The Nigerian tax system, governed primarily by the Personal Income Tax Act (PITA) and the recent Nigeria Tax Act 2025, requires every resident to report their total income from all sources annually. Whether you are a full-time employee, a freelancer, or a business owner with multiple side hustles, filing is your way of declaring your earnings and expenses to the government to ensure you are paying exactly what you owe.

In Nigeria, there is often a misconception that only businesses file taxes, and once an employer has remitted and filed taxes on your behalf, you have met your responsibilities to the government. While registered businesses must file by January 31, individuals have a slightly longer window. Every individual earning an income in Nigeria is required by law to file their personal annual tax return by March 31 of each year for the preceding year.

Before you file your tax return

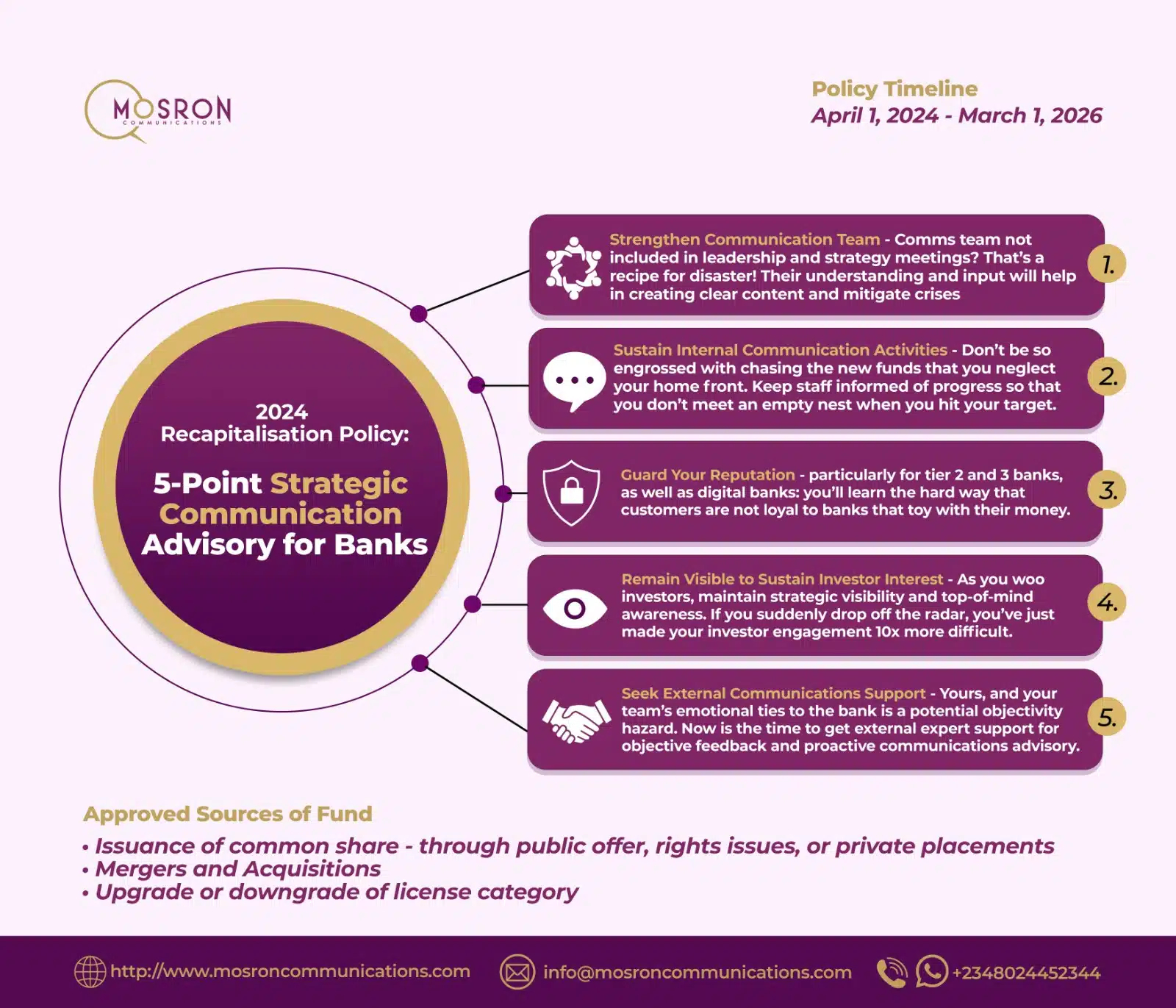

Filing taxes is one of the last steps in the tax compliance process. It is simply a summary of your financial standing and proof of the taxes you remitted during the year. Hence, before you file your tax return, you should calculate your tax liability and remit it. Below is an example from the Lagos State e-tax digital portal.

