSG Group after being dismissed from his co-founded stockbroking firm. PSG invests in sectors including banking, agriculture, and financial services, focusing on long-term value and supporting strong management teams.

In 2025, PSG Group increased its stake in Capitec Bank, strengthening its position in the expanding financial sector. Mouton’s leadership is characterized by resilience and strategic patience, having rebuilt his career after early setbacks. He emphasizes careful analysis and long-term thinking in investments.

Mouton’s experience shows that challenges can lead to new opportunities when combined with determination and sound strategy. PSG’s diversified portfolio reflects its cautious yet ambitious approach to growth.

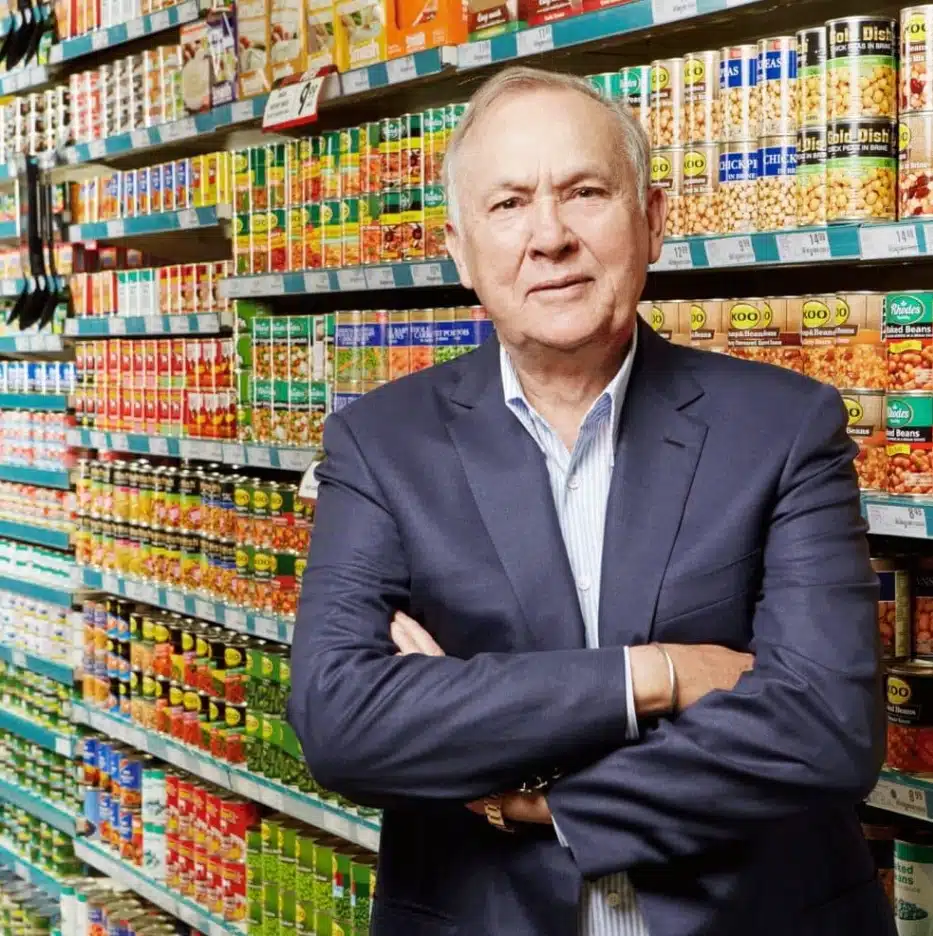

9. Christoffel Wiese

Net Worth (Jan–June 2025): $1.2–$1.7 billion

Leading Company: Shoprite, Pepkor (Retail)

Starting with a small chain of supermarkets, Christoffel Wiese built Shoprite into Africa’s largest food retailer. Wiese’s strategy was simple: buy undervalued businesses and scale them up. However, his acquisition of OK Bazaars and expansion across Africa have created thousands of jobs that have changed the retail dynamics. However, Wiese’s journey hit turbulence with the Steinhoff scandal in 2017, which wiped out billions from his net worth and forced him to fight legal battles to recover his losses.