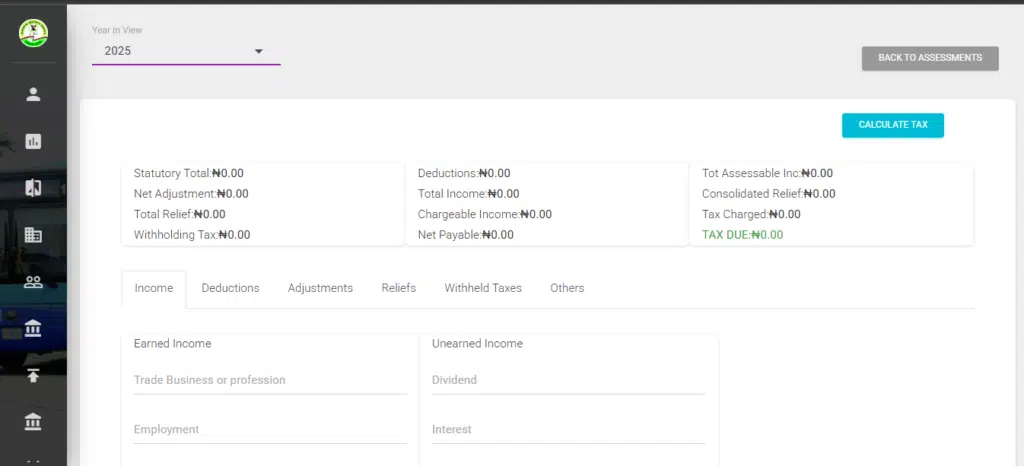

Under assessments, you can calculate your tax by inputting all the figures that apply to you. If the only figures that apply are your salary and pension or the inflow from your business, input those and leave everything else blank.

If you have multiple sources of income, you can list each separately.

The system automatically calculates your tax. If your employer has remitted some taxes on your behalf, deduct that amount from the total amount and remit the balance.

Where and how to file your tax return

The first thing to remember when filing taxes is that individual income tax is administered at the state level.

Individuals remit and file their taxes with the State Internal Revenue Service (SIRS) of the state where they live (e.g., Lagos State Internal Revenue Service, Kano State Internal Revenue Service, Rivers State Internal Revenue Service, etc)

On the other hand, incorporated entities remit and file their Corporate Income Tax with the federal authority, the Nigeria Revenue Service (NRS), formerly known as the Federal Inland Revenue Service.

Victoria Fakiya – Senior Writer

Techpoint Digest

Stop struggling to find your tech career path

Discover in-demand tech skills and build a standout portfolio in this FREE 5-day email course

Step 1: Identify your tax jurisdiction and medium

Before you begin, you must determine where and how to file. The process varies by state. Some states, such as Lagos, Ogun, and Edo, have completely eliminated paper-based processes for tax payments and filings and now operate solely through digital portals; other states, such as Kano, Plateau, and Rivers, use a combination of paper and online processes.

- Determine your state of residence: You pay and file in the state where you reside, regardless of where your employer is based or where your clients are located. For example, if you live in Lagos but work remotely for a firm in Abuja, you are a Lagos State taxpayer.

- Choose your medium: If your state of residence has a digital portal, visit it to sign up. If the state operates a hybrid or manual model, you may need to visit its office to complete the return form.

Step 2: Consolidate your income and fill out your assessment form

Once you know where to file, the next step is calculating your taxable income. Under the Nigeria Tax Act 2025, the tax calculation formula has changed significantly to favour low and middle-income earners while closing loopholes for those with multiple streams of income.

If you earn multiple streams of income, the law expects you to consolidate. This means adding your 9-to-5 salary to your side-hustle profits and filing them as a combined gross total. If you work primarily as a freelancer without a 9-to-5 job, the process is the same, and you are expected to consolidate all your sources of income.