Despite these setbacks, Wiese clawed back to billionaire status after settling disputes and regaining a stake in Pepkor. His story is one of highs and lows, marked by bold deals, controversy, and a relentless drive to rebuild after adversity.

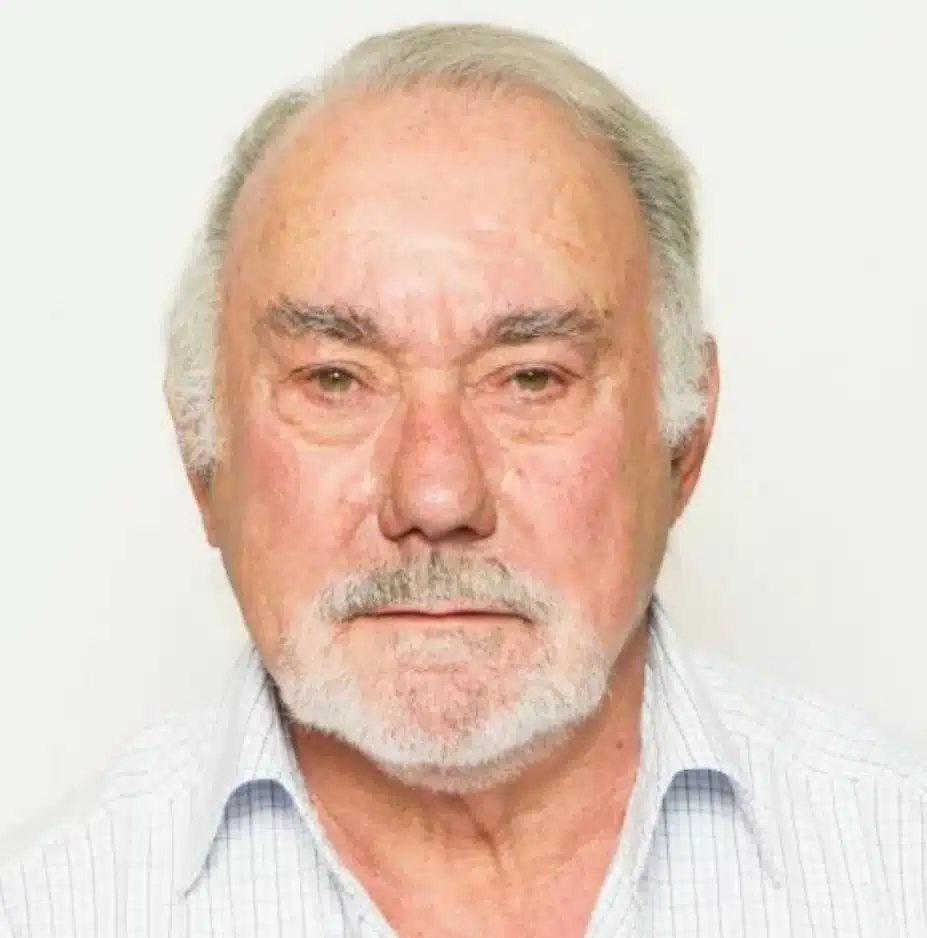

10. Desmond Sacco

Net Worth (Jan – June 2025): Approximately $1.1 billion

Leading Companies: Assore Group, Assmang Limited

Industry: Mining (Iron Ore, Manganese, Chrome)

Position: Chairman and Managing Director of Assore Limited; Chairman of Assmang Limited

Education: Bachelor of Science in Geology, University of the Witwatersrand and University of South Africa

Desmond Sacco is a prominent South African businessman and geologist who has played a pivotal role in the growth and success of the Assore Group, one of South Africa’s leading mining companies. Born in Johannesburg in 1940, Sacco inherited a strong mining legacy from his father, Guido Sacco, an Italian immigrant who founded the Assore Group in 1928. Guido’s pioneering work in manganese exploration laid the foundation for the family’s enduring influence in mining.

Desmond Sacco joined the Assore Group in 1968 and was appointed to the board of directors in 1974. Since 1992, he has served as the Chairman and Managing Director, overseeing the company’s expansion and diversification.

Under his stewardship, Assore has become a key player in mining iron ore, manganese, and chrome. He holds a significant 50% stake in Assmang Limited, a joint venture with African Rainbow Minerals. Assmang is one of the most profitable mining operations in South Africa, with extensive mineral rights and operations across the country.

His academic background in geology has been instrumental in guiding Assore’s strategic decisions and exploration activities. Sacco is also a fellow of the Institute of Directors and the Geological Society of South Africa, reflecting his professional commitment to business and science.

As of 2025, Desmond Sacco’s net worth is estimated at around $1.1 billion, primarily derived from his substantial ownership in Assore and its subsidiaries. Despite his wealth, Sacco maintains a relatively low public profile. He is married with two children and resides in Johannesburg.

Past his business achievements, Sacco is known for his passion for mineral collection. He boasts one of South Africa’s finest private collections. His legacy is marked by sustained growth in the mining industry and contributions to South Africa’s economic development.

11. Laurie Dippenaar

Net Worth (Jan–June 2025): Approximately $610 million

Leading Company: FirstRand Limited (Banking, Financial Services)

Lawrence Dippenaar co-founded Rand Consolidated Investments, which evolved into FirstRand Limited, one of South Africa’s leading financial services groups. FirstRand offers a broad range of banking, insurance, and investment products.

During the first half of 2025, FirstRand expanded its digital banking platform, attracting a younger demographic and increasing its market share. The company’s focus on technology-driven services has been key to maintaining competitiveness amid rapid industry evolution.

Dippenaar is credited with cultivating an entrepreneurial culture within FirstRand, empowering management teams to innovate and adapt. His guidance has helped the company navigate regulatory changes and economic challenges while prioritizing customer service and operational efficiency.

12. Mark Shuttleworth

Net Worth (Jan–June 2025): $500 million

Leading Company: Canonical Ltd. (Technology, Open Source Software)

Mark Shuttleworth founded Canonical Ltd., the company behind Ubuntu, a widely used open-source operating system favored for servers, cloud computing, and personal devices. Shuttleworth’s vision was to make software accessible and affordable, challenging the dominance of proprietary software giants.

In 2025, Canonical released Ubuntu 24.04 LTS, optimized for artificial intelligence workloads and edge computing, helping the company stay competitive in fast-evolving tech markets. This release supports industries adopting AI and IoT technologies, expanding Ubuntu’s footprint in enterprise environments.

Shuttleworth is also notable for being the first African space tourist in 2002, funding his own trip to the International Space Station. His adventurous spirit complements his entrepreneurial drive.

Despite rapid changes in the technology sector and intense competition, Canonical’s steady innovation and commitment to open-source principles have kept it influential. Shuttleworth continues to advocate for open collaboration and digital inclusion, supporting communities worldwide through technology.

13. Stephen Saad

Net Worth (Jan–June 2025): Approximately $1.4 billion(varies with stock market fluctuations)

Leading Company: Aspen Pharmacare (Pharmaceuticals)

Stephen Saad is a South African billionaire businessman and the founder and CEO of Aspen Pharmacare, the largest pharmaceutical company in Africa. Aspen operates in over 150 countries and is valued at approximately R75 billion (around $5 billion). Saad’s stake in Aspen is significant, with about 12.82% ownership as of early 2025.

Born in Durban in June 1964 to Lebanese parents, Saad completed a Bachelor of Commerce degree at the University of KwaZulu-Natal and qualified as a Chartered Accountant. He began his career at Coopers & Lybrand and later worked at Quickmed, a prescription drug distributor serving South African townships during apartheid. Saad played a crucial role in saving Quickmed from being sold by advocating for intellectual property ownership to grow the business.

He became a 50% shareholder in Quickmed and identified Covan, an eye-drop manufacturer, as a strategic acquisition target. The merger of Quickmed and Covan formed Zurich, which Adcock Ingram eventually acquired for R75 million. Saad earned about R20 million from this sale, becoming a millionaire before turning 30.