This is the best time to review your financial statements for all sources of inflow, as you will be required to state them on the assessment form.

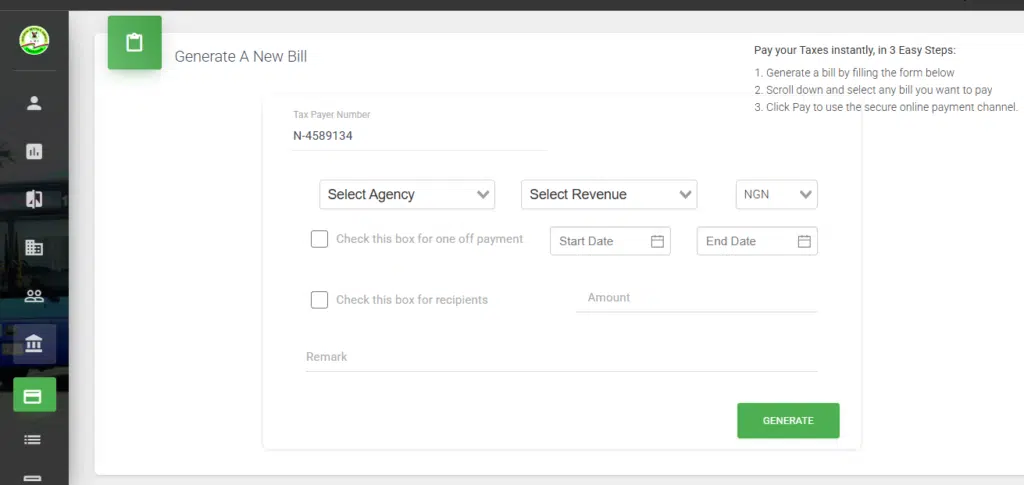

As shown in the image below, fill the form by doing the following;

- Choose the year for which you are filing the return.

- Input your gross salary. If you do not earn a salary, leave it as zero.

- If you have earned an income from trading a commodity, been given an allowance by your employer, or earned a commission, input the aggregate of those figures individually.

- You can also attach any supporting documents, like your financial statement for the year, your rent receipt or tenancy agreement, if you want to access rent relief, and any other documents that can support the figures you are providing.