In 1997, Saad co-founded Aspen Pharmacare with Gus Attridge. Under his guidance, Aspen grew into a global leader in generic medicines, expanding aggressively through acquisitions and strategic partnerships. Aspen is publicly traded on the Johannesburg Stock Exchange and has a reputation for quality manufacturing and global reach.

In 2025, Aspen strengthened its position by partnering with international organizations to manufacture COVID-19 treatments and vaccines, contributing to global health efforts. Saad’s business acumen and strategic vision have been recognized with the Entrepreneur of the Year award at the All Africa Business Leaders Awards in 2016.

Outside of business, Saad is chairman of the Sharks rugby union club and supports his alma mater, Durban High School. He owns a private game reserve near Kruger National Park and is married with four daughters.

14. Adrian Gore

Net Worth (Jan–June 2025): $480 million

Leading Company: Discovery Limited (Insurance, Financial Services)

Adrian Gore established Discovery Limited in 1992 to transform health insurance by rewarding customers for maintaining healthy lifestyles. The company’s flagship program, Vitality, incentivizes members through discounts, rewards, and wellness challenges. This model has gained international recognition and has been adopted by insurers in countries including the United States, the United Kingdom, and Australia.

Throughout the first half of 2025, Discovery introduced several innovative digital health tools to enhance user engagement and promote preventive care. Among these was the Discovery Health App 3.0, which integrated AI-driven personalized health coaching and real-time biometric monitoring. Additionally, the company launched the Vitality Active Rewards program, encouraging physical activity by linking wearable device data with rewards redeemable at partner retailers.

To expand its healthcare ecosystem, Discovery forged strategic partnerships with leading providers such as Netcare Group, South Africa’s largest private hospital network, and Life Healthcare, a primary healthcare services provider. These collaborations enable Discovery members to access integrated healthcare services, including telemedicine consultations and chronic disease management programs, all coordinated through Discovery’s digital platforms.

Adrian Gore’s vision faced skepticism from traditional insurers and regulatory bodies early on, as his approach challenged conventional insurance models. However, his persistence and commitment to innovation have positioned Discovery as a global leader in health insurance and wellness solutions.

Under his supervision, the company has expanded its market presence and contributed significantly to raising health awareness and improving insurance practices in South Africa and beyond.

15. Cyril Ramaphosa

Net Worth (Jan–June 2025): Approximately $450 million

Leading Company: Shanduka Group (Investments, Mining, Energy)

Cyril Ramaphosa, South Africa’s president since 2018, also manages significant business interests through Shanduka Group. The company invests in mining, energy, and financial services, focusing on economic transformation and empowerment initiatives.

In the first half of 2025, Shanduka advanced a renewable energy project to electrify rural communities. This project aligns with national goals to expand access to electricity and promote sustainable development, supporting South Africa’s transition toward greener energy sources.

While balancing his political responsibilities and business activities has drawn public attention, Ramaphosa remains committed to fostering inclusive economic growth. His efforts emphasize creating opportunities for historically disadvantaged groups and encouraging investment in key sectors to create jobs.

16. Gus Attridge

Net Worth (Jan–June 2025): $410 million

Leading Company: Aspen Pharmacare (Pharmaceuticals)

Gus Attridge was pivotal in co-founding Aspen Pharmacare with Stephen Saad in 1997. The company has grown to become Africa’s largest pharmaceutical manufacturer. Aspen produces and distributes generic medicines, reaching global markets and supplying affordable drugs to developing nations. Attridge has consistently focused on ensuring high-quality manufacturing standards and navigating complex regulatory environments across various jurisdictions.

During the first half of 2025, Aspen significantly expanded its global reach by formalizing partnerships with international organizations to bolster the production of essential COVID-19 treatments and vaccines. These strategic alliances underscore Aspen’s commitment to public health, particularly in underserved regions, by facilitating access to essential medical supplies.

Attridge’s calm, behind-the-scenes approach helps steer Aspen through challenges like government-imposed price controls and patent disputes, maintaining its strong position in the pharmaceutical sector. His commitment to expanding access to medicines and improving global health outcomes remains central to the company’s mission.