Next,

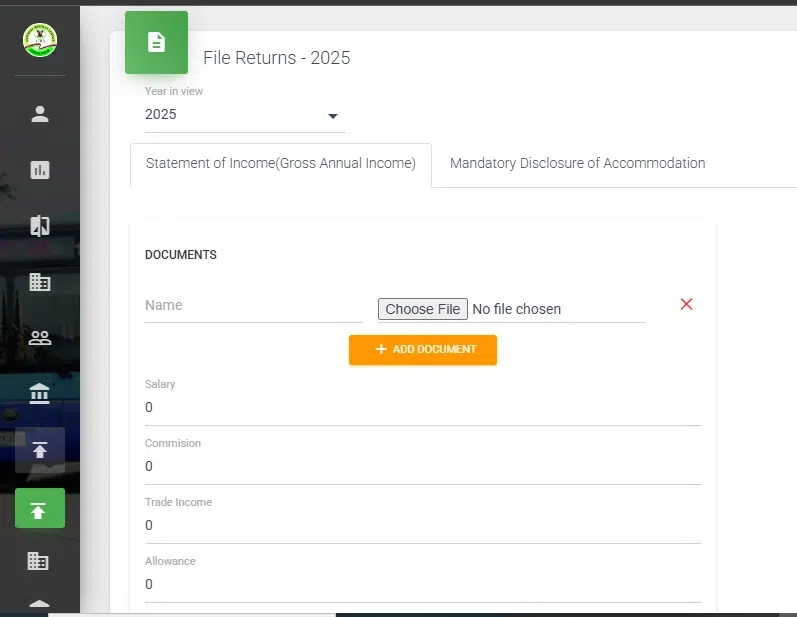

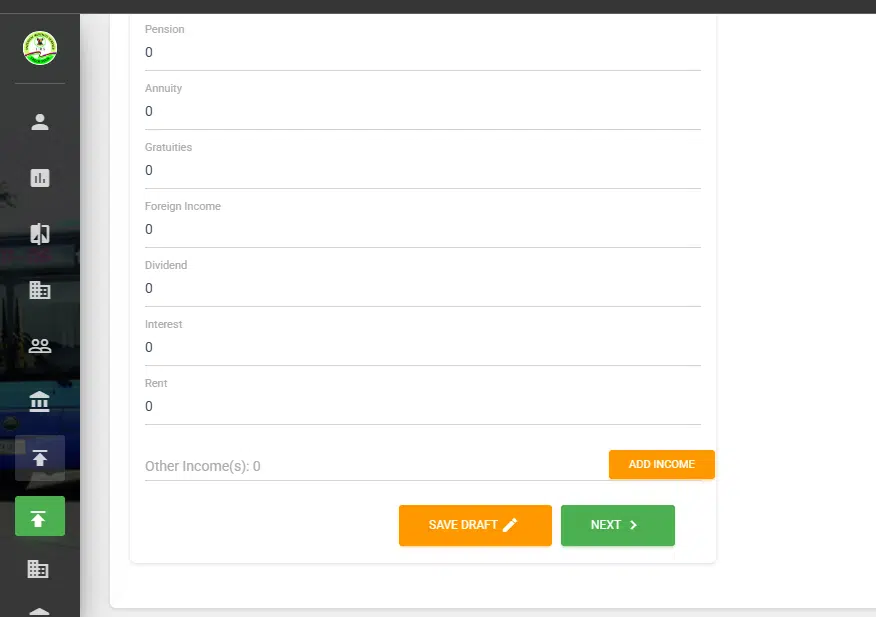

- Input your annual pension amount if you have made any pension contributions. If you are a salaried employee, 8% of your annual gross income typically goes to a pension and is remitted by your employer. (Note that when a pension is deducted, your taxable income reduces. If you do not include a pension amount, the entirety of your gross income will be taxed.)

- Input any contributions you made for annuities as they are deductible from your taxable income and will help in reducing your tax liability.

- Input any gratuities you have earned in the previous year. Gratuities are tax-exempt. However, gratuity paid as compensation for losing your job is exempt up to ₦50,000,000.

- Foreign income refers to dividends, interest, rent, or royalties earned abroad and remitted to Nigeria. This category of income is tax-exempt so long as it came into the country through government-approved banking channels. Dividends from wholly export-related businesses are tax-exempt if the proceeds were brought in through government-approved banking channels.

- Input any dividends or interests you have earned in the previous year.

- If you are a landlord, input the total amount of rent you received in the previous year.

- Lastly, you can add any other sources of income not covered on the form. Clicking ‘add income’ opens a field to enter the income name and amount. If you have multiple streams of income, this is where to list them.

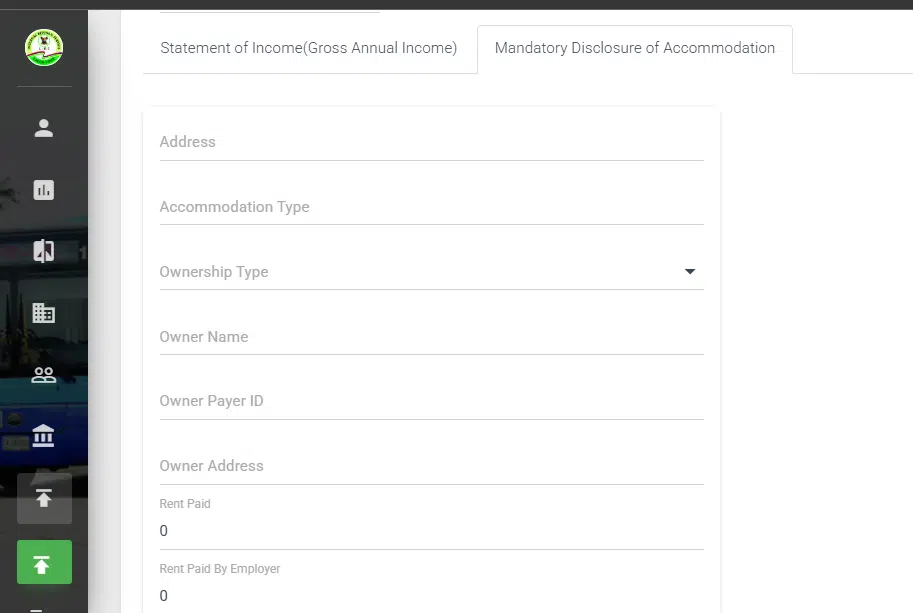

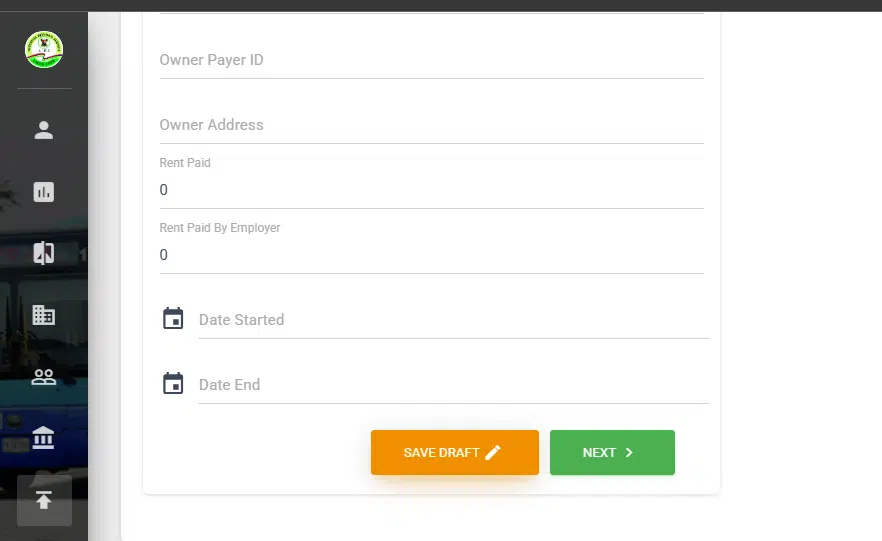

The next step is to fill out your accommodation information. Under the Nigeria Tax Act 2025, the new rent relief is one of the most effective ways to lower your tax liability. As a tenant, you are entitled to deduct 20% of your annual rent from your taxable income, subject to a maximum cap of ₦500,000.

To ensure your claim is successful, documentation is key. You must upload a valid rent receipt and a tenancy agreement as evidence. Also, you can only claim relief for rent paid within the specific tax year you are filing for.

Conclusion

Filing your taxes with multiple income streams may seem daunting, but it is pretty straightforward, especially with the increasing adoption of digital filing portals. It is important to note that everyone is expected to file their taxes, regardless of whether they are tax-exempt.

Missing the March 31 deadline can result in steep penalties, starting at ₦100,000 and increasing to ₦50,000 in subsequent months, so don’t wait until the final week. Gather your receipts, log onto your state’s portal, and stay compliant.

Frequently asked questions

- Do I need to file my taxes if I’m unemployed?

Yes, if you are unemployed, the law still requires you to file your tax return to declare your status. In this case, you can leave any section blank or set it to ₦0. The same applies to tax-exempt individuals, who do not meet the ₦800,000 threshold. You do not need to pay taxes, but you must file them before the deadline. - My employer has already filed taxes on my behalf. Do I still have to file again?

If your employer has filed taxes on your behalf, you must still file them. Your employer’s filing is to keep the company compliant; hence, you must also stay compliant. - When is the deadline to file taxes?

The deadline for individuals to file their taxes is March 31 each year. In 2026, you will file your 2025 taxes by March 31, 2026. - Where will I file my taxes?

File your tax return at the State Internal Revenue Service of the state where you reside. If they have a digital portal, use it. Otherwise, visit their office. - Do I need to visit a tax office before I can file my taxes?

No, you do not. However, if your state does not have a digital portal, you might need to visit their office. - How do I claim tax relief?

To claim tax relief, you must manually enter your eligible expenses, such as rent (capped at ₦500,000), pension, and insurance, into the deductions section of your state’s digital tax portal when calculating your tax and during your annual filing. For these claims to be valid, you must upload supporting documents like rent receipts or insurance certificates to prove the expenses were actually incurred.