17. Giovanni Ravazzotti

Net Worth (Jan – June 2025): Approximately $330 million

Leading Companies: Italtile Limited, Ceramic Industries Ltd, Rallen (Pty) Ltd

Industry: Retail, Manufacturing (Tiles and Bathroomware)

Position: Founder and Non-Executive Chairman of Italtile Ltd; Chairman of Ceramic Industries Ltd

Giovanni Ravazzotti is a South African tycoon and entrepreneur who founded Italtile, South Africa’s leading franchisor, retailer, and manufacturer of tiles and bathroomware. Arriving from Italy in 1969, Ravazzotti identified a growing demand for affordable tiles and ceramics in the rapidly urbanizing South African market. He initially focused on importing and retailing these products, but anticipating trade sanctions during the 1970s, he pivoted to local manufacturing, founding Ceramic Industries in 1976.

Italtile and Ceramic Industries were listed on the Johannesburg Stock Exchange in 1992, marking the beginning of their growth into industry benchmarks. Today, Italtile operates several prominent retail brands, including Italtile Retail, CTM, TopT, and U-Light, and serves as a bellwether for consumer spending in South Africa’s home improvement sector.

In 2025, the Italtile Group employed over 2,500 people and recorded a system-wide turnover of approximately R10 billion. Ravazzotti controls a 56.46% stake in Italtile, comprising over 746 million shares. Despite recent market volatility, his stake’s value rebounded to nearly $420 million in June 2025 after recovering from a dip earlier in the year.

Aside from business, Ravazzotti is known for his philanthropic work. He founded the Italtile and Ceramic Foundation, a broad-based black empowerment ownership scheme for public benefit activities. He is also active in conservation efforts, supporting the Lapalala Wilderness School and Foundation. He has received prestigious honors from the Italian government, including the Senior Order of Knighthood, Cavaliere del Lavoro.

Giovanni Ravazzotti remains a respected figure in South African business, combining entrepreneurial vision with a commitment to social responsibility and environmental conservation.

18. Wendy Appelbaum

Net Worth (Jan–June 2025): Approximately $260 million

Main Industries: Wine Estate Ownership, Investment, Philanthropy

Key Assets: De Morgenzon Wine Estate, Quoin Rock Estate, Investment Portfolio

Wendy Appelbaum is a prominent South African businesswoman and philanthropist, widely recognized for her leadership in the wine industry and her impactful contributions to social causes. She is the daughter of Donald Gordon, the founder of the Liberty Group, one of South Africa’s largest financial services companies. Despite her privileged background, Wendy has forged her own path in business with a focus on strategic investments and philanthropy.

After serving on the board of Liberty Investors in the early 1990s and co-founding Women’s Investment Portfolio Holdings (Wiphold)—South Africa’s first female-controlled investment firm to list on the Johannesburg Stock Exchange—Appelbaum transitioned to entrepreneurship.

In 2003, she and her husband acquired the 224-acre De Morgenzon Wine Estate in Stellenbosch, which has since gained international acclaim for its award-winning Chenin Blanc wines. The estate exports approximately 85% of its 500,000-bottle annual production to global markets, establishing her as a key figure in South Africa’s wine export sector.

In 2011, she expanded her wine holdings by purchasing the nearby Quoin Rock Estate. Her business acumen and dedication have transformed these estates into thriving enterprises, blending traditional winemaking with innovative practices.

Beyond business, Wendy Appelbaum is a committed philanthropist who focuses on women’s health, education, and social development. She is known for her generous donations and active involvement in initiatives promoting economic inclusion and improving South Africa’s healthcare facilities.

19. Phuthuma Nhleko

Net Worth (Jan–June 2025): Approximately $120 million

Leading Company: MTN Group (Telecommunications)

Phuthuma Freedom Nhleko was born on 7 April 1960 in Kwa-Thema, Springs, Gauteng, South Africa. He completed his secondary education at St Mark’s High School in Swaziland, achieving his O levels in 1977. Driven by a passion for engineering and business, Nhleko moved to the United States, where he earned a Bachelor of Science degree in civil engineering from Ohio State University in 1983, followed by an MBA in finance from Atlanta University in 1987.

Nhleko began his professional career as a civil engineer in Ohio and South Dakota before returning to Southern Africa as a senior road engineer for the Ministry of Works in Swaziland. He later took on the role of Project Manager at the Urban Foundation in South Africa, gaining valuable experience in project management and development.

In 1994, Nhleko founded Worldwide African Investment Holdings (later renamed Phembani Group), an investment holding company with interests spanning petroleum, telecommunications, and information technology. His entrepreneurial spirit and strategic vision soon led him to join MTN Group in 2001 as chairman, and in 2002, he was appointed CEO.

Under Nhleko’s leadership from 2002 to 2011, MTN transformed from a local South African telecom operator into a pan-African powerhouse, expanding its subscriber base to over 185 million users across 22 countries in Africa and the Middle East. The company’s market capitalization soared from approximately R20 billion to over R250 billion during this period, reflecting its rapid growth and dominant market position.

Nhleko’s tenure was marked by bold strategic decisions that helped bridge Africa’s digital divide, making mobile telecommunications accessible to millions. He also emphasized sustainable business practices and corporate social responsibility, ensuring MTN’s footprint aligned with environmental and social goals.

After stepping down as CEO, Nhleko continued to serve as MTN’s non-executive chairman from 2013 to 2019. Beyond MTN, he chairs the Phembani Group and holds leadership roles in Tullow Oil Plc and the Johannesburg Stock Exchange (JSE). He is also known for his philanthropic efforts and advisory roles in infrastructure development and entrepreneurship across Africa.

20. Sipho Nkosi

Net Worth (Jan – June 2025): $117 million

Leading Companies: Eyesizwe Holdings, Exxaro Resources, Sasol (former Chair), Talent10 Holdings, Tronox Holdings, and others

Industry: Mining, Energy, Investment

Sipho Nkosi is a renowned South African mining magnate and business leader whose influence spans multiple sectors, including mining, energy, and investment. His career is marked by visionary leadership, strategic partnerships, and a commitment to social development and inclusive economic practices.

Nkosi founded Eyesizwe Holdings in 1999, a special purpose vehicle that owns Eyesizwe Mining, a key player in South Africa’s coal mining industry. This venture was born from collaborations with industry giants Anglo-American and BHP Billiton, positioning Nkosi as a significant figure in the mining sector. Eyesizwe later evolved into Eyesizwe Coal, further solidifying his impact.

He also served as CEO of Exxaro Resources, a diversified mining company operating in South Africa, Europe, the Democratic Republic of the Congo, and the United States. Primary interests included the Sishen Iron Ore Company. Under Nkosi’s leadership, Exxaro became one of Africa’s leading mining firms.

Nkosi’s tenure as chairman of Sasol Limited, South Africa’s integrated energy and chemical company, began in 2019. He was the first black chairman of Sasol and played a pivotal role in steering the company towards renewables and operational efficiency. In November 2023, Nkosi stepped down from this role to avoid potential conflicts of interest related to his other business ventures. His departure was met with praise for his steady guidance and dedication.

Outside of mining and energy, Nkosi co-founded Talent10 Holdings, a venture capital firm focused on nurturing disruptive early-stage companies in South Africa’s innovation ecosystem. He is also involved with Tranter Holdings, which played a key role in forming Exxaro, and holds directorships in companies like Tronox Holdings.

In 2022, President Cyril Ramaphosa appointed Nkosi to lead a government task team to cut bureaucratic red tape, highlighting his influence beyond business into national development.

Rounding up

This list makes clear that money isn’t made in a vacuum in South Africa. Something always had to be given. For some, they built a little idea into an unshakable money-stamped enterprise, and others naturally made their way into it by birth but still worked to hold up its relevance and continuity.

These names aren’t just wealthy but connected to real structures, ownership, and decision-making.

If you’re looking to understand where power sits in South Africa’s economy today, this list gets straight to the point.